What You Should Know:

- The digital health sector has encountered substantial declines in funding and deal volume; however, quarterly trends are now stabilizing within a fresh investment cycle, with investors directing funds toward startups engaged in exploring innovative treatment pathways and addressing nonclinical workflow challenges.

- Despite witnessing notable bankruptcies among former IPO success stories in 2023, the overall public market performance of the entire digital health sector has shown resilience. The present state of digital health can be characterized as “smaller but mighty.”

Unpacking Insights from Digital Health Funding in Q3 2023

In Q3 2023, the digital health sector experienced positive developments, including a stabilized funding pace, increased investments in critical areas like workflow support and value-based care, and signs of growing confidence in the public market. While challenges remain, especially for founders managing fundraising and commercialization transitions, there is hope that both investors and entrepreneurs can establish a more predictable pattern in response to the evolving market dynamics.

Key insights from the report are as follows:

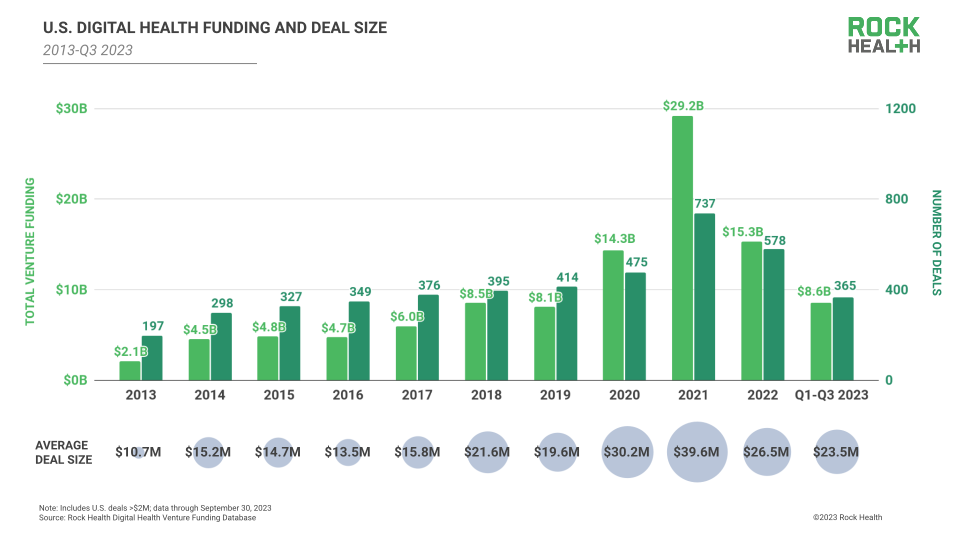

- Unpacking the “New Normal”: In Q3 2023, U.S. digital health startups secured $2.5B across 119 deals, marking the second-lowest funding quarter since Q4 2019. The year-to-date total for 2023 reached $8.6B across 365 deals. Over the past five quarters, four have seen funding in the $2B range, and all have recorded deal counts in the low 100s, establishing new norms in this funding cycle. Various factors contribute to the reduced funding levels, including economic uncertainty, rising interest rates, lower startup valuations, and limited IPO activity. These factors have made investors more cautious, resulting in fewer deals and tougher negotiations on terms. This funding environment presents challenges for startups, including concerns about down rounds and discussions about financing growth with potential dilution for founders and prior investors. Some founders are mitigating dilution risks by seeking extension or unlabeled rounds, leading to fewer mid-stage Series B and C raises in 2023 compared to previous years. It is ultimately expected that the new funding cycle will bring with it a new market equilibrium wherein startups and investors are both able to prosper.

- Funding Focused on Disease Treatment, Value Based Care: Funding has shifted away from pandemic-related areas like on-demand healthcare and life science R&D catalysts, which were prominent in 2021 and 2022. Instead, investments are now directed towards digital health products and services that support disease treatment, nonclinical workflow, and the management of complex conditions such as kidney disease. Disease treatment secured the top funding spot, with $1.64B raised from Q1-Q3 2023, supporting comprehensive virtual clinics like Vivante Health. Nonclinical workflow solutions received $1.59B in funding during the same period, addressing tasks from medical equipment management to patient scheduling. Mental health remains the top-funded clinical indication among digital health startups, with $0.9B deployed year-to-date, while nephrology has seen substantial growth, raising $0.7B in 2023. Increasingly, these investments focus on startups enabling value-based care arrangements or assuming risk themselves, particularly in high-cost therapeutic areas such as mental health, kidney care, cardiovascular care, and oncology. As policy initiatives and healthcare enterprises embrace value-based care models, VBC enablement will become a vital aspect of startups’ commercial strategies and drive partnerships with large healthcare organizations.

- Digital Health and the Public Market: In 2023, the IPO drought has affected the financial market, with the digital health sector facing additional challenges due to bankruptcies (Pear Therapeutics and Babylon Health) and a private equity acquisition (NextGen Healthcare). However, it’s essential to consider each company’s unique circumstances, such as Pear’s reimbursement difficulties, Babylon’s contract losses, and NextGen’s pursuit of strategic flexibility. Despite these challenges, the overall public market performance of the digital health sector, as measured by the Rock Health Digital Health Index (RHDHI), showed a mixed picture, underperforming the S&P 500 but outperforming the S&P 500 Health Care and Nasdaq Biotechnology Index from Q1 to Q3 2023.