Dive Brief:

- Edwards Lifesciences’ upcoming five-year data on transcatheter aortic valve replacement (TAVR) for low-risk patients is unlikely to have a big effect on market share or growth, according to several physicians.

- Analysts at Jefferies, Stifel and Truist Securities spoke to cardiologists ahead of the release of data from the PARTNER 3 trial, an event that is a focal point for investors but seemingly less significant to doctors who use the devices.

- The physicians expect TAVR to be statistically non-inferior to open-chest surgery. Some doctors think TAVR may perform numerically worse but see little impact on the market unless there is a statistically significant result in PARTNER 3 or a trial run by Medtronic, Edwards’ main TAVR rival.

Dive Insight:

Edwards is set to present five-year PARTNER 3 data at TCT 2023 next week. The update is a source of concern for investors, with the Truist analysts citing it as a reason Edwards’ stock has underperformed the market, but discussions with high-volume interventional cardiologists suggest the impact of the data may be more muted than feared.

Dr. Michael Lee, an interventional cardiologist interviewed by Jefferies analysts, currently only uses Edwards’ devices for TAVR procedures and will remain loyal unless the PARTNER 3 data are very bad or rivals show their valves are statistically superior to surgical aortic valve replacement (SAVR). While the physicians are split on whether TAVR may be numerically worse than SAVR in the five-year data, none of them expect big, market-shaping differences.

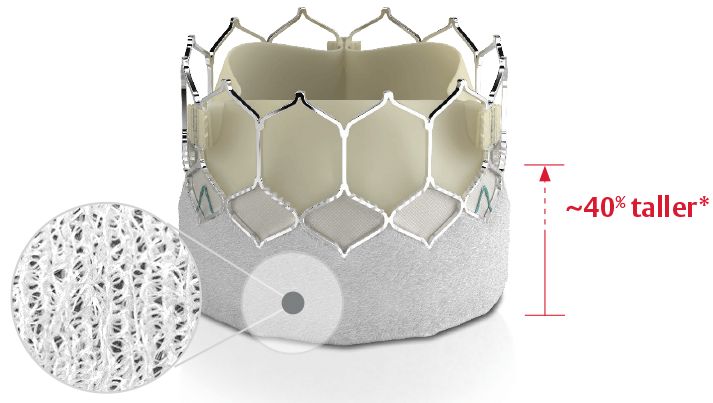

“De. Lee does not expect [Edwards’] PARTNER 3 5-year data to have a big impact on clinical practice or TAVR share,” analysts at Jefferies wrote in a note to investors. Lee noted surgeons are biased to use valves they are comfortable with, and referenced advancements Edwards has made to its product, such as its Resilia tissue.

Analysts at Stifel told investors they were “particularly struck by one doctor’s comments suggesting his indifference to whether ‘the lines cross,’” making TAVR numerically worse than SAVR. To that physician, the key point is whether TAVR is statistically non-inferior. Provided that remains the case, the physician is unlikely to change their approach to TAVR in low-risk patients.

The key opinion leader interviewed by analysts at Truist “expects the current trend of steadily increasing adoption into low-risk patients to continue.” Currently, the physician estimates that up to 25% of low-risk patients undergo TAVR, and forecasts that figure could increase to 50% over time.

Edwards will end the uncertainty at a transcatheter meeting next week. Medtronic is also expected to share corresponding four-year data from its EVOLUT trial.

The analysts identified several other notable updates that are planned for the event, including the publication of results from trials of Boston Scientific’s Agent drug-coated balloon and Edwards’ Evoque transcatheter tricuspid valve replacement therapy.