Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Good morning. My colleague Ed Silverman, who I view as the foremost expert on drug patents (and coffee flavors), has been taking a closer look at patent claims to bring us an exclusive analysis. We get into all of that today.

advertisement

The need-to-know this morning

- Organon said it will acquire Dermavant, a subsidiary of Roivant Sciences, for $175 million plus an additional $75 million contingent on expanded approval of VTama, Dermavant’s topical medicine for psoriasis. Roivant will also be eligible for another $950 million tied to the achievement of certain VTama commmercial milestones.

- Applied Therapeutics said the FDA has decided against convening an outside advisory committee to review the company’s drug govorestat for the treament of galactosemia. The FDA review is ongoing, with a decision expected on Nov. 28.

How drugmakers quietly expand their patent claims

Drugmakers are understandably eager to expand their patents. A new STAT analysis shows one way in which they do that through the Orange Book, a key FDA registry.

At issue are “use codes,” which are brief descriptions of a type of patent claim that focuses on the specific use of a medicine, or the “method of use” in legal vernacular. Between 2017 and this year, the total number of use codes for all patents in the Orange Book grew 35%, from 7,919 to 10,731, according to the new analysis.

.png)

As STAT’s Ed Silverman and data journalist Michael Nolan explain, by listing a large number of codes pertaining to one or more patents for a medicine, a brand-name pharmaceutical company can make it difficult for a would-be generic rival to successfully battle patent litigation designed to stall its plan to market a lower-cost version.

advertisement

Novartis breast cancer drug wins expanded approval

The FDA yesterday approved Novartis’ Kisqali in combination with hormone therapy for patients with certain early-stage breast cancers, significantly expanding the number of patients who will have access to the pill. (The therapy was previously indicated only for patients with metastatic disease.)

Kisqali is in a class of treatments called CDK4/6 inhibitors. Last year, the FDA approved Eli Lilly’s CDK4/6 inhibitor, called Verzenio, for use in certain stages of breast cancer, but not for settings in which the cancer had not yet spread to nearby lymph nodes.

This new approval for Kisqali takes that extra step, now for the first time offering CDK4/6 inhibitors to patients who don’t have positive lymph nodes.

Read more from STAT’s Angus Chen.

Biotech updates from the Cantor conference

Here are a few tidbits that my colleague Adam Feuerstein and I picked up yesterday while attending the Cantor Global Healthcare Conference:

- “This Summit thing is wild.” We’ve heard variations on that sentiment from investors multiple times yesterday. Summit Therapeutics isn’t presenting here but that hasn’t stopped the Bob Duggan-led company, or more accurately, its anti-PD-1xVEGF antibody ivonescimab, from garnering a lot of hallway buzz. There still doesn’t seem to be a consensus on whether its recently reported China data will be confirmed in global studies, but, still, Summit is now worth $18 billion.

- Celldex Therapeutics will reveal the first look at 52-week data from its Phase 2 study of barzolvolimab in chronic hives next Wednesday, Sept. 25, at a European medical meeting. Efficacy results will matter, but the focus remains on safety given concerns about anaphylaxis and infection risk, tied to the drug’s mechanism, which depletes mast cells.

- So entrenched is Vertex Pharma’s cystic fibrosis franchise that it barely warranted a mention during the company’s fireside chat. The bulk of the conversation centered around Vertex’s next big growth opportunity — the non-opioid pain drug VX-548, or suzetrigine. The FDA is reviewing suzetrigine for acute pain, with a decision expected on Jan. 30. Before that, in chronic pain, Vertex will report results in December from a mid-stage study in lumbosacral radiculopathy (LSR), commonly known as sciatica.

- “We will be ready to go,” said BridgeBio CEO Neil Kumar, when asked about the company’s preparations for the approval and commercial launch of acoramidis, its protein-stabilizing drug for the progressive heart disease known as ATTR-CM. How well BridgeBio competes against Pfizer, its larger and deeply entrenched competitor, will be a storyline to watch in the coming months.

