Strong patient interest in GLP-1 drugs to treat obesity has prompted medtech companies to take a hard look at the potential impact on demand for procedures like bariatric surgery and products such as glucose monitors and sleep apnea devices.

The potential threat to medical device sales has spooked investors, who have sold shares in companies across the sector.

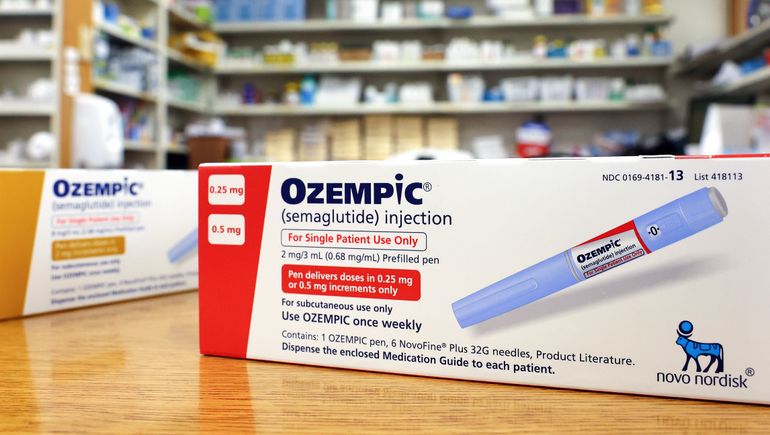

Fears that medications such as Ozempic, Mounjaro and Wegovy, which are used for diabetes and weight loss, will eventually reshape treatment for a variety of diseases have driven the most severe correction in the medtech sector since the onset of COVID-19, wiping out about $370 billion in market capitalization, according to Mizuho analyst Anthony Petrone.

“The basic thought process here is that excess weight is the root of many ailments ranging from cardiac artery disease to sleep apnea,” Petrone wrote in a recent report. “Hence, if you solve for excess weight, demand for surgery could wane over time.”

For now, “we believe the risk is more perceived than real,” he added.

Here is what executives from six medtech companies said on their latest earnings calls about the impact of weight-loss drugs on device demand.

Abbott

Wearers of the FreeStyle Libre continuous glucose monitor who are also on GLP-1 medications showed a higher rate of use for both products, and the number of patients taking this combination approach is growing, according to a recent analysis of Abbott’s user base, CEO Robert Ford told investors on the company’s third-quarter earnings call last month.

Better treatment compliance ultimately will improve health outcomes, Ford said. “While we traditionally think of therapy choices as having to compete against one another, this is a good example of a complementary relationship between two products that both help optimize the treatment of diabetes,” the CEO said.

Boston Scientific

While GLP-1 drugs are “promising agents” for weight loss, the short-term impact on cardiovascular disease is “very limited” due to barriers to usage such as cost, convenience and tolerability, Global Chief Medical Officer Kenneth Stein said last week on the device maker’s earnings call.

Longer term, Stein predicted the drugs’ effect on U.S. coronary and peripheral procedure volumes will be minor, even at peak GLP-1 usage.

“We expect it will take at least a decade to reach peak penetration of these drugs in the indicated population. And even after a decade, we expect that only a minority of American patients with obesity will be taking these drugs,” Stein said in response to an analyst’s question.

Dexcom

CEO Kevin Sayer said prescriptions for continuous glucose monitors increase once patients start GLP-1 therapy, insurance claims data show, demonstrating that the drugs and devices are complementary.

“This dynamic is even more pronounced among the newest generation of these drugs,” Sayer said last week on Dexcom’s third-quarter call.

Intuitive Surgical

The robotic surgery leader said patient interest in weight-loss drugs reduced its bariatric procedure growth in the second quarter, and a modest slowdown continued in the third quarter. Still, bariatric procedures continue to grow at a double-digit rate, and the company believes it is taking market share, CFO Jamie Samath told analysts on Intuitive’s third-quarter call in October.

Chief Medical Officer Myriam Curet also addressed the GLP-1 issue, saying she thinks many patients who try the drugs will not stay on them for more than a year or two due to compliance challenges, costs and side effects, and at that point will consider bariatric surgery.

Johnson & Johnson

The medtech giant is seeing a short-term impact on its bariatric business as some patients reconsider whether to have surgery, CEO Joaquin Duato told investors on J&J’s earnings call in October. But bariatric surgeons tell the company that the medications could complement surgery in the long run, the CEO said in response to an analyst’s question.

“Many of them comment on the fact that they could see a tailwind for bariatric surgery down the road given this complementary nature – the increased awareness about obesity, more patients seeking treatment,” Duato said. “And many of the patients, about 30% of them, are not going to be tolerating these medications, so they would be another funnel for our bariatric business.”

ResMed

The maker of sleep apnea devices reported solid first-quarter financial results last week but dedicated much of its call to discussing how it is tracking the impact of GLP-1 medications on patients’ use of continuous positive airway pressure (CPAP) machines, William Blair analyst Margaret Kaczor Andrew noted in a report to clients.

ResMed has found no change in CPAP adherence rates or resupply needs based on a database that includes thousands of patients who are using both its devices and the weight-loss medications, CEO Mick Farrell told investors on the company’s call. “These data indicate that there is a cohort of patients on combined therapies in a stable state,” Farrell said.

New users of ResMed’s devices are also at an all-time high, according to the CEO.

“The bottom line is that we are driving strong growth of patients into the funnel. We believe the work that’s being done in the pharmaceutical industry right now with obesity drugs will be a net positive for patient flow and patient growth in sleep apnea, COPD and for ResMed overall,” Farrell said.