Dive Brief:

- Medtronic said Monday the Centers for Medicare and Medicaid Services opened a national coverage analysis for renal denervation procedures in patients with high blood pressure.

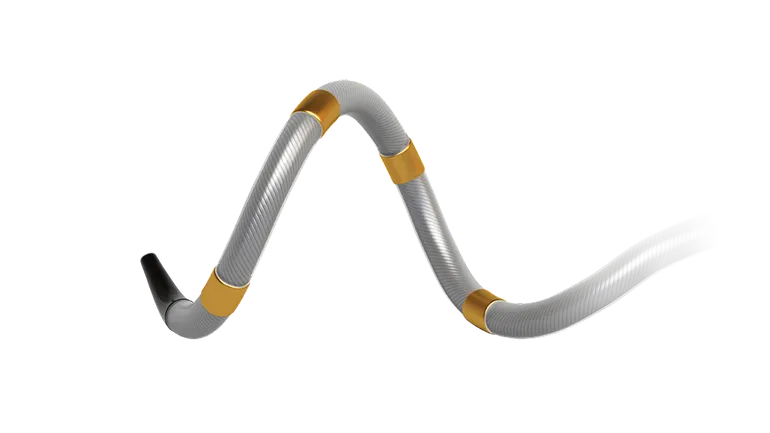

- The policy, which the CMS aims to finalize by Oct. 11, could provide immediate Medicare coverage for Medtronic’s Symplicity Spyral and Recor Medical’s rival Paradise renal denervation device. The systems are used in a minimally invasive procedure to ablate nerves around the renal arteries to reduce blood pressure.

- J.P. Morgan analysts said in a note to investors that the CMS’ initiation of a national coverage analysis “validates the technology and could potentially move the needle on growth for Medtronic.”

Dive Insight:

The CMS gave transitional pass-through payment status to Medtronic’s and Recor’s devices in November 2024. While the status encourages hospitals to use the technologies, national Medicare coverage could enable more widespread use of the products. Medtronic CEO Geoff Martha discussed the CMS’ opening of a national coverage analysis in a presentation at the J.P. Morgan Healthcare Conference Monday.

“This is huge news, huge news for patients, and it marks a pivotal development in our efforts to support access to this innovative procedure,” Martha said. “We’ve made a tremendous amount of progress over the last couple of years with Medicare coding and payment for Symplicity already in place. Now we’re really excited to see this final piece of the puzzle, which is coverage, snap into place.”

The CMS opened a 30-day public comment period Monday. The feedback will inform the publication of a draft national coverage decision by July 13. The CMS will use comments on the draft to finalize the text by Oct. 11.

J.P. Morgan and RBC Capital Markets analysts welcomed the development, respectively hailing the CMS’ actions as “one of the biggest updates of the day” and “a step in the right direction.” Exactly how beneficial the coverage is for Medtronic will depend on the scope of the determination, specifically how many patients can access renal denervation. Both sets of analysts noted the uncertainty.

Yet, RBC analysts said “this is a significant opportunity for [Medtronic] even if they get initial limited coverage (with evidence development) given the large number of patients affected by hypertension.” J.P. Morgan analysts concurred, telling investors “any standardization of coverage would be a big win for Medtronic.” Standardization would move the field away from patient-by-patient prior authorizations.

The analysts’ positivity reflects the size of the market. Martha said high blood pressure affects more than 1 billion people globally. If Medtronic penetrates 1% of the sector, the company will unlock a $1 billion market, according to the CEO.

Medtronic asked the CMS to make a national coverage determination for renal denervation. The policy could apply to both Medtronic’s Symplicity Spyral and Recor’s Paradise. Recor, a subsidiary of Otsuka Medical Devices, said in a statement that it appreciates the CMS’ consideration of potential national coverage.