This story first appeared in The Readout newsletter. Sign up for The Readout and receive STAT’s award-winning biotech news delivered straight to your inbox.

Morning! Today, we discuss Madrigal’s impressive launch of its MASH drug Rezdiffra, see psychedelics player Compass Pathways shed 30% of its staff, and more.

advertisement

Some drug launches go really well

From STAT’s Adam Feuerstein: Add Madrigal Pharmaceuticals to that list. Yesterday the company reported $62 million in third-quarter sales of Rezdiffra, its treatment for the serious liver disease known as MASH. Sales topped Street expectations by a wide margin, with the company more than tripling the number of patients on the drug from the end of the June quarter.

“While we still have a lot of work left to do, we have made terrific progress to date,” said Madrigal CEO Bill Siebold on the company’s conference call.

Rezdiffra was approved in March amid questions about whether a once-daily pill specifically addressing the liver damage caused by MASH could succeed in an era when physicians are turning first to GLP-1s to address obesity — often a precursor to a MASH diagnosis.

advertisement

A fast launch fueled by stronger-than-expected patient demand should ease investor concerns that Madrigal is selling into a shrinking market. The stock was up 20% yesterday, but is still below its all-time high — so Siebold is right, there’s more work and convincing to do.

Compass Pathways is laying off 30% of its staff

Compass Pathways, which is now the further along than any other drugmaker in developing a psychedelic therapy for a mental health indication, is laying off 30% of its staff, including some in senior management roles, as clinical trials are running much longer than expected.

The news follows Lykos Therapeutics’ failed bid to win FDA approval for its psychedelic PTSD treatment this past summer: As FierceBiotech points out, CEO Kabir Nath said in an earnings call that there was “a high degree of scrutiny regarding unblinding, which is very relevant to our studies.”

Phase 3 results for Compass’ psilocybin treatment COMP360, aimed at treatment-resistant depression, were initially expected this summer; now, that’s been delayed to the second quarter of 2025. Another study’s results are now delayed to 2026.

“There have been a number of items related to the complexity of the trials that we’re now learning along the way,” Nath said. He added that scheduling complexities for patients and therapists “have resulted in inexperienced sites carefully managing patient flow as they become more proficient.”

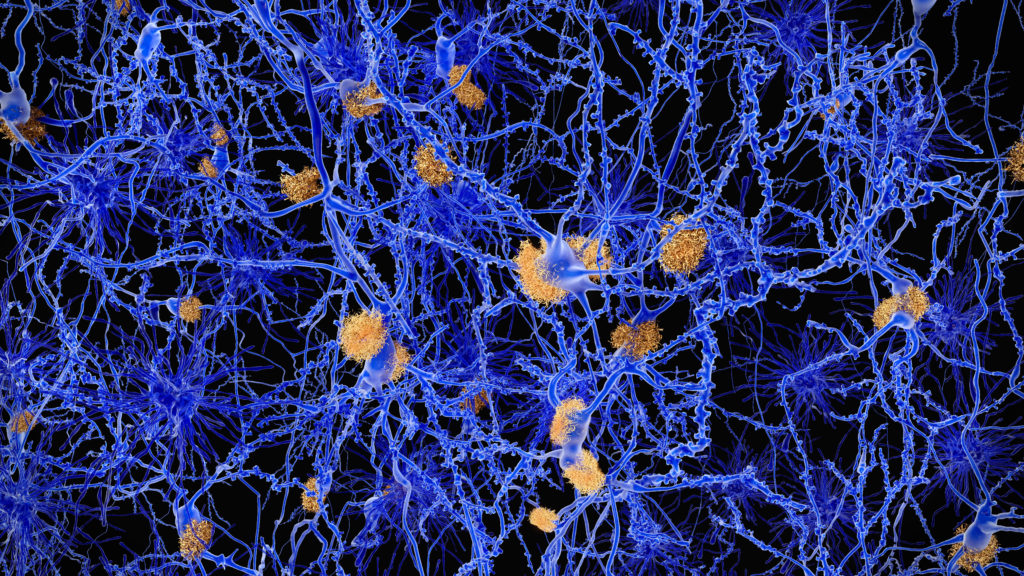

A setback for the tau approach to Alzheimer’s

From STAT’s Andrew Joseph: In the effort to expand approaches to treating Alzheimer’s beyond targeting amyloid, some companies have sought to target another protein thought to play a role in the disease — tau. But the approach faced a bit of a setback this week.

The Belgian biopharma UCB company presented data yesterday showing that its tau-targeting antibody called bepranemab successfully slowed tau accumulation versus placebo in a Phase 2 clinical trial. But the study, which enrolled more than 450 participants, did not meet its primary endpoint of slowing Alzheimer’s progression, based on a commonly used metric known as Clinical Dementia Rating sum of boxes, CDR-SB.

UCB did some further slicing and dicing of its data, and found that patients who either had low levels of tau to begin with or who were not carriers of a particular genetic variant called APOE4 (or who fit both those groups) did see a slowing of disease progression on bepranemab. UCB’s Matthew Barton, who presented the data at the Clinical Trials on Alzheimer’s Disease conference in Madrid, said researchers were “encouraged” by the trial, and UCB said it is evaluating what steps to take next with bepranemab.

Expectations for the results were not particularly high. Last week, UCB said that Roche and its subsidiary Genentech, which had bought into bepranemab in 2020, had given back rights to the drug.

Lilly earnings surprise and a spooky ghost story

What would a Kamala Harris or Donald Trump presidency mean for health care policy? Why did Eli Lilly’s Mounjaro and Zepbound sales miss expectations? And does Adam believe in ghosts? We talk about all that and more on this week’s episode of “The Readout LOUD,” STAT’s biotech podcast.

Adam, Allison, and Elaine get into the Halloween spirit this week, discussing their favorite candies — and Eli Lilly’s and Pfizer’s surprise earnings reports. Then, they discuss what a Trump or Harris presidency could mean for health care and the biopharma industry, and what investors and biopharma executives think about either outcome.

More reads

- To mitigate drug shortages, a new study suggests looking at Canada, STAT

- Two generic drugmakers pay $49 million to settle price-fixing charges, STAT

- Purdue Pharma nears new bankruptcy deal with Sacklers, mediator says, Reuters

- Teva fined $503 million for disparaging a rival and using patents to thwart competition, STAT