By the numbers

Q2 Revenue: $1.53 billion

11% increase year-over-year

Q2 Net income: $305.5 million

25% decrease year-over-year

Q2 Earnings per share: $0.50

23% decrease year-over-year

Q2 Insights:

Growth of Edwards Lifesciences’ key transcatheter aortic valve replacement (TAVR) franchise slowed sequentially in the second quarter as the company continued to contend with aftereffects of the pandemic and competitive pressures in Japan.

The financial results of Edwards, a leading provider of heart disease devices, continue to be affected by the pandemic even as medtech companies working in other therapeutic areas have recovered. In the second quarter, TAVR sales grew 9.8%, compared to a 10.8% increase in the first quarter. Larry Wood discussed the pressures on the unit in a call with investors.

“When we track staffing, we’re not where we should be, and we’re not where we would have projected to be in absence of the pandemic,” said Wood, group president for TAVR and surgical structural heart at Edwards. “We still feel constrained somewhat at the cath lab level. That’s still a place that we still struggle. We’re not back to what I call pre-COVID normal levels.”

Abbott rivalry heats up

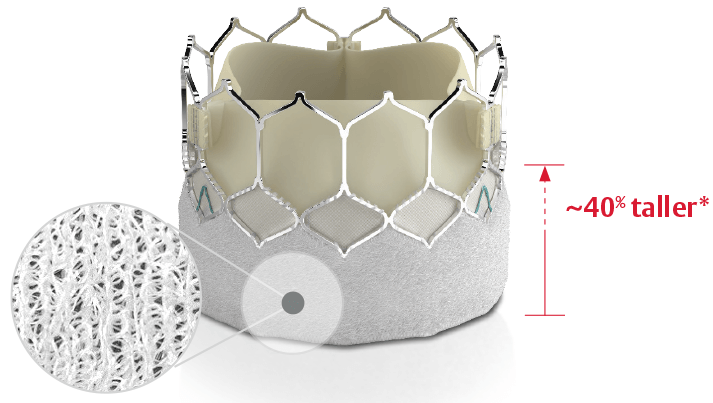

Edwards has identified transcatheter mitral and tricuspid therapies (TMTT) as one of its next growth drivers and made progress on that front in the second quarter. Abbott, which competes with Edwards for the mitral market, recently told investors it needs to “reignite and restart” the referral funnel in the U.S. to recover from the pandemic and that will “take a little bit of time.”

At Edwards, TMTT sales increased almost 70% year on year, albeit from a low base, to climb to $47.6 million. While still a small part of the business, Edwards sees positive signs for the franchise.

“The overall TMTT market with both tricuspid and mitral continues to grow very well on a global basis,” Daveen Chopra, global leader of TMTT at Edwards, said on the quarterly results call. “As we launch in new countries, that will help the market grow as well as the continued adoption of mitral in the U.S.”

Forecast

Edwards raised its full-year sales outlook to the $5.9 billion to $6.1 billion range, up from $5.6 billion to $6.0 billion under the prior forecast. The company increased the bottom end of its TAVR outlook from $3.8 billion to $3.85 billion.