Biotech Pulse

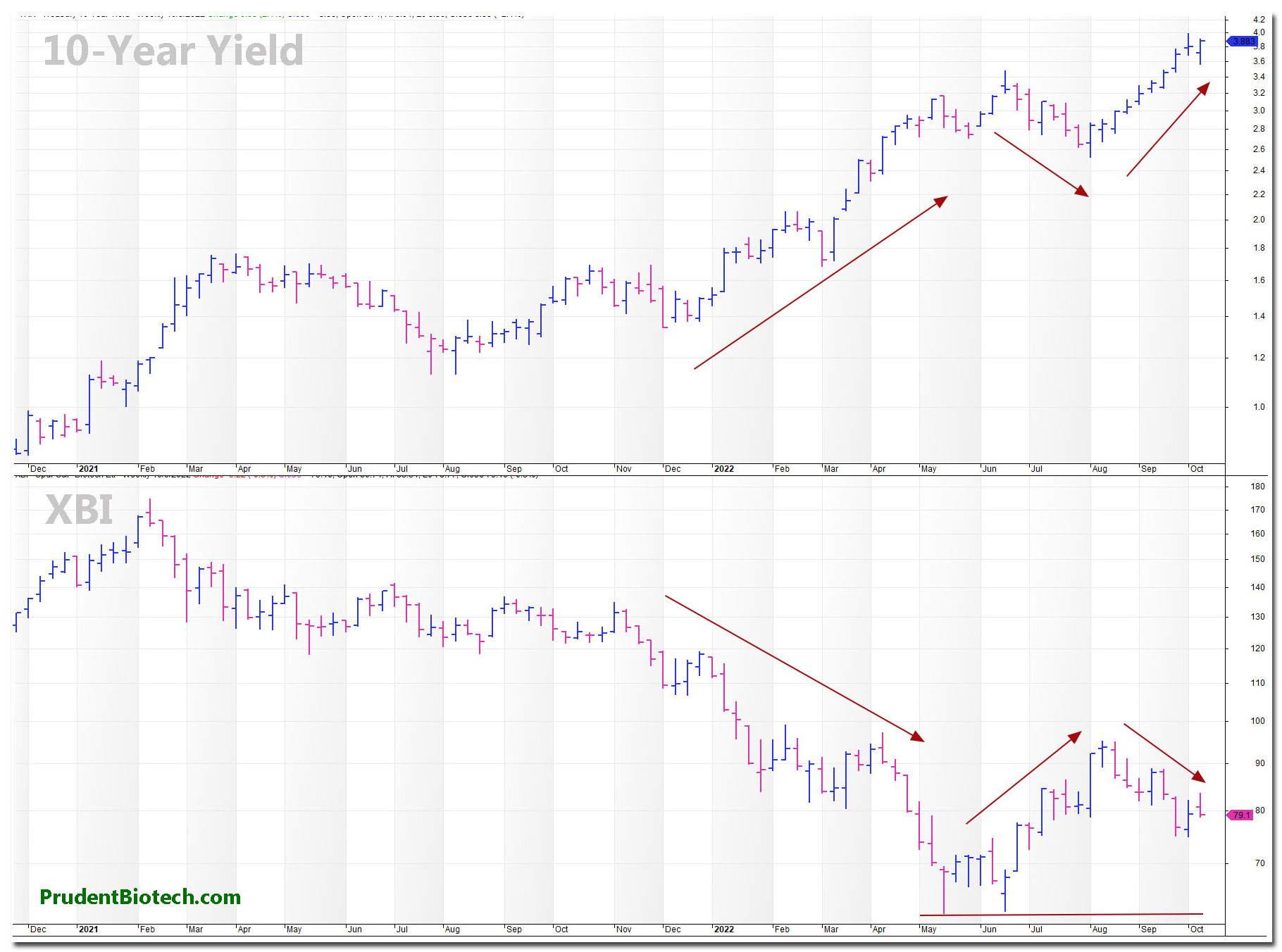

Biotechs have been outperforming the broader market in this decline phase of the bear market. While most major indexes made new lows for the year or retested prior lows set in June, biotech indexes have resisted declining back to those lows for now even though yields have soared past the June highs. The biotech group has been under pressure since early 2021 with the S&P Biotech Index (XBI) at its worst point this year declining by 65% from its February 2021 high, down nearly two-thirds. Presently, the index is 55% below that high.

Interest Rate Dynamics

The interest rate environment remains highly dynamic with no near-term sign of a potential shift in the Federal Reserve’s (Fed) rate policy. At the September Fed meeting, the central bank had forecast a 4.5% Federal Funds rate by the end of 2022. Presently, this rate is at 3.25%. That would suggest a 75 basis point move at the November 1-2 meeting and a 50 basis point at the December 13-14 meeting to end the year at 4.5%.

