Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Good morning, all. Damian here with news of a new biotech venture fund, a bold bet against a billion-dollar deal, and the weight of expectations on Eli Lilly.

advertisement

The need-to-know this morning

- Biotech earnings last night: Amgen and Gilead Sciences.

- BridgeBio Pharma granted Kyowa Kirin a license to co-develop an experimental drug, called infigratinib, for skeletal dysplasias in Japan. BridgeBio will receive $100 million upfront plus royalties on sales if approved.

A biotech VC playing the long game

A trio of biotech venture capitalists have raised $310 million for a new fund that will take it slow, disbursing its money over the course of 20 years, double the standard timeframe for industry VCs.

As STAT’s Allison DeAngelis reports, the firm is called Scion Life Sciences, and its founders include a pair of Apple Tree Partners veterans and a managing partner at Petrichor. Among the lessons of recent biotech history is that there are probably more companies than there are winning ideas. Scion wants to be part of the solution, taking its time incubating ideas that may — or may not — eventually grow into startups.

“We’re not a company formation factory,” said partner Aaron Kantoff, who helped start the oncology firm RayzeBio. “We’re really curating for quality, not quantity.”

advertisement

Will Novartis’ latest deal actually happen?

STAT’s Adam Feuerstein is betting no, based on reporting that points to a doubtful path forward for MorphoSys and its late-stage treatment for blood cancer.

The backstory is this: Novartis signed an agreement to purchase MorphoSys for nearly $3 billion, largely to acquire pelabresib, a treatment for myelofibrosis. In its pivotal study, pelabresib met its primary goal but missed a key secondary endpoint.

That’s where the problems start. As Adam reports, the FDA has been clear on the approval standards for myelofibrosis treatments, and MorphoSys’ drug doesn’t meet them. The merger with Novartis is expected to close in the next four months, during which time MorphoSys is slated to meet with the FDA. If that meeting doesn’t go well — and Adam believes it will not — odds are Novartis will terminate the transaction and walk away.

The GLP-1 panic is alive and well

Yesterday, Eli Lilly said its GLP-1-targeting medicine met its primary goal in mid-stage study enrolling patients with MASH, the obesity-related liver disease formerly known as NASH. And then biotech companies working in MASH, including one weeks away from an expected FDA approval, fell by double digits.

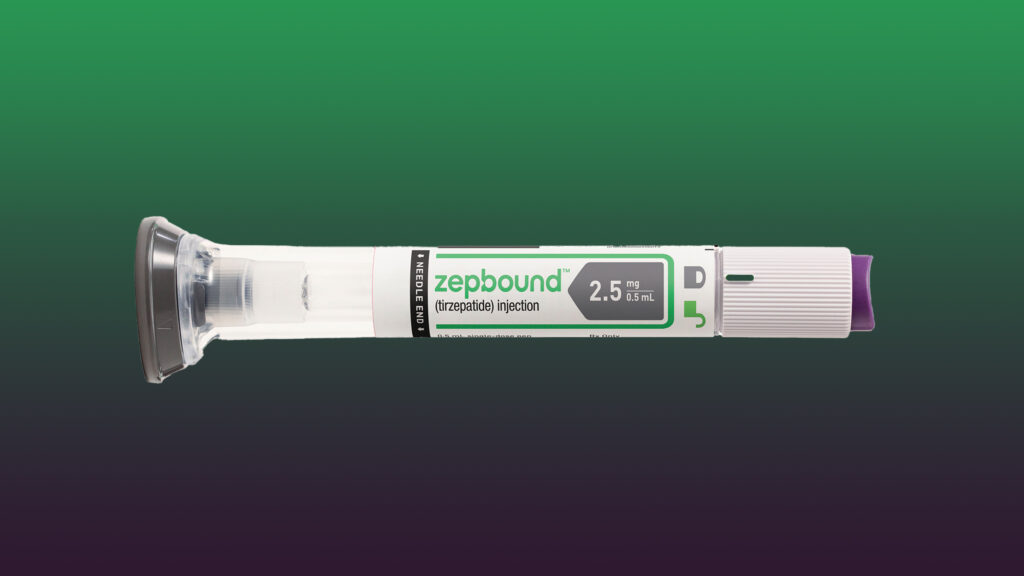

The news is that tirzepatide, which Lilly sells as Mounjaro and Zepbound, led to resolution of MASH for 74% of patients in a Phase 2 trial. Lilly said the drug also had a “clinically meaningful” effect on liver fibrosis, one of the hallmarks of MASH, but the company did not say whether that difference met the threshold of statistical significance.

What’s curious is how this datapoint could so dramatically affect the fortunes of a company like Madrigal Pharmaceuticals, which lost as much as 17% of its value yesterday. Madrigal’s drug, up for approval on March 14, has demonstrated a significant improvement in liver fibrosis in a Phase 3 study.

There’s a compelling theory that medicines like Zepbound and Wegovy, by virtue of their ability to reduce body weight, will shrink the market for MASH therapies by preventing patients from developing the disease in the first place. But until one of them can demonstrate a reduction in fibrosis, there will almost certainly be demand for drugs like Madrigal’s.

Lilly and the weight of impossible expectations

Eli Lilly’s stock price is up more than 15% in 2024, and it has doubled over the past 12 months, driven higher by its aforementioned GLP-1 treatment and a creeping consensus that the roughly 150-year-old company has entered a sort of drug development renaissance.

But when a company reaches such rarified heights — Lilly is now valued at about $670 billion — is there anywhere to go but down?

As STAT’s Matthew Herper writes, Lilly’s stock price is arguably getting ahead of itself, and the latest evidence came with the company’s fourth-quarter earnings. The company’s headline financial success was in part driven by an accounting change, and the data in MASH, while positive enough to roil the biotech market, didn’t quite measure up to the outsized expectations placed on Lilly.

More reads

- Aduhelm was a mess — and it could happen again, STAT

- Novo Nordisk’s parent invests in India’s Manipal hospital chain, Reuters

- Colombia proceeds with plans to issue a compulsory license for an HIV medicine sold by GSK’s ViiV, STAT

- Eisai falls behind on Leqembi patient goal, BioPharma Dive