SVB Rattles The Market

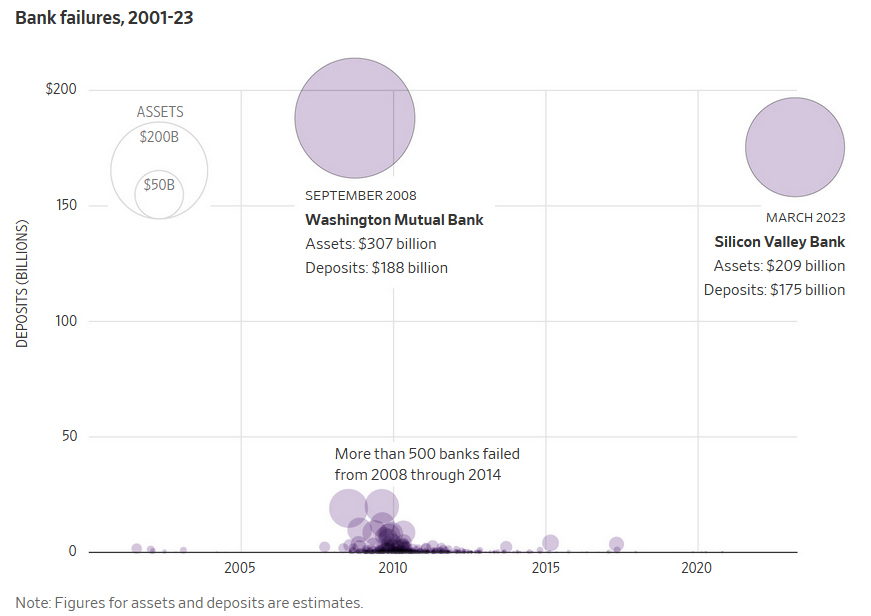

The financial markets were jolted last week by the collapse of Silicon Valley Bank (SVB), the 16th largest lender in the US with assets over $200 billion. The speed with which the bank crumbled under a run on its deposits was astonishing and highlighted how systemic risks can rapidly evolve in a risk-averse environment. This was the second bank failure of the week after Silvergate Bank, which was focused on serving crypto clients and traders, causing investors to worry about where the risk will bubble up next.

Banks are built on trust, and if depositors begin to doubt that their deposits will be available when needed, they will attempt to withdraw their funds, leading to bank runs that can convulse the entire system.

The question that financial markets will attempt to answer this week is whether the closing of two banks in a row indicates the beginning of a contagion. Investors and depositors will now use stricter yardsticks to gauge the health of a bank, and any doubts will trigger a withdrawal first and ask questions later approach. Already, First Republic Bank and Signature Bank are under stress with rapidly falling stock prices and there may be more. Regulators will be hard-pressed to contain the fallout quickly and prevent it from turning into a domino effect that targets smaller regional banks.

Fed Policy Now Likely To Maintain Its Pace

Instead of Accelerating It

The Federal Reserve, as the central bank of the nation, is responsible for promoting the stability of the U.S. financial system and containing systemic risks.

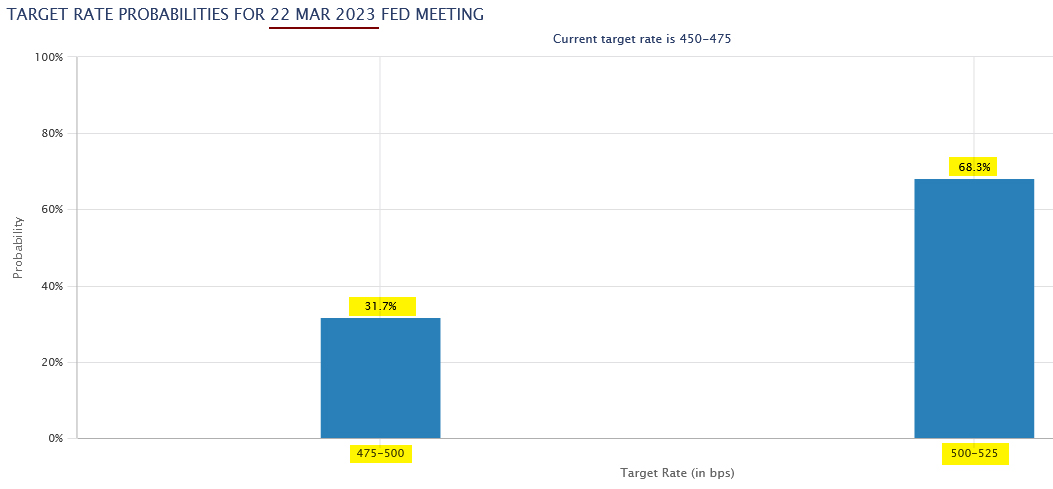

It is our belief that the developing bank crisis will nudge the Fed to maintain its pace of rate hikes at its March 21-22 meeting to a quarter-point increase instead of a half-point, as is the present expectation. The Fed must be cautious in containing the banking crisis, even though recent economic data and inflation reports have been stronger than anticipated which has raised expectations for a half-point increase. This adjustment could support market valuations and soothe the financial markets as the crisis is resolved. If the majority expectation shifts down during the coming week, that will be favorable for the stock market.

