You’re reading the web version of Health Care Inc., STAT’s weekly newsletter following the flow of money in medicine. Sign up to get it in your inbox every Monday.

The ‘#1 PRIORITY’

The emails from inside a physician practice owned by UnitedHealth Group sounded cheery, but were all business.

advertisement

One email trumpeted “ADDITIONAL BONUSES!!” for doctors who scheduled more appointments, encouraging them to meet with older patients on weekends. Another showed how doctors who completed the most wellness visits with older patients got a “SHOUT OUT!!” and were eligible for up to $10,000 in bonuses. The “#1 PRIORITY”, another email said, was documenting patients’ chronic illnesses.

The end goal? Generating more revenue from these patients, who were on Medicare Advantage. These emails provide a window into UnitedHealth’s corporate strategy to enlist its doctors to pile moneymaking diagnoses onto Medicare Advantage patients. Since the government pays insurers more for sicker patients — a system known as risk adjustment — UnitedHealth uses its unrivaled control over its doctors to push them to make those patients look as sick as possible on paper, STAT has found.

Read more from the latest installment of our Health Care’s Colossus series from Tara Bannow, Casey Ross, Lizzy Lawrence, and me.

advertisement

Tumult within CVS

With investors breathing down its neck, CVS Health removed its CEO, Karen Lynch.

The main troubles within CVS haven’t been its pharmacies or MinuteClinics or pharmacy benefit manager. The big problem has been Aetna, the health insurance giant that CVS bought for $69 billion in 2018. And Aetna’s undoing over the past year has been its Medicare Advantage business, where the company enrolled more new members than any other insurer in the 2024 season but was way off on how much care those new enrollees would use.

Lynch was the top Aetna lieutenant after former CEO Mark Bertolini rode off into the sunset (and then reappeared at Oscar Health). Her time at CVS seemed limited after her Aetna colleague Brian Kane was forced out in August.

Her replacement, David Joyner, may signal where CVS is going. Joyner led the company’s PBM, the real money-maker of the company and perhaps a nod to the idea that the PBM will be at the center of all its efforts moving forward.

The ‘utilization’ overhang

Low-income patients who rely on Medicaid are getting more procedures and prescription drugs, and that’s bad news for Elevance Health. The Blues insurer rolled out third-quarter earnings last week that sent its stock into a tailspin, and brought its peers along for the ride, Tara reports.

If you’re having déjà vu, Tara writes, it might be because we have also reported on insurers struggling with high costs in a different government program: Medicare Advantage. (Ahem, see above.)

The situation is a bit different with Medicaid: People who maintained Medicaid coverage after states redetermined their eligibility tend to be sicker and need more care. That gap between members’ high needs and the amounts states pay the insurers to cover them seems to be growing even larger, at least in the case of Elevance. That perplexed several Wall Street analysts on Elevance’s earnings call, who wondered why the opposite wasn’t happening, especially because some states have agreed to make mid-year tweaks to their payment rates.

Elevance didn’t have satisfying answers, but CEO Gail Boudreaux told analysts she does believe the issues affecting Medicaid are “time bound.” Even a KFF Medicaid expert Tara talked to wasn’t sure why that was happening. Read more.

