What You Should Know:

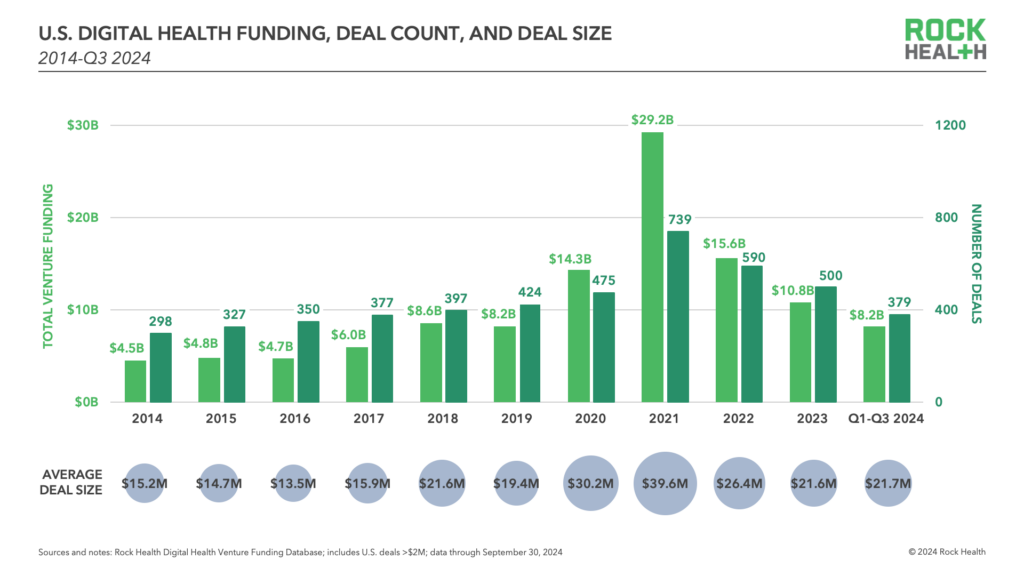

– The digital health sector maintained its “small but mighty” trajectory in Q3 2024, characterized by disciplined investments and strategic activities, according to Rock Health’s Q3 Digital Health Funding report.

– While deal counts decreased compared to previous quarters, average investment sizes remained steady, indicating a shift towards more focused funding. This trend, coupled with strategic acquisitions and a focus on enhanced product offerings, reflects a maturing market where companies are positioning themselves for long-term success.

3 Key Trends in Digital Health Funding Q3 2024

- Disciplined Investments: Venture funding reached $2.4B across 110 deals, with an average deal size of $22 million. This suggests investors are making calculated bets on fewer companies.

- Strategic Acquisitions: Mergers and acquisitions (M&A) activity remained low, with 21 deals in Q3. However, a notable trend is the rise of “tapestry weaving,” where companies acquire startups to integrate new features and capabilities into their existing offerings.

- Public Market Recalibration: Publicly traded digital health companies faced continued pressure, with some opting to go private or be acquired to optimize performance and reduce operational costs.

Tapestry Weaving: A New M&A Strategy

The “tapestry weaving” trend is particularly noteworthy, as it reflects a shift away from peer acquisitions towards strategic acquisitions that enhance product offerings and address a broader range of customer needs. This approach allows companies to expand their capabilities and compete more effectively with legacy healthcare players and market incumbents.

Examples of Tapestry Weaving

- DarioHealth: Acquired Twill to expand its mental health offering and enhance patient engagement features.

- Commure: Merged with Athelas to add revenue cycle management (RCM) capabilities, acquired Rx.Health for care coordination, and Augmedix1 to enter the AI scribe market.

- Fabric Health: Made several acquisitions to transform from an emergency room efficiency solution to a comprehensive virtual care platform.

Benefits and Challenges of Tapestry Weaving

This strategy offers several advantages, including faster product development, access to established customer bases, and potential cost savings compared to building new solutions from scratch. However, successful tapestry weaving requires careful integration of products, teams, and go-to-market strategies.