Dive Brief:

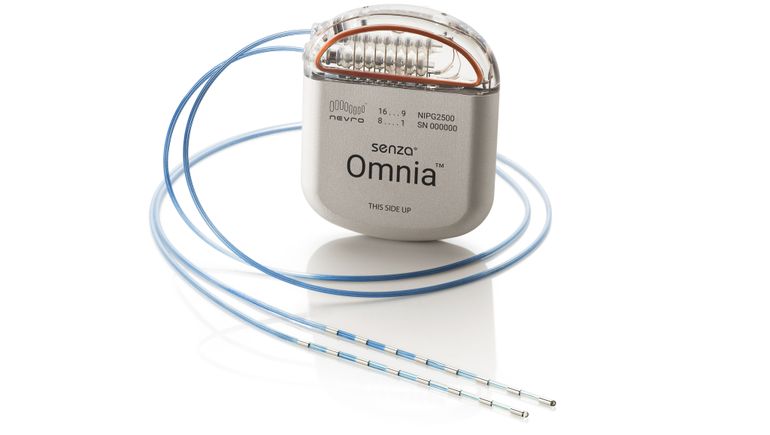

- Activist investor Engaged Capital has taken an approximately 6% stake in the spinal cord stimulation (SCS) specialist Nevro, according to a recent filing with the U.S. Securities and Exchange Commission.

- Bloomberg reported Monday that Engaged is opposed to Nevro going after acquisitions that may jeopardize its core business until after its recent acquisition of Vyrsa Technologies has proven to be a success.

- Bloomberg also reported that the investor sees Nevro as a likely acquisition target for a rival. Nevro is a pure-play SCS company that competes with Abbott, Boston Scientific and Medtronic. Engaged Capital declined MedTech Dive’s request for comment, and Nevro did not respond at the time of publication.

Dive Insight:

Nevro has lowered its sales expectations from the beginning of the year. The company went into 2023 forecasting sales of from $445 million to $455 million, a range that reflected 10% to 13% growth on a constant currency basis. The company adjusted its guidance several times throughout the year, ultimately forecasting in November a revenue range of from $417 million to $419 million for the full year, an increase of 3% over the prior year.

The stock has fallen roughly 50% this year to $20.06 when the market closed Monday.

Early this month, Nevro moved to add a growth driver by agreeing to pay $40 million upfront, plus up to $35 million in milestones, to acquire Vyrsa for its minimally invasive treatment for chronic sacroiliac joint pain. The deal expanded Nevro’s portfolio of chronic pain devices.

Writing in a research note at the time of the Vyrsa deal, J.P. Morgan analyst Robbie Marcus said “Nevro’s ability to either hold or return to capturing share” in SCS would remain the main priority for investors.

Engaged Capital wants to make sure Nevro stays focused on that key task rather than strike more acquisitions, according to Bloomberg’s report, which cited unnamed sources with knowledge of the matter.

The SEC filing noted that Engaged Capital has “engaged, and intend to continue to engage, in communications with the Issuer’s Board of Directors … and management team regarding opportunities to maximize stockholder value.”

Shareholders have successfully changed the direction of Nevro in the recent past. In 2019, “constructive engagement” with Broadfin Capital led Nevro to appoint a new CEO and shake up its board. Nevro’s share price went from below $50 to above $180 in less than two years after the changes, only to fall this year to its lowest price in the company’s nine-year history on public markets.