You’re reading the web edition of STAT’s Health Tech newsletter, our guide to how technology is transforming the life sciences. Sign up to get it delivered in your inbox every Tuesday and Thursday.

Good morning health tech readers!

advertisement

On Monday, February 10 at 11 a.m. ET, my colleagues Casey Ross and Brittany Trang will be hosting a virtual event on the future of AI in health care. It’s something of a launch party for AI Prognosis, Brittany’s new newsletter for STAT+ subscribers.

IMPORTANT NOTE: We’re going to send the first few editions of AI Prognosis to all STAT Health Tech subscribers — That means you! If you’re a STAT+ subscriber on this list, you’ll keep receiving AI Prognosis after that introductory period. Don’t want AI Prognosis? Click here to opt out.

Reach me: [email protected]

advertisement

Amazon Pharmacy study touts refill rate

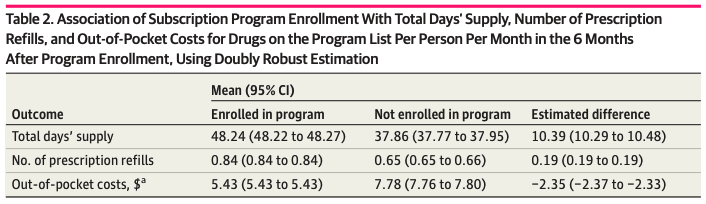

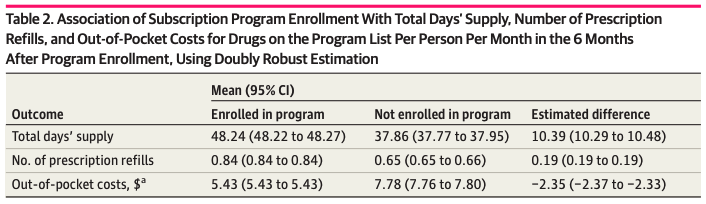

In a new paper published in JAMA Network Open, Amazon employees present data suggesting people who sign up for the company’s RxPass subscription are more likely to refill prescriptions for common drugs like statins and antidepressants than those not enrolled in the program. Launched in 2023, the subscription gives members access to 60 generic medications for a $5 monthly fee. Drugs do not just show up because someone is enrolled in RxPass; users must choose to refill them. Many RxPass drugs are meant to be taken for a long-period of time, so the data helps make the case that Amazon’s service supports medication adherence and better health care outcomes.

The study design is pretty clever, but not bulletproof. The study compares 5,000 people who enrolled in the program to 5,000 people who clicked enroll but lived in states where the program wasn’t available. To reduce the impact of people going to other pharmacies, the study was limited to those who had used Amazon to fill two prescription for drugs available through RxPass. According to the data, six months after enrolling or (or clicking enroll), people in the program had on average 10 more days medication on hand and a slight uptick in refills.

The paper makes a number of arguments about what may be driving this positive change, including the impact of price sensitivity and “cognitive and behavioral factors.” But I think it’s pretty clear that if you make it cheap and easy to do the right thing, people will do it.

Are there confounders? Of course. Is it neat to see Amazon show some data about Amazon Pharmacy? Absolutely. Since launching RxPass, the company has only moved more aggressively into Pharmacy which remains its most successful foray into health care so far. It will be interesting to watch if the company continues to build evidence that the business is improving the health of users.

Medicare

Hospital at home advocates remind us that, yes, it’s February

I know you can’t believe it either, but it’s February. Even with the seismic activity happening in the federal government right now, there’s a separate political fight around funding the government on the horizon. At the end of last year, Congress failed to arrive at a full-year spending deal and opted to just fund the government through March 14th. For our purposes, an important consequence is that multi-year extensions of health tech-friendly policies adopted during the pandemic did not pass.

advertisement

Earlier this week, Moving Health Home, a group that represents huge hospital systems like Ascension and vendors of home health tech like Best Buy, sent a letter to lawmakers asking them to include in the forthcoming March funding package a five-year extension of a Medicare program that allows approved hospitals to deliver inpatient care in people’s homes. At the end of last year a five-year extension was on the way to getting done when the broader funding deal fell apart.

It’s just a letter, but it’s also a reminder that this hospital at home program as well as an expansion of telehealth covered by Medicare may be in a tough extension vortex for the foreseeable future. People I’ve spoken to are unsure what will happen. Given all that needs to be done it seems likely that the upcoming deal will only extend the policies to the end of the year, when advocates will again have to jockey to get longer extensions into the spending package. And if Congress doesn’t fund the government for the rest of the year next month, we may be having this conversation again sooner.

New Teladoc, same acquisition strategy

On Wednesday I reported that virtual care giant Teladoc Health plans to buy Catapult Health for $65 million. Catapult makes a kit that allows people to take their blood pressure and a blood sample for lab testing at home. After mailing in their sample, people meet with a nurse practitioner to discuss the results. The purchase is aimed at growing Teladoc’s chronic disease business and is very much in line with Teladoc strategies going back years.

First of all, Teladoc has always been a rollup. Before the pandemic helped Teladoc Health grow from earning $500 million a year to $2.6 billion a year, the company steadily built the foundation for this growth by strategically acquiring companies here and there. These days, people like me are constantly reminding you about the company’s record-breaking $18.5 billion deal to buy digital diabetes management company Livongo, which ultimately led to Teladoc writing off billions in losses. But it’s been a mostly good strategy: The company bought BetterHelp in 2015 for a song and has since grown it to a $1 billion business on its own. (BetterHelp is having some issues these days, but we’ll set that aside for now.)

advertisement

Amid growth that has slowed to a crawl, Teladoc last year replaced its CEO. New leader Chuck Divita has made some internal changes and pushed new priorities, like international expansion, but the new purchase shows how much of Teladoc’s strategy is more of the same. With 93 million people eligible for Teladoc services, the company’s main lever for growth in the United States, its biggest market, remains getting eligible people to use its more services. The hope, dating back to the Livongo purchase, is that more people using Teladoc for virtual urgent care would eventually use its chronic disease offerings. Now it’s got a home testing company to support that goal.

Read more about the deal here.

Fundraising and shutdowns

- Zest Health, which provides virtual care for people with inflammatory skin diseases like psoriasis, raised $13 million.

- Axena Health, maker of a device to help strengthen pelvic floor muscles to treat conditions like female urinary incontinence, has a new deal to use content developed by Mayo Clinic, which also made an investment of an undisclosed amount in Axena.

- Lynx, a financial platform for health benefits programs, raised $27 million led by Flare Capital Partners, with participation from CVS HealthVentures, and McKesson Ventures.

Dolan shutdowns. - Caraway, a virtual health clinic targeted at “Gen Z women” and Miga Health, a heart-health focused clinic, both shutdown, Exits & Outcomes reported.

- E&O also noted that Miga Health, a heart-focused virtual clinic, is not longer accepting new patients. A posting from benefits provider Sana suggests the company shut down at the end of 2024. I reached out to Miga CEO Jarrad Aguirre, who we interviewed in STAT Health Tech in 2022, but he did not respond.

- Benevolent AI, an AI drug development company, announced today that it is delisting from the Dutch stock exchange and becoming a private company. The company has had three CEOs and three rounds of layoffs in the last two years and had failed to show efficacy in its Phase IIa trial for its atopic dermatitis treatment.

What we’re reading

- OpenAI’s new trademark application hints at humanoid robots, smart jewelry, and more, TechCrunch

- Knowing less about AI makes people more open to having it in their lives – new research, The Conversation

- The CRISPR companies are not OK, STAT