This is an aggressive path for the year. Nonetheless, it is a path that offers clarity and diminishes market uncertainty. The stock market has already discounted the new rate path. The Fed’s forecast also calls for an average 4.6% interest rate by the end of 2023, up from the 4.5% level at the end of 2022.

We believe based on this Fed forecast the market can see a three-month or longer pause entering next year, with nothing done at the meeting on Jan 31/Feb 1. The next move will likely come at the late March meeting. It is also highly likely that the Fed will use smaller-sized hikes in 2023 as it needs to more finely calibrate its response in 2023 rather than play catch-up using a sledgehammer approach, like this year. After some spaced-out increases during 2023, we believe the market will end the year with rate cuts. This reasoning is based on the Fed’s present forecast which can likely be adjusted at future meetings.

Some economists and seasoned investors with market heft have cautioned at the pace of rate increases which they fear will trigger a deeper slowdown than needed to tame inflation. That can be true and hurt stocks. But from a biotech standpoint, it may not be as profoundly relevant if yields would be sliding lower from such a slowdown.

Why Are Biotechs Relatively Well Positioned Now?

Biotechs are highly sensitive to the 10-year Treasury yield, which is the preferred discount rate used for valuations. The 10-year yield has risen to levels not seen since 2010. In an economic slowdown, while growth stocks come under pressure even with a declining yield, the biotech group can outperform as they are not affected by revenue and earnings growth concerns triggered by a slowdown. If the longer-term yields can stabilize and begin a downtrend, it will provide a strong and sustainable boost to biotech stocks.

It is quite likely that any future change in the path of interest rates from the Fed forecast will be more inclined toward a market-favorable outcome. This means that the probability of the Fed entering a pause phase soon, perhaps in January 2023, or reducing the size of its rate increases, perhaps in December 2022, with both being favorable outcomes, is likely higher than the probability of a larger size rate increase of 100 basis point in November 2022 or a 75 basis point increase in December 2022.

Thus, biotechs are well positioned at these levels. If an economic slowdown strengthens it will bend the yield curve, or if we enter a Fed pause phase in January 2023, it will stabilize the longer-term yields.

The M&A transaction market for biotech companies has also perked up over the past couple of months with acquisitions by Amgen (AMGN) of ChemoCentryx (CCXI), Pfizer (PFE) of Global Blood Therapeutics (GBT), and Novo Nordisk (NVO) of Forma Therapeutics (FMTX). An increase in transaction activity at these levels contributes to providing a valuation floor.

Biotechs have also been reporting significant milestone news. Recently, bluebird (BLUE) received approval for its second multi-million dollar gene therapy. Rhythm Pharmaceuticals (RYTM) received FDA approval for its obesity drug for patients with Bardet-Biedl syndrome, the first-ever approved treatment. Neuroscience has been delivering positive news as well. Karuna Therapeutics (KRTX) reported meeting endpoints in a Phase 3 trial for schizophrenia. In late September, it was announced that Lecanemab, an Alzheimer’s drug co-developed by Biogen (BIIB) and Japanese firm Eisai, slowed the cognitive and functional decline in a Phase 3 trial of patients in earlier stages of the disease. This is the first such successful study that has now resuscitated the dying theory of reducing amyloid plaque to achieve some success in treating Alzheimer’s. Last month, Akero Therapeutics (AKRO) reported meeting the primary endpoints in a Phase 2 trial for NASH (nonalcoholic steatohepatitis), a fatty liver disease. NASH has been a very difficult disease to treat and Akero’s success so far is one of the very few ones in this therapeutic area.

At this point, there is nothing more important for biotechs than a stable and preferably a declining 10-year yield environment to catalyze a strong and durable rally.

Conclusion

It is hard to invest in a recessionary environment, particularly one where high inflation is a prominent variable. All asset classes can move in sync or appear highly correlated in such an environment. Even the bond market has struggled mightily.

More clarity on the interest rate path, early signs of a greater awareness at the Fed to diminish economic pain, and softer economic data, can set the stage for the 10-year yield to stabilize and trend downwards. Stocks are oversold and the market appears to be one good inflation report away from a sharp and short-term rally. It can likely come during this quarter. A longer sustained rally for the broader market will have to wait till interest rates peak.

The market remains highly unsettled and can move lower. Biotech indexes, (IBB) and (XBI), will not escape a surge in volatility and can be vulnerable to a short-term downside risk of 5% to 10%. However, biotechs are relatively outperforming most industry groups and well-placed for the fourth quarter as concerns of an economic slowdown mount. Biotechs that have had recent positive trial results and updates should be preferred.

(The article was first published on Seeking Alpha)