Research on antisense oligonucleotides (ASOs) began in the early 1980s, leading to rapid advances in RNA-based therapeutics over the past 40 years. Several DNA and RNA-based medicines are now approved, with many more in clinical trials. An increased understanding of RNA function in the body is allowing for even broader treatment potential, pushing drug developers and manufacturers to expand their therapeutic targets.

All about oligos

Oligonucleotides are short single- or double-stranded DNA or RNA molecules. As modulators of gene activity, they can be synthesized and used therapeutically to alter gene expression and suppress or promote the translation of target proteins. Longer oligonucleotides sequences can also act as a guiding sequence supporting innovative systems such as CRISPR/Cas. These novel approaches to disease management are garnering excitement with the potential for single, curative therapies for a wide range of complex conditions. Because of their ability to target and interact with specific genetic sequences, oligonucleotides are set to play a crucial role in the future of genomic medicine.

ASOs and small interfering RNAs (siRNAs) operating via an RNA interference (RNAi) mechanism are two types of oligonucleotide therapeutics, both of which are being widely studied for their ability to silence gene expression. ASO and siRNA drugs are reaching the market, with even more in clinical trials. Interest and investment are growing in this rapidly evolving therapeutic space.

Carina Andersson confirms the importance of oligonucleotide therapeutics as part of a suite of tools available in genomic medicine. “Manufacturers can now target rare diseases as well as more common ones,” she says. “With RNA sequences, you can personalize them, allowing treatment to be specific for one person and their disease. Its potential is related to the fact that it’s acting in several ways. Oligos can inhibit protein activity and translation, as well as supporting the gene editing process as guide RNA.”

More clinical possibilities, more market potential

Oligonucleotide therapeutics were initially investigated for rare diseases, warranting fast-track approvals by regulatory authorities due to otherwise unmet medical needs. These early oligonucleotide drugs confirmed the potential of this approach to treatment, motivating researchers to consider using the same mechanism of action to tackle conditions affecting larger patient populations ― a move that proved worthwhile with the approval of Kynamro® (mipomersen, Ionis Pharmaceuticals) to treat familial hypercholesterolemia.

The life-changing potential of these therapies can also be seen with the drug Spinraza® (nusinersen, Biogen). Approved in 2016, this ASO is designed to treat spinal muscular atrophy (SMA) by promoting the production of functional survival motor neuron (SMN) protein, leading to improvement in motor milestones and reduced mortality in affected individuals. The ASO’s ability to selectively bind target mRNA enhances gene expression.

Katarina Stenklo says that the adaptability and wide range of oligonucleotide applications will make this modality a big part of the future. She singles out the recent approval of CASGEVY™ (exagamglogene autotemcel, Vertex Pharmaceuticals), a CRISPR/Cas9 gene-edited therapy for sickle cell disease: “I think it shows the diversity of oligos, that they can be used in different ways. That’s the beauty of it. It’s like moving to the next level.”

Precision medicines

Because oligonucleotide and RNAi-based therapeutics have the potential to specifically target the cause of disease at the molecular level, they are important drivers of personalized medicine. According to the most recent data available from the FDA, there were 17 personalized medicines approved in 2021, with over a third of new drugs from the past four out of five years being based on a personalized treatment approach.[i]

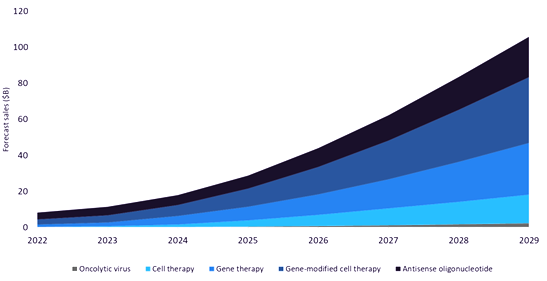

The market for personalized and precision medicines, including gene-modified cell therapies and ASOs, is expanding rapidly. According to GlobalData’s pipeline product database, ASO therapies represent over 50% of all RNA-based therapeutics in clinical development. [ii] GlobalData also forecasts an increase in sales of personalized medicines from $8 billion in 2022 to nearly $106 billion in 2029, a compound annual growth rate (CAGR) of 44%. The growth of oligonucleotide-based therapies is, in part, due to the ability to easily modify sequences as well as the low cost, high speed, and scalability of manufacturing.

