Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

And hello again! Miss us?

advertisement

This morning STAT brings you an exclusive story about how the Biden administration’s program to develop antivirals for future pandemics has faltered. We also point out that gene-editing player Tome will lay off nearly all of its employees, and highlight a cautionary tale from Harvard’s Jeffrey Flier on dismissing promising technology too soon.

Biden’s antiviral therapy plan is flailing

After the hard lessons driven home by Covid-19, the Biden administration launched the Antiviral Program for Pandemics with $3.2 billion to prepare for the future. But the 2021 initiative has faced tremendous setbacks.

At first, the APP aimed to bolster antiviral research and create a framework to prepare against future pathogens. That structure, STAT’s Jason Mast reports exclusively, was never built.

advertisement

Funding was provided, however, for nine antiviral drug discovery centers. But now, with money set to run dry sooner than expected — and well before any company, nonprofit, or government agency would be willing to take over the research — it’s uncertain how pandemic preparedness will continue.

“There will be papers coming, there will be some progress. But in the big picture it is not going to be the revolution in antiviral drug discovery and development that was the goal,” Luis Schang, president of the International Society for Antiviral Research, told STAT.

A Galapagos investor signals impatience with its turnaround efforts

Ecor1 Capital, a biotech hedge fund run by investor Oleg Nodelman, has increased its stake in Galapagos NV, the long-struggling Belgian drugmaker, to 9.9% — a move that indicates Nodelman may take a more active role in the company’s turnaround efforts.

Galapagos shares are “deeply undervalued and represent an attractive investment opportunity,” Ecor1 said in a filing Friday with the Securities and Exchange Commission that disclosed the firm’s upsized position. Ecor1 intends to communicate with Galapagos’ management and board of directors about a variety of topics relating to the company’s “performance, business, operations, strategic opportunities and governance, including Board composition,” the filing added.

Galapagos was once regarded as one of Europe’s most successful inventors of new medicines, but the company has fallen on hard times due to a series of R&D failures, regulatory setbacks, and unproductive partnerships. In 2022, legendary drug hunter and Belgian native Paul Stoffels came out of a brief retirement after 20 years at J&J to take over as Galapagos’ CEO.

Stofells promised a reinvention of Galapagos’ R&D efforts, focused mostly on CAR-T therapy for cancer, but the work has been slow and from Wall Street’s perspective, largely unremarkable. Galapagos trades at an enterprise value of negative $2.1 billion, meaning its cash is worth far more than all of the company’s assets, including the drugs in its research pipeline.

Tome laying off practically entire staff

Tome Biosciences, a high-profile gene-editing startup, will lay off virtually its entire staff this fall, according to a legal notice filed Friday. The notice came a day after STAT reported the company was flailing.

Tome announced an incredible $213 million fundraise just last December — with grand ambitions to write the “final chapter in genomic medicines.”

Its technology, called PASTE, was meant to write large sequences of DNA, allowing scientists to potentially replace entire genes or rewire cells — as opposed to making smaller changes. But there was concern about the technology’s accuracy, as well as issues with intellectual property.

This startup was way ahead of its time

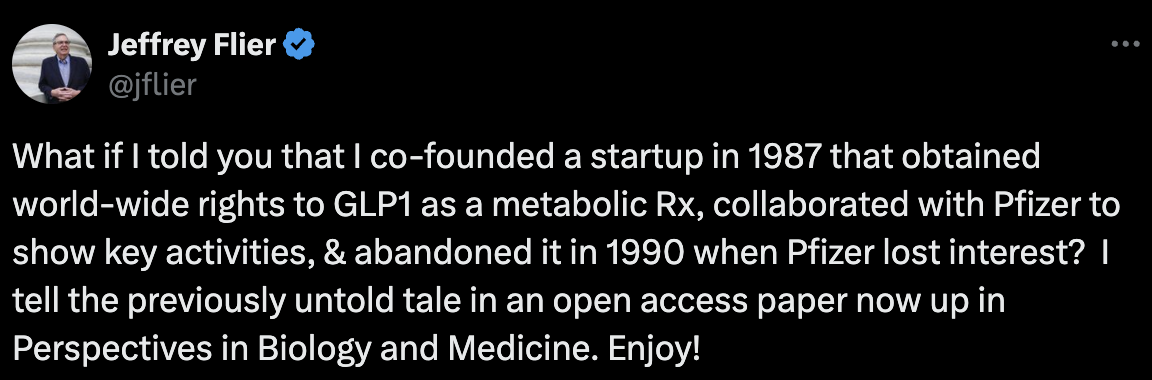

Ooh, what an origin story. Jeffrey Flier, the former dean of Harvard Medical School, posted the above on X. In 1990 his GLP-1 company MetaBio “failed,” he said — and you can see why a preprint that details why this blockbuster class of drugs was essentially shelved for decades. Part of the problem, he says, was the corporate structure in place, not the science.

Pfizer expressed interest in MetaBio’s work, but company leadership ultimately came to the baffling (and still unexplained) conclusion that “there would never be another injectable therapy for diabetes other than insulin.”

“Sadly, MetaBio, the little company that could — and perhaps should have — been hugely successful with GLP-1, was a decade or more ahead of its time,” Flier writes in the preprint. “Even the biggest blockbusters can be dismissed as unworthy by smart and ambitious people.”

More reads

- Siemens Healthiness boosts cancer imaging with €200 million Novartis deal, Financial Times

- Nestle to keep Health Science unit after CEO’s exit, chairman tells paper, Reuters

- FDA approves updated Covid-19 vaccines, shots should be available in days, STAT

Correction: An earlier version of this newsletter incorrectly stated that Eli Lilly was involved with MetaBio’s GLP-1 work.