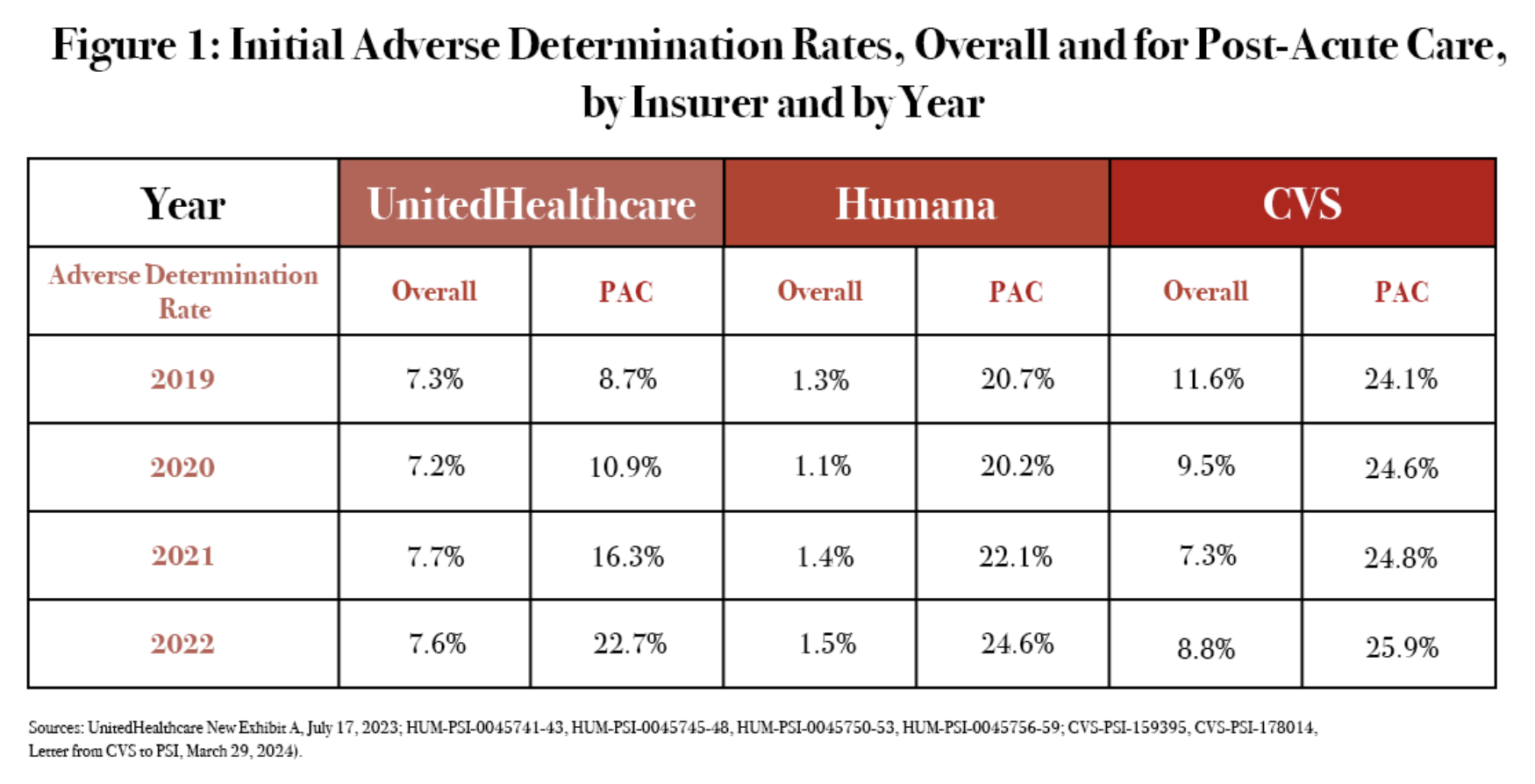

Denial rates, charted

As of 2022, the three largest Medicare Advantage insurers — UnitedHealthcare, Humana, and CVS Health’s Aetna — were turning down roughly a quarter of all requests for post-acute care. The sharp uptick in denials of care to sick, older patients coincided with the increased use of algorithmic tools. That’s all according to a new Senate subcommittee report that extensively cites STAT’s Denied by AI series from last year.

Summit snippets

Did you miss last week’s STAT Summit in Boston? Tara and I were both there, and both of our sessions covered Medicare Advantage.

I sat down with Don Berwick, the former CMS chief during the Obama administration. Berwick took a grim view of Medicare, saying the program is in trouble largely because of Medicare Advantage. He said he doesn’t think the solution is to ban private insurers from the program, but “we gotta regulate the hell out of them.” That’s in contrast to another Summit speaker, former Trump adviser Joe Grogan, who floated the idea of putting everyone in Medicare Advantage plans, in an interview with my colleague Rachel Cohrs Zhang.

Tara was on stage with three doctors who STAT interviewed as part of our Health Care’s Colossus investigation into UnitedHealth. The doctors said UnitedHealth promised a vision of value-based care that ultimately did not materialize. One of them said it felt like a “bait and switch.”

Industry odds and ends

- Humana finally did it: Late Friday, the company sued HHS and CMS (full lawsuit here) over its downgraded Medicare Advantage star ratings, following in the footsteps of UnitedHealth.

- The VA is investigating Acadia Healthcare over fraud concerns, Jessica Silver-Greenberg and Katie Thomas report for the New York Times.

- Hospitals and clinics purchased $63 billion of prescription drugs through the federal 340B drug program in 2023, a 23% increase from 2022, my colleague Ed Silverman reports.

- An exposé from reporters at The Guardian details how Parkview Health, a nonprofit hospital system in Indiana, has become an expensive, powerful player that has squeezed patients and employers in the area.

- Another hospital system, University of Vermont Medical Center, is ditching Moody’s as its credit ratings agency.

The Meme Ward