Express Scripts sues over ‘biased’ PBM report

Express Scripts, one of the largest pharmacy benefit managers in the U.S., filed a lawsuit against the FTC yesterday, demanding the agency retract a report on PBMs that it released in July.

Express Scripts argues the report was full of “unsupported innuendo leveled … under a false and defamatory headline.” FTC Chair Lina Khan was also accused of “anti-PBM bias.”

The lawsuit, which was filed in a federal court in St. Louis, comes amid intensifying controversy over the roles that PBMs play in the opaque pharmaceutical supply chain in the U.S., as STAT’s Ed Silverman notes.

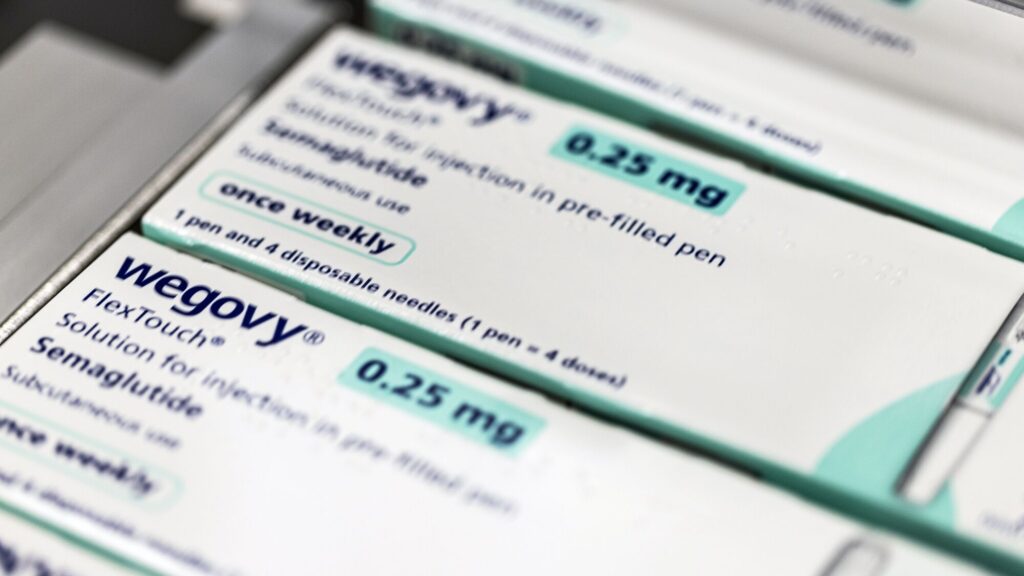

Bernie keeps the heat on Novo’s high prices

Ahead of a Senate hearing next week at which Novo Nordisk’s CEO has been called to testify, health committee chair Bernie Sanders is keeping the heat on the company.

Since April of this year, Sanders has been probing the high prices that Novo charges for Ozempic and Wegovy (about and over a $1,000/month, respectively, in the U.S.). Yesterday, Sanders brought together a panel of patients and doctors to discuss the impact of these prices.

He said that executives of major generic pharmaceutical companies told him they would be willing to make generic versions of Ozempic for less than $100 a month. A recent analysis from Yale researchers found that the drugs could be made for around $0.89 to $4.73 per month.

Sanders also said that one of the largest health insurers in the country told him it would have to double premiums for all policyholders if it covers Wegovy and Ozempic for all eligible patients.

With his recent campaign against Novo, calling on the company to lower prices, Sanders may be pushing the limits of his power as Senate health chair. My colleague Rachel Cohrs Zhang wrote about this a few months ago. Read more here.

More reads

- U.S. agency threatens J&J with sanctions if it switches payments to 340B hospitals, STAT

- Athira Pharma to cut about 70% of workforce, MarketWatch

- Bad trip: How culture conflict and a need for cash nearly broke Lykos, Endpoints