Biotechs Hit Hard For Now,

But Lower Yields Should Benefit

SVB’s collapse caused major volatility in technology and life sciences stocks, as it had focused on serving clients in these industries. Corporate clients of SVB will have limited access to the bank deposits until the situation resolves, and may have additional risk if a large portion of their cash reserves were held at the bank.

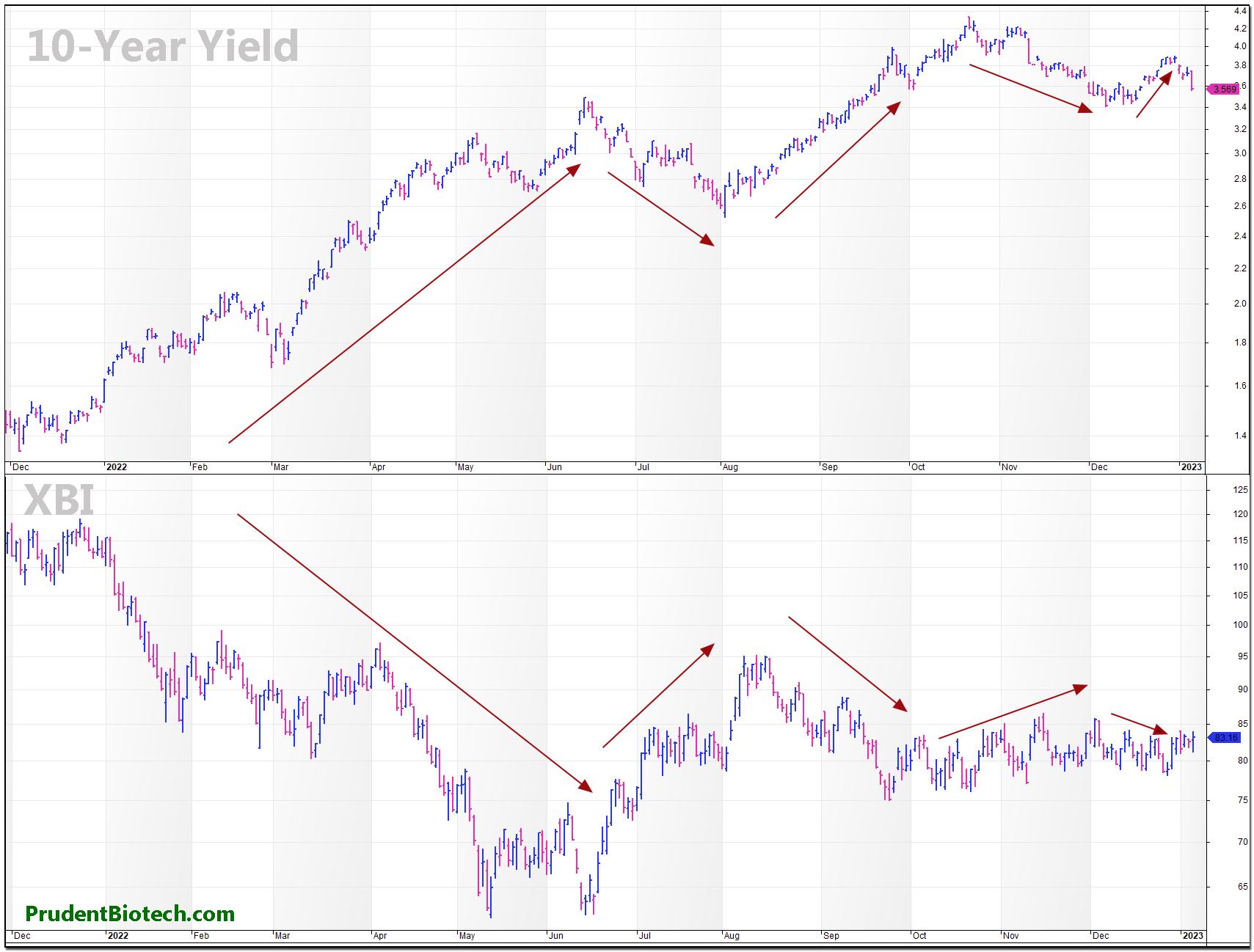

The bank failure also caused a sharp selloff in biotech stocks. While the exposure to SVB will begin to be publicly addressed this week by companies, the crisis has also depressed yields, due to increased demand for safe-haven assets, which should benefit biotech valuations. The 10-year yield and biotech valuations have a high inverse correlation, as discussed in the 2023 biotech outlook, and if the yield remains below 4%, it will be helpful for biotech valuations. The 10-year yield ended last week at 3.7%.

Biotech portfolios will need to be adjusted based on exposure to SVB. The broad-based selling of biotech stocks last week may prove unjustified for most companies. If no further issues emerge this week and regulators can contain the crisis, the market is likely to stabilize and recover. However, if the banking crisis is not contained and begins to snowball, a shift away from risk will punish riskier industry groups, like biotechs and technology growth companies, more.

The article was first published exclusively on Seeking Alpha.