Antisense oligonucleotides represented the largest segment of precision and personalized medicines in 2022, generating nearly $4 billion and having the highest number of marketed drugs. Sales of therapeutic ASOs are set to grow at a CAGR of 30%, and are projected to generate over $22 billion by 2029.[iii]

Beacon Data currently tracks over 1400 DNA and oligonucleotide therapies, along with 930 trials investigating oligonucleotide therapeutics[iv]. Most oligonucleotide and RNA-based drugs are in pre-clinical development, reflecting continued investment within industry and academia. According to the GlobalData Drug database, this amounts to over 1200 drugs in the pipeline. If approved, these novel therapeutics could address a huge range of indications, including genetic diseases, cancer, and metabolic disorders.[v]

The space has evolved since the first oligonucleotide therapeutic approval 25 years ago to now target a vast range of disease areas. Development is expected to continue to accelerate due to advances in delivery systems, such as lipid nanoparticles (LNPs).

Avoiding manufacturing hurdles

Early oligo therapeutic wins gained the interest of investors and led to new funding channels, collaboration opportunities and dedicated programs. Within a couple of short years, there was an urgent demand for the expertise and capacity needed to lead the pipeline toward success. Many companies are continuing to invest in oligonucleotide therapeutics today, so secure, fast process development and a stable supply of oligonucleotides remain pivotal to success and drug approval.

When working with complex personalized medicines, contract development and manufacturing organizations (CDMOs) can offer efficient process development and production of high-quality drugs ― however, outsourcing can also result in a loss of process control. CDMOs may assert ownership of process development through intellectual property (IP) laws, which can reduce internal understanding of key processes and make moving production in-house or to another CDMO challenging.

Regardless of the production strategy chosen, time and cost challenges are common when manufacturing oligonucleotides. Focusing on the most important elements of your process early on to avoid delays and allow for fast production of high-quality products to meet demand is crucial. The speed of successful process development and scale-up is directly correlated to the amount of expertise and experience available to support the development of your synthesis step as well as the full oligonucleotide workflow.

Stenklo explains that Cytiva can support scaling up from optimizing your synthesis step through to manufacturing a complete drug product. “From the synthesis side, we have small-scale equipment that is used for process development, all the way up to really large-scale equipment,” she says. “And the same goes for the purification side of it. And it’s all supported by the same software, so it’s very easy to go from your lab bench up to full-scale manufacturing.”

She continues: “The benefit of going with one supplier is that we make sure equipment and software fit together and can talk to each other. We have the knowledge, especially on the synthesis side, and we are a leader in developing these systems.”

Cytiva has built an organization with a focus on nucleic acid therapeutics, dedicated to supporting manufacturers bringing nucleic acid-based treatments to the market. The company has expertise in oligosynthesis and can collaborate to develop oligonucleotide therapeutics with scalable solutions for synthesis, purification, and filtration.

According to Andersson, “Our extensive experience from pharma means we understand that the systems are being used at all scales across the globe ― validated and verified by large companies and significant players in the market.”

Working with the FlexFactory™ platform from Cytiva can help manufacturers navigate some of the challenges associated with oligonucleotide manufacturing. “We have the essential pieces needed to set up manufacturing. We have the synthesis side, and purification too,” Stenklo explains. “We’re building the solution together with our customers. How would your manufacturing line look? What are your goals? From start to finish, we have the ability to deliver this as a package solution.”

FlexFactory doesn’t just include equipment ― it also comes with over 40 years of expertise and experience. “It includes management and services around qualification,” says Stenklo. “We make it easier for the customer to set up. You don’t have to deal with multiple suppliers, and you have a dedicated contact that will work with you. Additionally, we have experience in managing big projects.”

Cytiva has a team of scientists and engineers that have cultivated a robust understanding of synthesis, purification, and filtration methodologies applicable to a wide array of molecules. Consequently, the company is poised to offer comprehensive optimization and scientific assistance, backed by rigorous verification processes, across the entirety of the oligonucleotide workflow. Drawing on their wide-ranging experience can help you accelerate your therapeutic development.

For more information on how Cytiva can help with scaling manufacturing, download the paper on this page.

[i] PERSONALIZED MEDICINE AT FDA: The Scope & Significance of Progress in 2021. FDA website. Accessed February 5. 2024. https://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/Personalized_Medicine_at_FDA_The_Scope_Significance_of_Progress_in_2021.pdf

[ii] https://www.globaldata.com/store/report/precision-and-personalized-medicine-in-pharma-trend-analysis/, page 20.

[iii] Ibid.

[iv] RNA Therapy Dataset. Beacon Data. Accessed February 5, 2024. https://data.beacon-intelligence.com/

[v] Ibid., page 8.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.