Clinical-stage biopharmaceutical firm Abeona Therapeutics has raised $25m from its current select investors to launch and commercialise its cell therapy, EB-101.

Led by Nantahala Capital Management, the offering saw participation from Adage Capital Partners and two others.

The company will use the funding to prepare for launch activities in anticipation of filing the biologics licence application (BLA) and the future approval of EB-101.

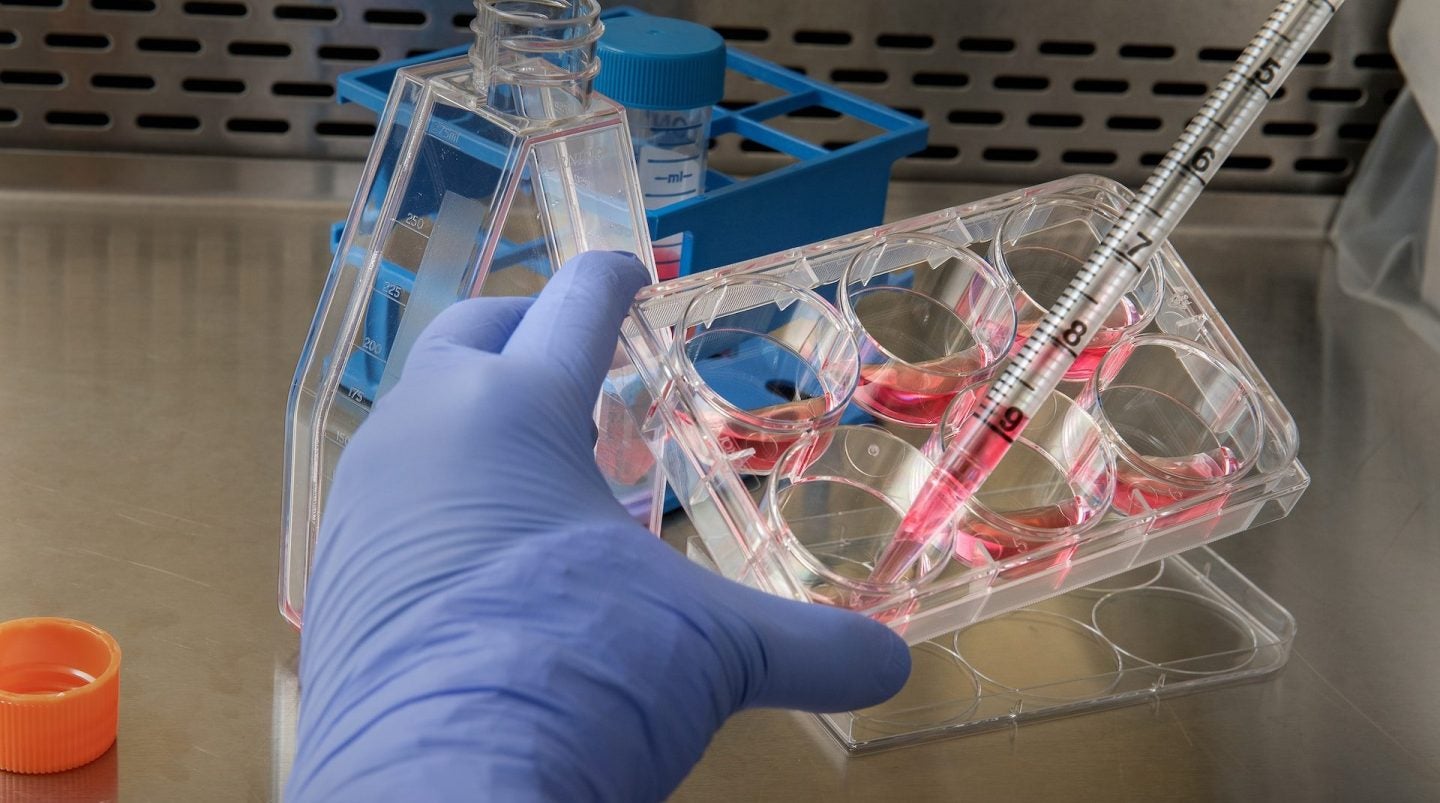

EB-101 is an autologous, engineered cell therapy that is being developed to treat recessive dystrophic epidermolysis bullosa.

It has received a rare paediatric disease designation and the company anticipates receiving a priority review voucher (PRV) from the Food and Drug Administration (FDA) on clearance of the BLA.

Abeona can utilise the PRV to gain an expedited review for the marketing application of another product, or it can be traded to another firm to generate extra funds for launching EB-101.

The proceeds will also be used for basic corporate activities and as working capital.

The offering will conclude on or about 6 July 2023.

The development portfolio of the company also comprises AAV-based gene therapies for ophthalmic ailments.

Abeona’s cell and gene therapy cGMP production facility manufactures EB-101 for the Phase III VIITAL trial. It is also equipped to manufacture AAV-based gene therapies for clinical and commercial purposes.

Cell & Gene Therapy coverage on Pharmaceutical Technology is supported by Cytiva.

Editorial content is independently produced and follows the highest standards of journalistic integrity. Topic sponsors are not involved in the creation of editorial content.