Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Good morning, everyone. Damian here with the plight of the venture capitalist, an idea for Gilead Sciences, and the latest in the quest to find potent treatments for Parkinson’s disease.

advertisement

The need-to-know this morning

- Cancer drug developer CG Oncology raised $380 million in an initial public offering. It’s the first biotech IPO of 2024.

Biotech VCs are feeling the squeeze

As fledgling drug companies struggle to raise the cash they need to survive, spare a moment for the venture capitalists on the other side of the Zoom screen.

As STAT’s Allison DeAngelis reports, biotech’s lengthy downturn has put some VCs in uncomfortable positions as they try to raise new funds from the pensions, endowments, and other big-money organizations that supply their capital. Those funds have started making bolder requests, multiple VCs said, including pushing for more favorable terms and even asking for equity in the firm itself.

“I’ve been at Sofinnova Partners for 26 years, and in the business for close to 30. This is the toughest it’s been,” said Antoine Papiernik, a managing partner at the firm. “Caution is important for the next 12 months.”

advertisement

Gilead: Now what?

Gilead Sciences’ dogged efforts to build a business in oncology have mostly amounted to disappointment, most recently with a clinical trial setback stemming from the company’s $21 billion investment into antibody-drug conjugates.

The shining exception is Gilead’s acquisition of Kite Pharma, a pioneer in CAR-T therapy whose work has led to cornerstone treatments for certain cancers. So instead of throwing more money at disparate ideas in oncology that might only end in failure, why not double down on what works?

As STAT’s Adam Feuerstein writes, Gilead has a path forward in CAR-T through its partnership with Arcellx, a biotech company at work on what could become a best-in-class treatment for multiple myeloma. Buying Arcellx outright could help Gilead meet its goal of having oncology drugs contribute 30% of total product sales by 2030, a mark it’s unlikely to hit on its own merits.

There’s always money in obesity

If biotech is going to pull off the market turnaround so many in the industry have predicted for 2024, the sector is going to need more than a few companies to successfully go public. Last year, which saw just 11 biotech IPOs, doesn’t exactly bode well. But there’s good news: An obesity-related company might be waiting in the wings.

According to Bloomberg, Kallyope is getting its paperwork together for an IPO, working with J.P. Morgan on an offering that could materialize this year. The company, founded in 2015, is developing oral treatments designed to stimulate bodily hormones tied to satiety, working upstream of GLP-1 drugs like Wegovy.

Treating obesity is among the vanishingly few things a biotech company can do to get attention from generalist investors in recent months, which means Kallyope’s potential public debut could bring some much-needed capital back to the sector. Structure Therapeutics, a company with an oral GLP-1 treatment, was among 2023’s only successful biotech IPOs.

Another step toward new drugs for Parkinson’s

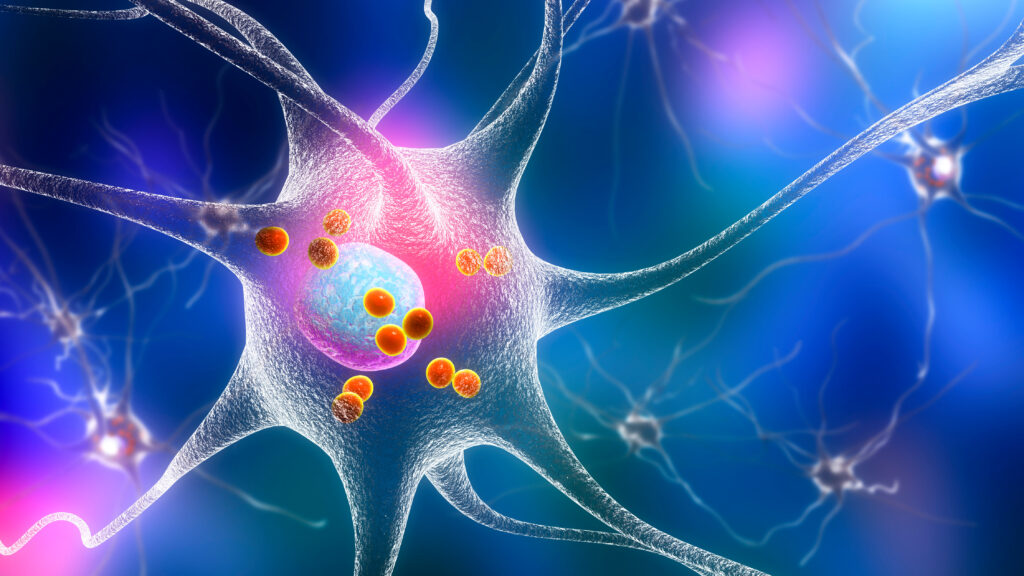

Building off of some landmark discoveries published last year, researchers have mapped out the biological underpinnings of Parkinson’s disease, creating a framework for medicines that might treat the root of the disease rather than just its symptoms.

Their work, published in the Lancet Neurology, stages Parkinson’s based on the accumulation of a misfolded protein called alpha-synuclein. Funded by the Michael J. Fox Foundation for Parkinson’s Research, the work expands on a 2023 publication that validated an alpha-synuclein diagnostic for the disease.

The new framework still has some gaps, but the researchers believe they’ve set out a path that will allow scientists to discover and rigorously test treatments aimed at the biological causes of Parkinson’s, providing a reliable measure of disease severity that might accelerate the process of drug development.

More reads

- When it comes to policing pharma, the FTC says it’s on ‘an incredible winning streak,’ STAT

- British billionaire Joe Lewis pleads guilty to biotech insider trading, CNBC

- Select A PBM in Africa flips the industry’s script in a bid to make people healthier, STAT

- Lilly’s Mounjaro dose in limited availability in US through next month, Reuters

Pssst. If you’ve made it to the end of this article, you might be interested in joining this secret list for an upcoming biotech newsletter. Just some food for thought.