Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Hello, everyone. Damian here with an update on biotech’s silly season, a looming showdown in Washington, and the latest twist in the Ozempic panic. This newsletter is taking the next couple days off in the spirit of the holiday, but we’ll be back in your inbox Monday morning.

advertisement

The need-to-know this morning

• Freeline Therapeutics, a cash-strapped developer of gene therapies, is being taken private in a transaction with Syncona Ltd., a life sciences investment fund. The acquisition, which values Freeline at $28 million, will enable the company to continue developing a gene therapy for Gaucher disease.

• Evelo Biosciences has shut down as a result of multiple drug-development setbacks and insurmountable financial troubles.

Does Daniel O’Day like hockey?

In the latest sign of shareholder desperation in a tough biotech market, Aurinia Pharmaceuticals rose as much as 20% over the last few days after an analyst tracked the flight path of a pharmaceutical plane and concluded that a lucrative buyout was in the offing.

If you’d like to follow the red string on the tackboard, it goes like this: The research firm Gordon Haskett observed that Gilead Sciences’ corporate jet had made a stop in Edmonton, Canada, which happens to house the headquarters of Aurinia, which is in the middle of a strategic review. On Twitter, aka X, there was little discussion of possible explanations — Gilead has a facility in Edmonton, perhaps someone wanted to catch an Oilers game — other than this being a definite prelude to a deal. (Gilead, understandably, declined to comment on jetgate.)

advertisement

Zooming out, the whole thing speaks to the sad state of biotech stocks in 2023, where a pervasive negative sentiment means companies narrowly benefit from good news and get pilloried for bad. When your only hope for a return is a high-dollar buyout, you might find yourself looking up pharmaceutical tail numbers.

Bernie to pharma: Debate me

Sen. Bernie Sanders is leading a group of Senate Democrats pressuring the executives of Merck, Johnson & Johnson, and Bristol Myers Squibb to testify in a January hearing on why the United States pays more for prescription drugs than other countries.

As STAT’s Rachel Cohrs reports, all three companies are suing the Biden administration over a law allowing Medicare to negotiate certain drug prices, and all three have top-selling medicines on the list of 10 drugs that will be subject to the program starting in 2026.

It’s unclear whether executives from the three companies will agree to testify, but Sanders’ previous invitations drew a crowd, including the leaders of the world’s major insulin manufacturers and Moderna CEO Stéphane Bancel.

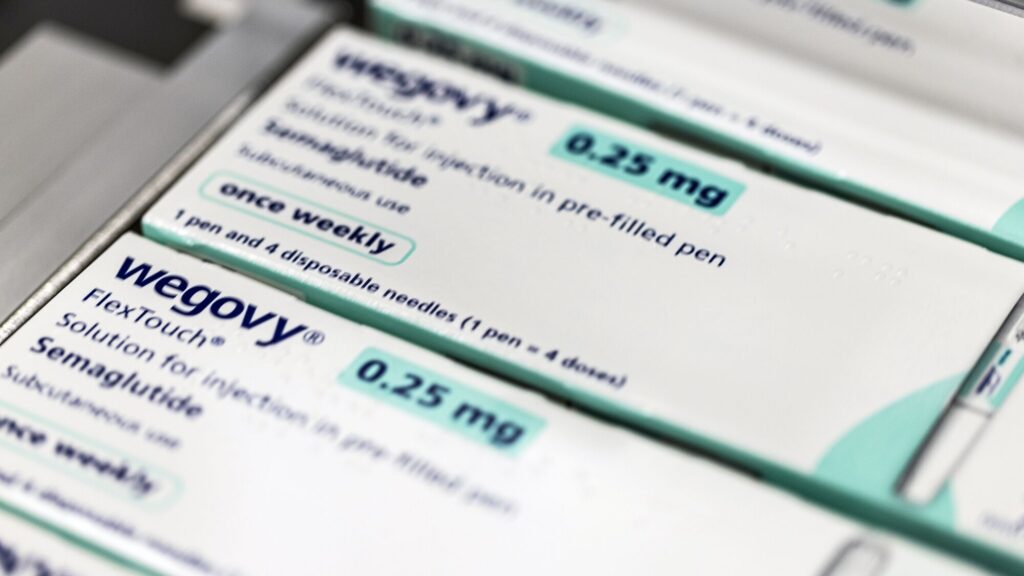

Medtronic isn’t afraid of Wegovy

Months after the furor over novel weight-loss medicine sent medtech stocks sharply downward, the world’s largest medical devices company raised its profit forecast and dismissed the purportedly disruptive effects of drugs like Novo Nordisk’s Wegovy.

Medtronic’s share price rose about 5% yesterday after the company beat Wall Street’s estimates on quarterly revenue and earnings and increased its projections for 2024. The company, which sells devices for diabetes and bariatric surgery, said the rise of GLP-1-targeting medicines didn’t pose an existential threat to its business.

The market reaction follows weeks of polarizing debate about how treatments including Wegovy, which has led to dramatic weight loss and long-term cardiovascular benefits, might affect the many companies that sell stents, glucose monitors, and dialysis machines. The sector went through a double-digit slump over the summer but has mounted a gradual recovery.

More reads

• How the shakeup at OpenAI underscores the need for AI standards in health care, STAT

• European Patent Office declares Moderna mRNA patent invalid, Reuters

• Novo sees Ozempic shortages continuing next year in Europe, Bloomberg