What You Should Know:

– After a decade of unchecked expansion, the health IT market faced a reality check in 2023, according to a new report from Healthcare Growth Partners.

– The report, January 2024 Health IT Market Review reveals runaway inflation, rising interest rates, and a tech valuation reset tempered investor enthusiasm and led to a correction in valuations across both M&A and investment activity. However, despite the challenges, there were signs of a rebound in late 2023, with M&A volume returning to pre-pandemic levels and a potential for renewed IPO activity in 2024.

M&A and Buyout Activity

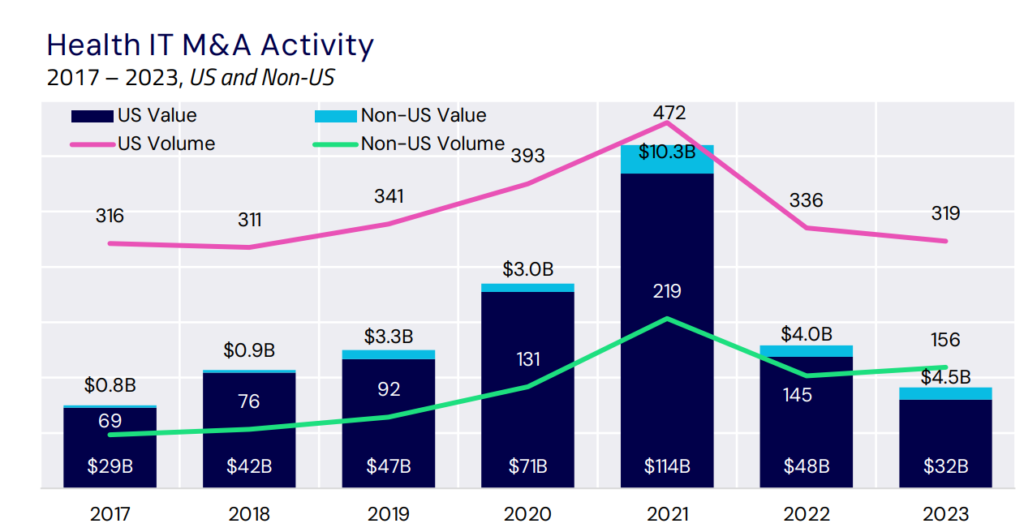

- Rebounded to pre-pandemic volume in 2023 after a decline in 2022.

- Valuations remained lower than pre-pandemic levels, but there were signs of recovery in the later part of the year.

- Buyout activity saw a slight increase in 2023 compared to 2022.

Investment Activity

- Fell from $29 billion in 2021 to $9 billion in 2023, but remained slightly above the pre-pandemic average.

- Declining interest rates and improving investor sentiment could lead to a revival in 2024.

Public Market Performance

- Health IT public market experienced significant volatility in 2023.

- Many companies saw their share prices decline and some even delisted or filed for bankruptcy.

- However, there were signs of a potential revival with improved broader market performance and stronger sentiment.

Economic Outlook

- The US economy is in a complex state with slowing growth and high unemployment.

- Declining interest rates are expected to drive capital reallocation towards risk assets, potentially benefiting the health IT market.

Future Outlook

Despite the lingering uncertainties, several positive indicators are emerging. Declining interest rates, improving investor sentiment, and a potential revival of IPOs suggest a more balanced and resilient market in 2024. Companies with strong financials and differentiated offerings are poised to capitalize on this shift.