What You Should Know:

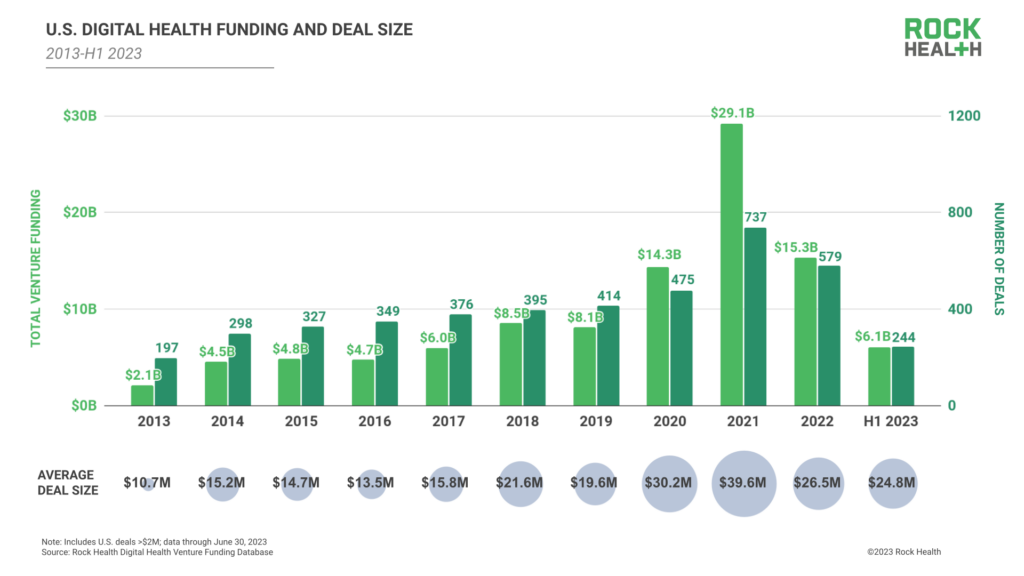

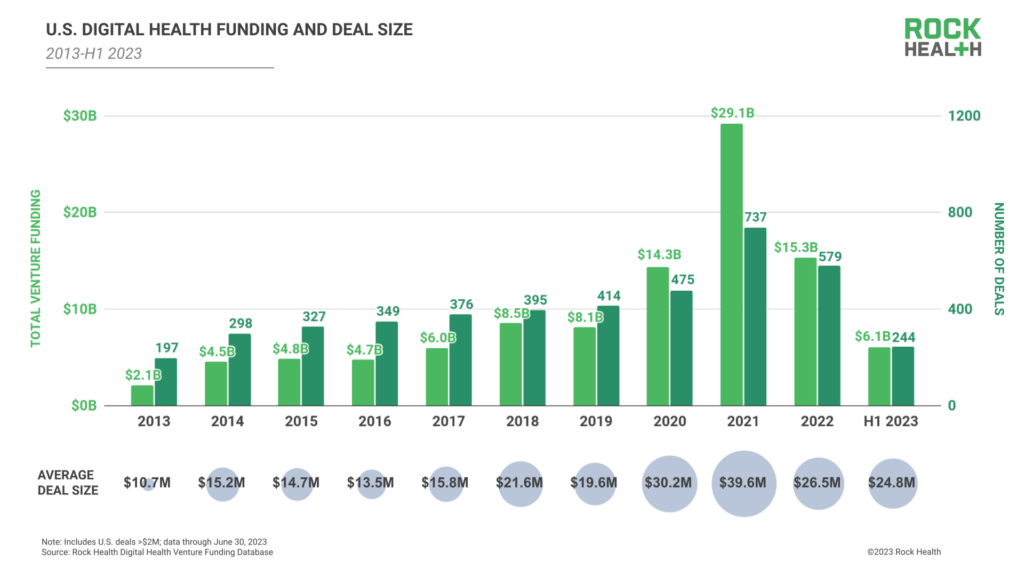

- Digital health funding in H1 2023 shows fewer deals, lower check sizes, and a smaller cohort of sector investors.

- Founders, investors, and healthcare innovators are adjusting to the new status quo, with some startups pursuing unlabelled raises, seasoned investors looking for the next big startups, and companies making decisions to sunset their businesses while their assets may continue as acquisitions or relaunched products.

Understanding Key Insights from the Rock Health H1 2023 Report

According to the report, in the first half of 2023, U.S. digital health startups secured $6.1 billion across 244 deals, with an average deal size of $24.8 million. However, Q2 2023 witnessed a decline in funding compared to the previous quarter, continuing the trend of sub-$3 billion funding quarters observed in the past year. Additionally, there was a decrease in the number of investors participating in digital health deals during H1 2023, with a shift away from generalist and crossover investors towards a more focused group of repeat digital health investors. These trends signify the start of a new funding cycle in digital health, characterized by smaller funding totals, lower deal volume, and a need for startups to adapt to the changing landscape.

Additionally, many digital health startups are facing challenges as they transition from the previous funding environment to the present one. The main struggle for founders lies in attracting new capital without significantly reducing established valuations or facing negative public relations associated with down rounds or smaller-than-expected funding rounds. To address this, an increasing number of digital health companies have opted for “unlabelled raises.” These unlabelled funding deals accounted for a remarkable 41% of H1 2023’s digital health funding, marking the highest proportion of such raises since 2011. Notably, most of these unlabelled deals were secured by startups that had previously raised early-stage rounds during the tail end of the “boom times” in late 2021 or early 2022. However, relying solely on unlabelled raises is seen as a short-term tactic rather than a sustainable long-term strategy. The current funding climate shows little tolerance for inflated valuations from 2021, and startups that adjust their valuations to align with sustainable profitability and growth targets may be better positioned for success with investors and potential acquirers in the future.

The report concludes by discussing that while some startups are adopting a wait-and-see approach amidst market fluctuations, digital health’s smaller group of active investors is actively pursuing companies they perceive as highly promising, demonstrated by their involvement in mega deal raises. H1 2023 witnessed 12 mega deals, which accounted for 37% of the total funding, with their sizes almost on par with previous years. The average check size for mega deals reached an impressive $185 million, comparable to the average mega deal size in the prosperous year of 2021. These substantial investments are occurring across various deal stages, including Series A, Series B, Series C, and Series D or higher, indicating confidence in the growth potential of these startups.