This story first appeared in The Readout newsletter. Sign up for The Readout and receive STAT’s award-winning biotech news delivered straight to your inbox.

Good morning. It’s another busy news day, and I’m layering up at home to avoid turning the heater on. Fall is officially here.

advertisement

Pfizer pulls sickle cell drug off global markets

In a shock announcement late yesterday, Pfizer said it would pull its sickle cell treatment Oxbryta off global markets due to high risks of severe safety events, including deaths.

The move is a stunning blow for the drug, which Pfizer got through its $5.4 billion acquisition of Global Blood Therapeutics in 2022.

The European Medicines Agency had been set to hold a hearing today on the treatment, in light of what it said were clinical trial data showing more deaths among patients taking the drug compared to a placebo.

advertisement

Read more from STAT’s Adam Feuerstein and Jason Mast.

Bob Nelsen’s firm raises a big new fund

ARCH Venture Partners announced today that it raised $3 billion for a new fund, one of the largest in the biotech industry.

The downturn in the biotech market over the last couple of years has led many industry investors to change tactics. They’ve forgone investments in early-stage startups with highly experimental scientific platforms in favor of companies with drugs that would soon head into the clinic and, ideally, be ready in a few years for pharma to acquire.

Chicago-based ARCH, however, is sticking to its long-running strategy, making investments based on the team’s curiosity and frustrations. “We don’t really care what the market thinks. It’s irrelevant. And we don’t really care what pharma thinks,” ARCH co-founder and Managing Director Bob Nelsen said.

Read more from STAT’s Allison DeAngelis.

Final Medicare decision on Alzheimer’s drugs could take ‘years’

From my colleague Rachel Cohrs Zhang: Medicare’s controversial decision to condition coverage for even fully approved Alzheimer’s drugs is here to stay, per a top CMS official. (This applies to new drugs like Eisai and Bigoen’s Leqembi and Eli Lilly’s Kisunla.)

Tamara Syrek Jensen, the director of the Coverage & Analysis Group at CMS that’s responsible for writing national coverage determination policies, doesn’t speak publicly often, but she did a brief fireside chat at an event hosted by the USC Leonard D. Schaeffer Center for Health Policy & Economics yesterday.

Currently, CMS will cover Alzheimer’s drugs if a patient’s data is collected in a registry to track how the treatments perform in the real world. Jensen said the current registry takes clinicians less than five minutes to complete. The next step will be collecting data from the registry and medical claims to start evaluating the drugs’ performance. “We hope to do that over the next…it’s not gonna take us months, so over the next few years,” Jensen said.

