By the numbers

Q4 net sales: $1.53 billion

13.8% increase year over year

Q4 TAVR sales: $979.4 million

Nearly 13% increase year over year

Q4 net income: $369.9 million

7.2% decrease year over year

2023 net sales: $6 billion

11.6% increase year over year

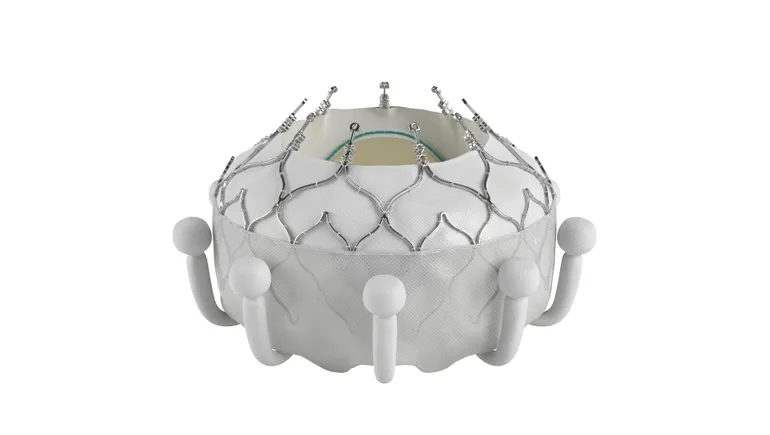

With approval for its new Evoque tricuspid valve in hand, Edwards Lifesciences is getting ready to create a new market to help patients who until now have had no treatment option for their disease, company executives said Tuesday.

Edwards last week secured an earlier-than-expected approval from the Food and Drug Administration for the Evoque transcatheter tricuspid valve replacement system, a first-of-its-kind treatment.

On the company’s fourth-quarter earnings call Tuesday, executives talked about the potential to treat a larger group of patients with tricuspid regurgitation, comparing the opportunity to when Edwards launched its biggest product line, transcatheter aortic valve replacement (TAVR), 20 years ago.

The company is now the market leader in TAVR devices to treat symptomatic severe aortic stenosis, where it competes against Medtronic. Edwards also offers the Pascal system in the U.S. and Europe for repairing the heart’s mitral valve. Pascal is approved in Europe for tricuspid patients as well.

Daveen Chopra, Edwards’ vice president for transcatheter mitral and tricuspid therapies (TMTT), said the FDA granted approval for Evoque through the agency’s breakthrough device pathway based on the strength of its clinical data in a 150-patient cohort. But the company submitted other data from a larger cohort that saw favorable trends for mortality, heart failure hospitalizations and tricuspid re-interventions.

“There are patients who are looking for options out there and don’t feel great and can’t do the things that they want to do every day in their life,” said Chopra. “This concept, the quality of life … to be able to pick up and play with your grandkids, walk up the stairs, it really does matter.”

The company plans a “controlled rollout” of the new system that will include careful physician training, starting with centers that are in a clinical trial, and then adding new centers over time, Chopra said. Edwards is pursuing a national coverage determination for Medicare patients.

“Here, we have a chance, the same way we did it in TAVR 20 years ago, to shape the TMTT space with Evoque and provide basically a toolbox to physicians to treat so many patients. So, that’s a very unique opportunity that we are taking very seriously,” Edwards CEO Bernard Zovighian said on the call.

Due to the early FDA approval for Evoque, Edwards now expects full-year TMTT sales to be at the higher end of its previously forecast range of $280 million to $320 million.

Spinoff is on track

Edwards became the latest in a string of medical device makers in recent years to reveal plans to spin off a business when it said in December it would shed its critical care group by the end of 2024. The critical care business generated $928.1 million in sales in the full-year 2023.

The proposed spinoff of the group, which offers technologies for monitoring critically ill patients, is progressing as planned, the company said.