What You Should Know:

– The digital health industry is showing signs of strength despite recent economic uncertainties, according to Rock Health’s latest H1 report.

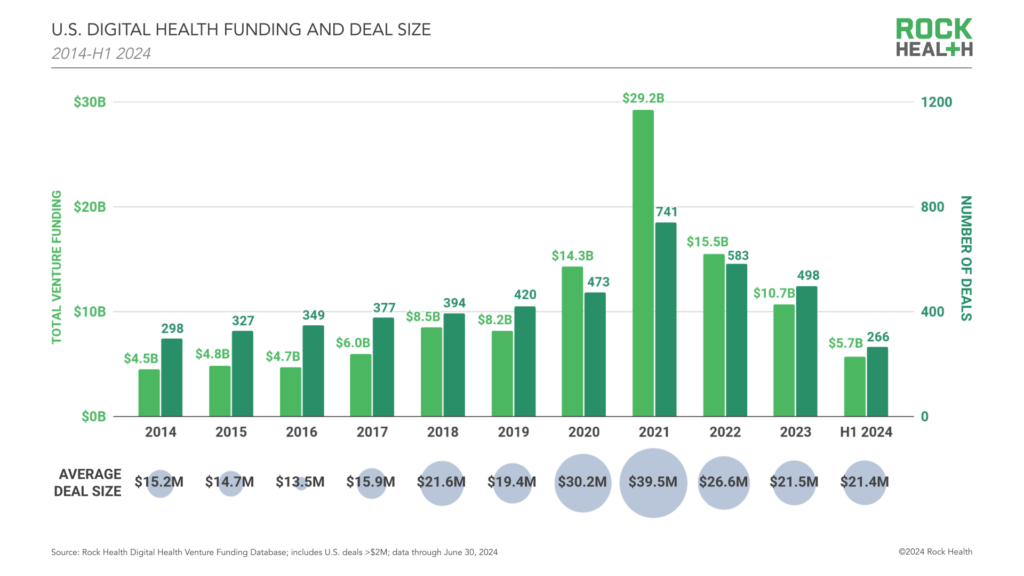

– U.S. digital health startups raised a significant amount in the first half of 2024 ($5.7B), with the potential to exceed full-year totals from 2019 and 2023. This growth is fueled by strong Series A activity, with a median deal size of $15M, indicating larger investments for early-stage companies.

Here’s a breakdown of key trends observed in H1 2024:

AI Powering Innovation

Artificial intelligence (AI) is a major driver of investment, with 38% of Series A-funded companies in H1 2024 leveraging this technology. Large early-stage funding rounds help support AI development costs and fuel innovation across various areas of digital health.

Shifting from Unlabeled Rounds

The prevalence of unlabeled funding rounds, used during market transitions, is decreasing. This suggests a return to a more predictable investment landscape where companies secure funding based on designated stages (Seed, Series A, etc.). However, some startups raising consecutive unlabeled rounds might face difficulties in reaching profitability.

Digital Health’s Evolving Landscape

Investors are backing a wider range of solutions beyond just on-demand healthcare (telemedicine). Consumer trends, market changes like commoditization and specialization, and AI are all shaping the types of companies receiving funding.

Top Investment Areas

Disease treatment, non-clinical workflow optimization, R&D for pharmaceuticals and medical devices, and clinical workflow improvements were the top-funded value propositions in H1 2024. Additionally, mental health remained the leading clinical focus, with significant funding also directed towards weight management, reproductive health, and menopause/pelvic health solutions.

Return of Public Exits

After a long hiatus, three digital health companies successfully completed IPOs in Q2 2024. This signals a potential uptick in public exits for the industry, with companies like Waystar and Tempus AI offering valuable insights into late-stage considerations like debt management and aligning exit prices with current market conditions.

M&A Landscape

While overall acquisition activity has declined, private equity firms are playing a more prominent role in digital health M&A. These firms favor companies with established business models and potential for profitability, offering opportunities for even financially challenged startups with clear growth strategies.