Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Wow, what a weekend. Following the news that President Biden is bowing out of the presidential race and endorsing Vice President Harris, we study her more left-leaning approach to health care. Also, a new report from HSBC on health investment, and more.

advertisement

Where does Kamala Harris stand on health care?

The answer: Left of President Biden.

Biden is endorsing Harris to replace him in the upcoming election — which could have a profound impact on the nation’s approach to health care, should she win. Her candidacy will be decided on at the Democratic National Convention in August.

Harris has previously supported Medicare for All and aggressive drug pricing reforms, STAT’s Rachel Cohrs Zhang and Sarah Owermohle write. She has also been a strong advocate for reproductive rights, especially following the fall of Roe v. Wade.

advertisement

While some progressive biotech entrepreneurs and health care venture capitalists were willing to endorse Harris yesterday, others withheld their views.

Health investment for the first half of 2024

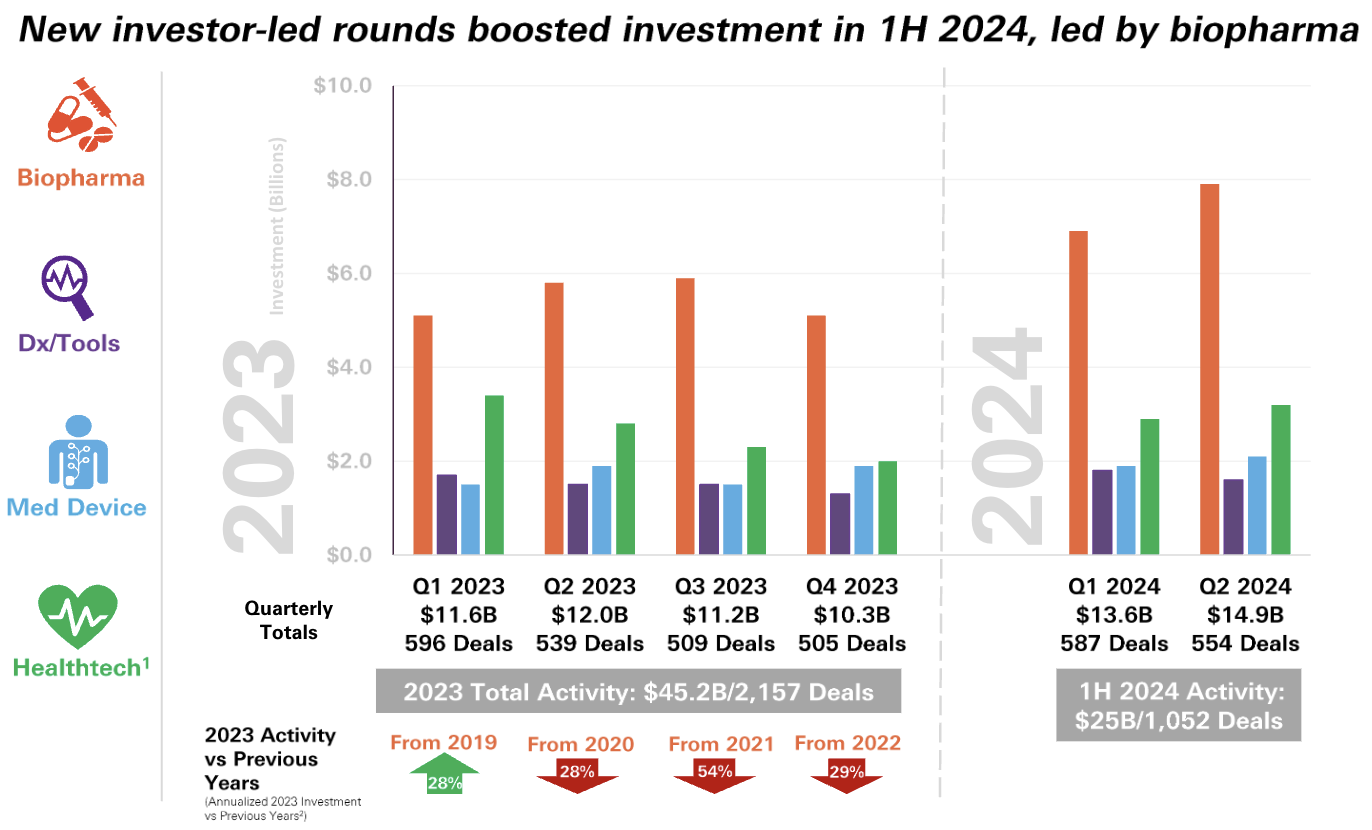

HSBC just released a new venture report for health care, noting trends for the first half of 2024. So far this year, there have been “real glimmers of hope,” with more dollars invested in all health sectors and many new investor-led financings. “Broadly speaking,” the report noted, “the exit environment for the industry was tepid, but the biopharma sector saw IPO interest and a sharp increase in high deal-value private M&A.”

The deals were particularly large in metabolic and auto-immune indications, but the most investment went into platform technologies and also into the oncology space. Notably, there have been 297 deals valued at $14.8 billion in the first half of this year, compared to the same period in 2023, when there were 299 deals — only worth a cumulative $10.9 billion.

Lilly’s tirzepatide wins approval in China

Eli Lilly’s weight loss drug tirzepatide — sold under the name Zepbound — just won regulatory approval in China, intensifying competition with Danish rival Novo Nordisk in the key Asian market, Reuters writes.

Novo’s competing weight loss drug, Wegovy, was approved in China just last month. Both Lilly and Novo are now working to increase production to meet the growing demand in a global weight loss market expected to reach $100 billion by the end of the decade.

Express Scripts overcharged postal workers by $45 million

A federal audit showed that Express Scripts, one of the largest pharmacy benefit managers, overcharged U.S. Postal Service employees by $45 million for prescription drugs between 2016 and 2021, primarily by withholding drug rebates meant for the health plan.

The audit provides timely fodder for federal lawmakers, who will grill top PBM executives this week in front of the House Committee on Oversight and Accountability, STAT’s Bob Herman and Ed Silverman write.

More reads

- Google co-founder backs biotech studying psychedelic African shrub, Financial Times

- Siga signs $113M U.S. supply contract for mpox antiviral Tpoxx, FierceBiotech

- OrbiMed forms biotech with assets from China-based Keymed, enlists former Biohaven exec as CEO, Endpoints