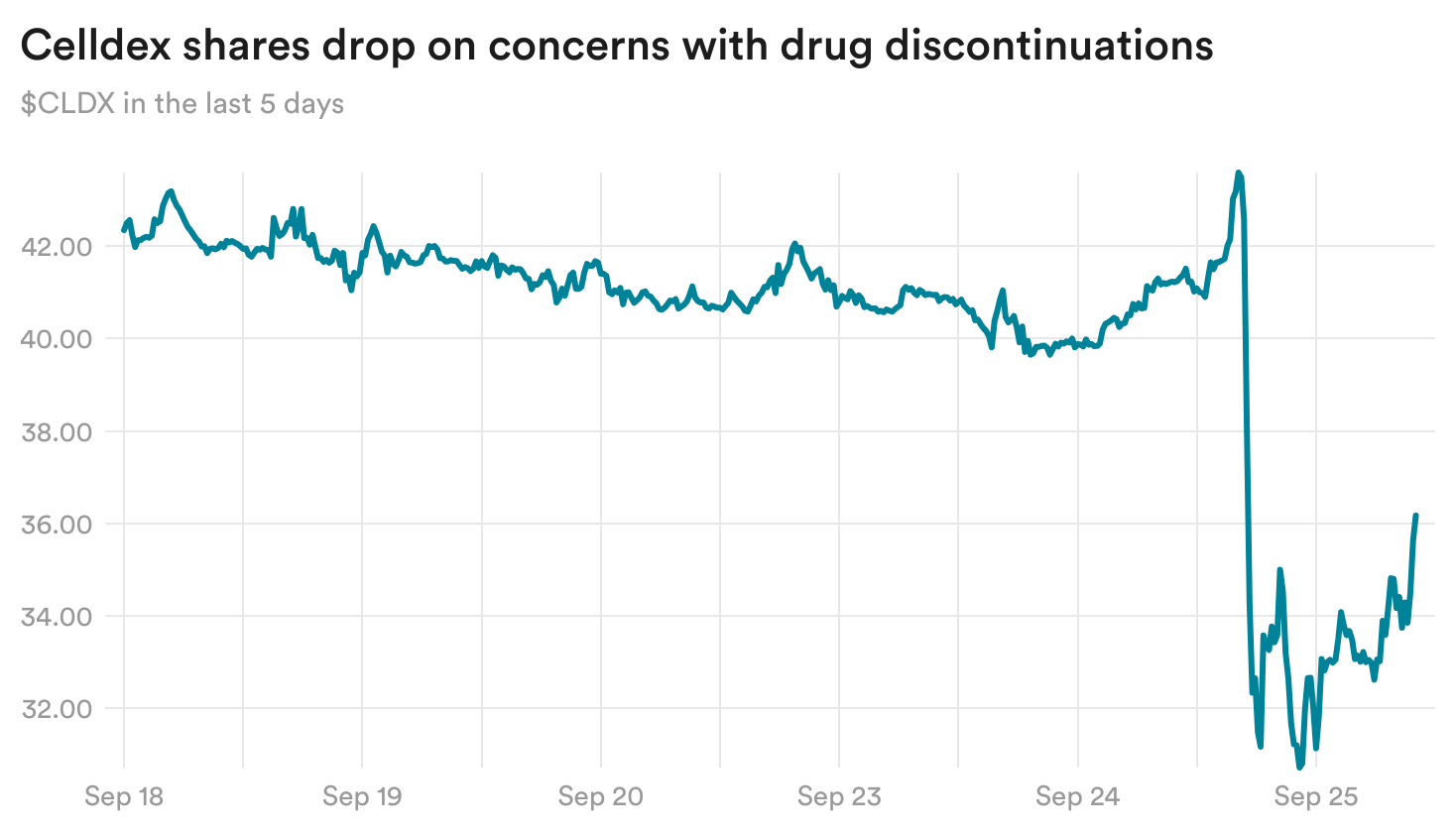

Celldex drug discontinuations raise questions

Celldex reported yesterday that its experimental medicine for a condition that causes chronic hives reduced hive activity in patients, completely clearing it in some. However, there was a high rate of patient discontinuations in the trial, due in part to side effects including changes in hair color.

Those concerns sent the biotech’s shares down 12% yesterday.

Celldex reported no cases of anaphylaxis, which observers were closely watching for. And while some treated patients saw a drop in their levels of neutrophils — a type of white blood cell involved in the body’s immune response — the biotech said that neutrophil levels did not drop with continued dosing and that patients who experienced drops did not see higher rates of infections.

Read more from STAT’s Drew Joseph.

Biotech’s real estate market is still upside down

From my colleague Jonathan Wosen: Biotech companies looking to rent lab space still have plenty of options, according to a new report from Jones Lang LaSalle, a commercial real estate services company.

The availability of vacant space for direct lease or sublease rose from nearly 25% last year to 30% by the middle of 2024. And rents have dipped nearly 9% over the past year, with per-square foot prices falling from $6.54 to $5.97.

That’s good news for companies looking to expand, and bad news for the industry’s landlords. The findings underscore that the balance between supply and demand for lab space remains out of whack, as we previously reported.

During the early years of the Covid-19 pandemic, when biotech stocks soared and investment dollars were easy to come by, many companies were in need of space. To meet that demand spike, developers began building tens of millions of square feet — just as a sharp market downturn forced biopharma firms to take a more cautious approach. JLL expects the situation to stabilize within the next 6 to 12 months, citing both the potential of lower interest rates to kickstart the industry’s growth and three consecutive quarters of increasing demand for space.

More reads

- J&J folds cardiovascular and metabolic drug unit, Endpoints

- Generic drug lobby taps former BIO exec as new CEO, STAT

- Ozempic linked to lower opioid overdose rate in those with diabetes, study shows, STAT

- Moderna is scolded by a U.K. trade group for offering kids $2,000 to participate in a Covid trial, STAT