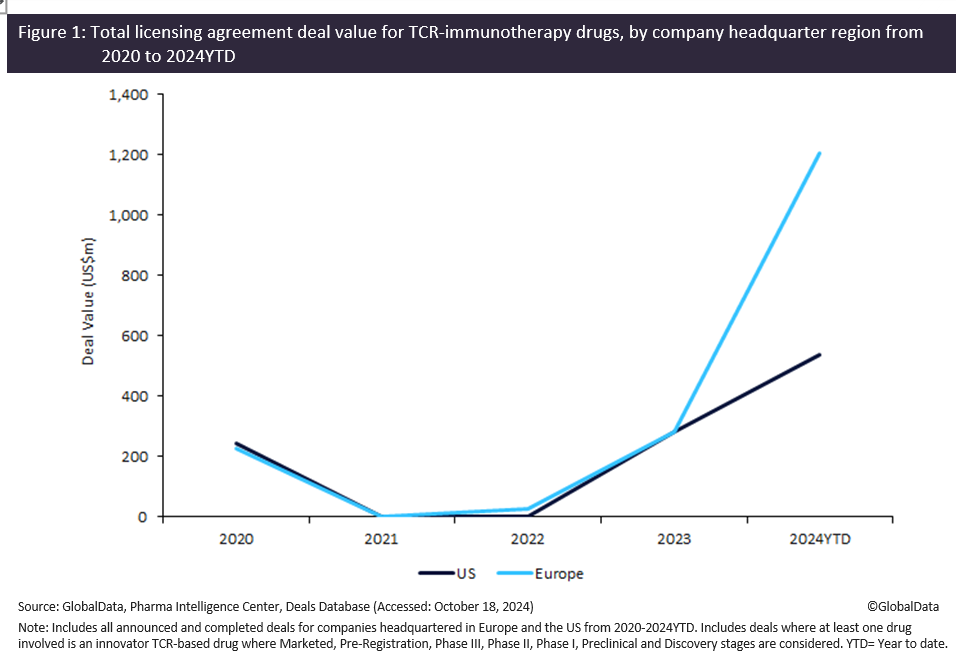

Licensing agreement deal values for innovator T-cell receptor (TCR) immunotherapy drugs for European biopharmaceutical companies increased by 325% (by $921 million) between 2023 to 2024 year-to-date (YTD). US biopharmaceutical companies reported a 90.5% rise (by $256 million) over the same period, according to GlobalData’s Pharma Intelligence Center Deals Database.

TCRs are expressed on the surface of T cells that recognise specific antigens presented by cancer cells, triggering an immune response that ultimately destroys the cells. Unlike chimeric antigen receptor (CAR)-T cells, which primarily target surface proteins, TCR-based therapies are unique in recognising and attacking intracellular antigens presented by the major histocompatibility complex (MHC). This advantage allows TCR therapies to target a broader range of tumour antigens, including those that are challenging for other therapies to detect.

In August 2024, the FDA approved the first TCR gene therapy, UK-based- Adaptimmune’s Tecelra (afamitresgene autoleucel), for treating adults with metastatic synovial sarcoma. Although Tecelra faces challenges related to side effects and complexity in manufacturing — since each batch must be precisely tailored to individual patients — this approval marks a pivotal step forward in advancing TCR immunotherapies and opens the door to fostering more collaborations. Meanwhile, Europe’s uptick in TCR immunotherapy licensing agreements in 2024 mirrors the growing investment seen in recent years, with companies such as Anocca, MediGene, T-Knife, Immatics and Immunocore leading within the region by number of active pipeline drugs.

According to GlobalData’s Pharma Intelligence Center Deals Database, companies headquartered in Europe saw licensing agreements for innovative TCR-based immunotherapy drugs reach a value of $1.2 billion in 2024 YTD, while their US counterparts reached $539 million. Notably, most of these deals involved therapies in the discovery and preclinical stages, with 17 and 12 deals respectively, reflecting a strong willingness among companies and investors to invest early in TCR immunotherapies.

2024 has seen some of the largest deal values in the TCR immunotherapy space. In August, Belgium-based Galapagos announced a strategic collaboration worth up to $665 million with Adaptimmune Therapeutics. This collaboration grants Galapagos exclusive rights to Adaptimmune’s next-generation TCR T-cell therapy, uzatresgene autoleucel, currently in Phase I trials for MAGE-A4-targeted head and neck cancer, with potential for additional solid tumour indications. This therapy will leverage Galapagos’s decentralised cell manufacturing platform, positioning both companies for advancements in the TCR immunotherapy landscape.

Boehringer Ingelheim completed its licensing agreement with 3T Biosciences, where Boehringer will provide patient-derived TCR data to support 3T’s target discovery efforts. The collaboration focuses on leveraging 3T’s T-cell receptor antigen and cross-reactivity engine discovery platform (3T-TRACE) to identify cognate antigens, advancing the development of next-generation cancer immunotherapies.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

TCR immunotherapy is emerging as a promising, targeted approach for treating solid tumours and other indications. With its precision targeting and ability to address a broad range of tumour antigens, TCR-immunotherapy stands out as an innovative treatment. The increase in licensing deal values in 2024 highlights growing interest from companies, especially in early-stage assets, reflecting optimism about TCR therapies and a strategic push to lead in this evolving field of cancer treatment.