What You Should Know:

– The COVID-19 pandemic propelled virtual care from a niche service to a mainstream necessity. However, as we move into a new era, consumer preferences surrounding virtual care are evolving, according to data from Rock Health’s 2023 Consumer Adoption of Digital Health Survey.

– The survey reveals that virtual care adoption has plateaued at a high level, with 76% of respondents having ever used it. However, a quarter of respondents still prefer in-person care, citing concerns about quality, lack of awareness, or cost. This highlights the need for a spectrum of care options – traditional, virtual, and retail – to cater to diverse preferences.

Virtual Care Here to Stay, But Not for Everything

While convenient, virtual care isn’t a one-size-fits-all solution. 24% of respondents prefer in-person care, citing quality concerns and lack of awareness as reasons. A spectrum of care options (virtual, in-person, and retail) will be needed. For certain needs like prescription refills and mental health, virtual care remains the preferred option. However, for chronic conditions, annual checkups, and physical therapy, in-person care is gaining traction again. This suggests convenience isn’t the only factor – factors like cost, existing provider relationships, and the nature of the care needed all play a role.

Other key findings from Rock Health’s 2023 Consumer Adoption of Digital Health Survey include:

Convenience Matters, But Value Drives Loyalty

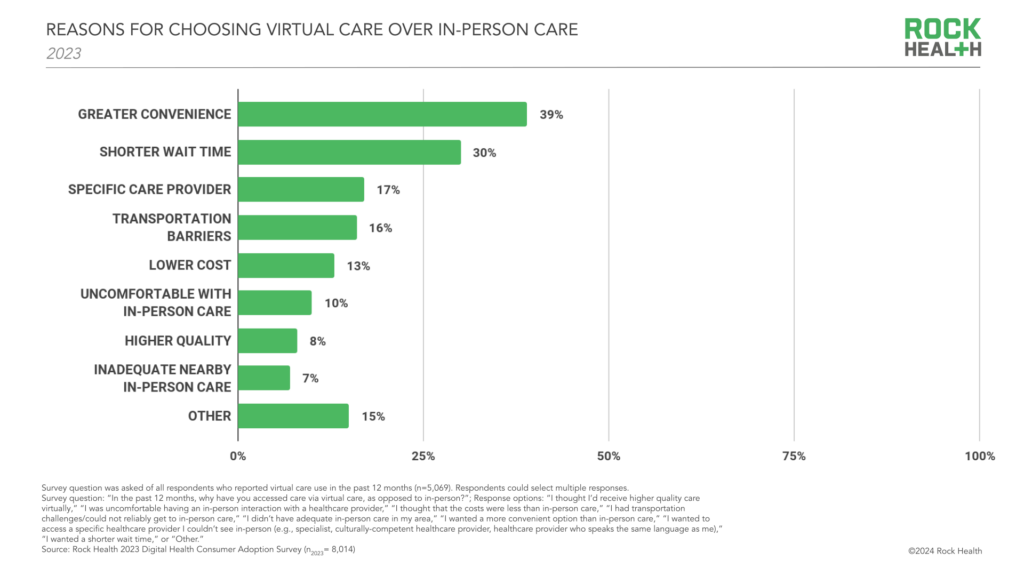

- Top Draws: Convenience (39%), shorter wait times (30%), and access to specific providers (17%) are the main reasons patients choose virtual care.

- Shifting Preferences: Virtual care is increasingly preferred for prescription refills, minor illness care, and mental health due to its convenience and ability to see specific providers.

- The Competition Heats Up: For other needs, consumers are looking beyond virtual care. Easy-to-access physical locations and on-demand care offered by retailers and clinics are emerging competitors.

- Beyond Convenience: To stay competitive, virtual players need to offer additional value propositions like clear communication, cost-effectiveness, insurance coverage, and culturally competent care.

The Familiarity of At-Home Testing Isn’t Universal

- COVID-19 Test Boom: 72% of respondents have used at-home tests, with COVID-19 tests being the primary driver (64%).

- Limited Appeal for Other Tests: Adoption for other at-home test types (genetic, gut biome, etc.) remains low, suggesting unique factors like ease of use and long-term value are crucial for broader adoption.

Data Sharing: Willingness with Reservations

- Open to Sharing: A large majority (90%) is willing to share health data, but with fewer entities (2.7 on average) compared to 2020 (3.4).

- The Doctor Disconnect: There’s a decline in sharing with doctors/clinicians (64% vs. 70% in 2022), potentially due to shrinking patient-provider relationships and demographic factors.

- Building Trust is Essential: Growing data privacy concerns highlight the need for robust security measures and clear communication about how data is used to improve the patient experience.

The Takeaway: A New Era of Discerning Patients

Consumers are no longer simply embracing virtual care; they are actively evaluating when and how to utilize it. Healthcare innovators must adapt by:

- Prioritizing Omnichannel Care: Cater to diverse needs with a range of virtual, in-person, and potentially retail-based options.

- User-First Design: Focus on user experience, convenience, and clear communication across all touchpoints.

- Building Trust with Data: Implement robust data security practices and transparent data usage policies to build trust with patients.