Dive Brief:

- New diabetes medicines could apply “short-lived pressures” to medtech companies by affecting the use of insulin, according to analysts at Mizuho.

- The development of new medicines that control blood sugar and drive weight loss has started a debate about whether demand for insulin, insulin delivery devices and blood glucose management solutions will continue to rise in the coming years.

- After attending the American Diabetes Association’s annual Scientific Sessions, Mizuho analysts concluded that, while the new therapies pose “some risk” in the near term, the diabetes space will remain one of the fastest-growing medtech markets.

Dive Insight:

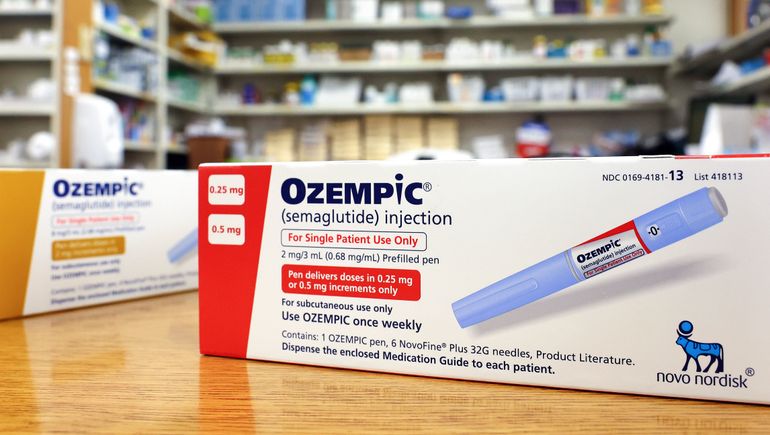

Eli Lilly and Novo Nordisk used the ADA meeting to share data on an emerging class of diabetes and weight loss drugs. The companies have linked the class of molecules, which includes Ozempic, to reductions in weight of 15% and more, leading to forecasts that the drugs will generate billions of dollars in annual revenues in the coming years.

What that means for use of insulin, and the range of devices that support people with diabetes who use the medicine, is an open question. According to Mizuho analysts, updates from Lilly and Novo Nordisk “drove the debates in favor of the idea that new insulin starts for [Type 2 diabetes] patients could hit a bit of an air pocket over the next 1-2 years at a minimum as these therapies are more heavily utilized.”

A fall in new insulin starts could affect companies such as Insulet, Medtronic and Tandem Diabetes Care, which make pumps that administer the medicine. While the analysts said “the jury is still out on whether a chasm will present itself,” they ultimately expect demand for devices to keep growing.

“Most physicians and companies we spoke to at the conference were in the camp that ultimately insulin therapy will not be displaced when patient adherence, difficulty in sustaining lifestyle changes, and side effects are taken into consideration. Short-lived pressures could emerge but will likely prove transient to underlying CGM and integrated pump market trajectories,” the analysts wrote.

Medtronic forecasted the expansion of automated insulin delivery from 10% penetration in 2022 to around 55% by 2030 during the ADA meeting. Dexcom shared its own forecasts for continuous glucose monitors, which the Mizuho analysts used to estimate that there are 11 million insulin-intensive and high-risk patients in the U.S. An average cost of $1,000 per year results in an $11 billion opportunity.

Based on the data and other considerations, the analysts expect the total addressable medtech market to expand, meaning diabetes is likely to remain one of the fast-growing markets in the industry in the years ahead.