Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Happy Monday. So, we’ve got a welcome bump in the XBI, see that European regulatory conditions are prompting Ozempic maker Novo Nordisk to look stateside for growth, and more.

advertisement

The need-to-know this morning

Celldex Therapeutics said its experimental treatment for chronic hives achieved the goals of a mid-stage clinical trial.

Moonlake Immunotherapeutics reported results from a mid-stage study of a drug that aims to treat people with psoriatic arthritis.

Eye-disease battle: Astellas vs Apellis

The arena was this weekend’s meeting of the American Academy of Opthalmology, where each company presented new data on their competing treatments for geographic atrophy, a common type of vision loss.

In dueling presentations, the Astellas drug, called Izervay, showed an increase treatment effect over two years – likely enough to lift restrictions placed on it by the FDA. But Apellis’ drug, called Syfovre, still looks more durable and potent.

advertisement

Adam Feuerstein’s take is here.

Biotech stocks sometimes go up

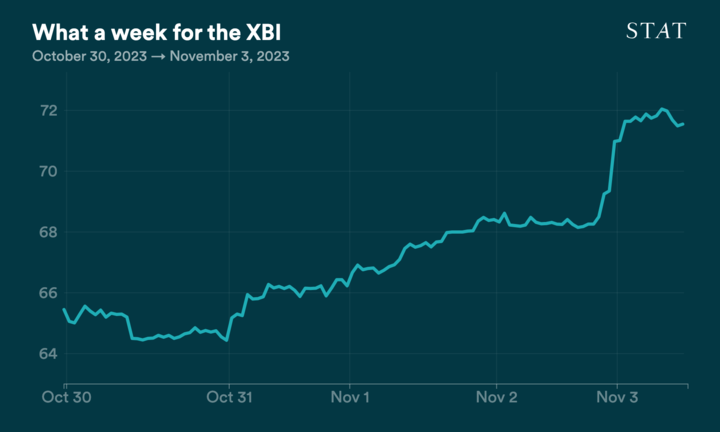

After a month of steady decline that bottomed out with a five-year low, the closely watched XBI biotech index rose more than 10% last week, giving long-suffering investors some hope that the worst might at last be over.

A busy week of earnings brought some downbeat news across biotech, but the resulting upswing across the sector suggests this all might have been one of those oft-discussed “clearing events,” meaning sentiment got better because it could hardly get any worse.

The XBI is still down about 12% on the year, and it’s nearly 25% off of its 2023 peak. But there’s a growing sense among investors that many biotech companies have fallen so far as to be undervalued, according to TD Cowen’s quarterly “sentimentometer,” lending weight to the theory that the market might pick back up in early 2024.

Novo Nordisk, citing report, will grow U.S. presence

Novo Nordisk will focus more heavily on growing its U.S. presence, which will come at the expense of the E.U. unless European regulators initiate some reforms, CEO Lars Fruergaard Jørgensen told the Financial Times. Much of the company’s research is now happening in Boston, he said, and that will likely only grow if the E.U. follows through with its pending policy that would decrease market exclusivity for drugmakers.

He cited a recent report that says pharmaceutical R&D in the E.U. would drop by €2 billion annually — with 50 out of 225 potential new treatments scrapped or undiscovered because they wouldn’t be economically feasible. The report, released by a research firm called Dolon, also said that the E.U.’s share of global R&D investment would be reduced by a third by 2040, from 32% to 21%.

“When we start clinical development, we start in the U.S. When we start commercial activity, we always start in the U.S.,” Jørgensen said. “And the success in the U.S. means that we are slower getting going in Europe because it’s just less attractive.”

BioNTech acquired a hot lipid nanoparticle startup

BioNTech, the German drugmaker that codeveloped a Covid-19 vaccine with Pfizer, has acquired a lipid nanoparticle startup called AexeRNA. AexeRNA, which aims to develop mRNA medicines, apparently just exists on paper, Endpoints reports — it has no lab or scientists on it roster. But among its founders is the mRNA pioneer and Nobel laureate Drew Weissman of the University of Pennsylvania. Another is Michael Buschmann, a bioengineer at George Mason University.

AexeRNA CEO Thomas Haag told Endpoints that the company had raised a small seed round in the “low single-digit millions” before it was “inundated” with potential buyers. “Everybody needs a delivery system, and there’s just not a lot of options,” he said. The company has synthesized a form of lipid nano particles that could optimize medicine delivery pretty dramatically, Haag said. The companies haven’t disclosed the terms of the deal.

More reads

• AstraZeneca’s failed cancer drug gets new lease on life thanks to positive kidney disease data, FierceBiotech

• In deal worth up to $640M, Pierre Fabre doubles down on its T-cell partnership with Atara, FiercePharma