2024 has seen serious issues for Novo Nordisk, headquartered in Bagsvaerd, Denmark. These have included fires at several of its facilities, the withdrawal of one of its obesity drugs, and changes of plan for major investments. The company’s GLP-1 receptor agonists to treat obesity are in high demand and there is naturally a large interest in developments that could affect the production of these drugs.

Novo Nordisk announced in June 2024 that it was withdrawing injectable Ozempic (semaglutide) for type 2 diabetes from the Romanian market for “commercial reasons,” leaving only Ozempic oral tablets available for diabetes treatment. Ozempic as an injectable solution in a prefilled pen will cease to be available in Romania after 31 July. Injectable versions of Ozempic have shown a major spike in demand in all markets as a high-profile weight loss treatment, resulting in widespread shortages as Novo attempts to manufacture sufficient supplies.

Novo Nordisk faced scrutiny on Capitol Hill for pulling Levemir insulin from the US market on 16 July. Reuters stated that aides for Senators Jeanne Shaheen, Raphael Warnock and Elizabeth Warren have met with the Danish drugmaker. In April, lawmakers wrote to the company expressing alarm at its decision to permanently discontinue Levemir by the end of 2024. Novo responded that it has given patients enough time to switch to other options.

Three fires within a month

On 20 June 2024, the third fire within a month hit one of Novo Nordisk’s facilities in Denmark. The cause of the fire, at an office building connected to the company’s headquarters in the Bagsvaerd area of Copenhagen, is under investigation. However, company representatives were quick to state that “there is nothing to suggest that there was anything criminal behind the fires.” A fire at another office building, also in Bagsvaerd, occurred in late May 2024. An earlier, major fire that broke out at Novo Nordisk’s Kalundborg facility on 16 May was blamed by company representatives on construction workers operating without necessary permits. In early July, internal minutes revealed that safety measures were seriously lacking at the construction site in Kalundborg and there was dissatisfaction with the fire evacuation process.

On 24 July, a fourth fire was reported in a basement at Novo Nordisk premises in the Danish city of Måløv. The cause is currently unknown.

Mundane explanations for the fires are more credible than the fanciful speculation from some quarters, which alleges that the damage has been deliberately caused. Such speculation, which lacks supporting evidence, hinges on assessments from the Danish Security and Intelligence Service, which has warned that threats of physical and economic sabotage by alleged Russian-backed agents are multiplying in response to Denmark’s military support and training programmes for Ukraine. A more likely explanation is that the fast pace at which the company is moving to boost production capacity and expand manufacturing linked to the Wegovy (semaglutide) and Ozempic anti-obesity and diabetes drugs was a contributing factor.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Changing plans to increase GLP-1 manufacturing capacity

Novo’s plans to increase GLP-1 manufacturing capacity have not been smooth, with large investments redirected from Ireland to the US. The industry more generally has been trying to scale up and satisfy demand for diabetes and obesity treatments that are now chronically in shortage.

On 24 June 2024, The Sunday Times reported that Novo Nordisk had abandoned investment plans at the company’s Grange Castle Business Park West site in Clondalkin, Dublin. The proposed $2.2 billion investment was unveiled at the end of 2023, to increase manufacturing capacity in Ireland to meet global demand for the company’s weight loss, diabetes, and rare blood and endocrine disease treatments. The decision to terminate the investment project is a massive blow to the Irish government. Novo Nordisk’s proposed Grange Castle Business Park West had the potential to make a substantive economic contribution as part of a cluster of similar pharmaceutical sector investments in the local area.

However, Novo Nordisk has strengthened separate plans to expand another facility based in Athlone, in central Ireland. Novo purchased the site from Alkermes Inc in late 2023, intending to develop the facility for oral drug manufacturing. The development of the Athlone unit is a much more modest investment, and this consolation prize will not disguise the disappointment of losing the proposed Grange Castle Business Park West project.

Novo’s competitors scale up production

On 25 June 2024, just after the news of the cancelled project in Ireland, Novo unveiled a $4.1 billion investment to expand the company’s US manufacturing footprint and boost the production of Wegovy. It aims to establish a second fill-and-finish facility alongside its three existing facilities in Clayton, North Carolina. Construction is expected to be completed by 2029, with some capacity coming onstream in 2027.

Novo’s competitors and their contract manufacturing organisations (CMOs) are scaling up production. In October 2023, Eli Lilly, headquartered in Indianapolis, Indiana, US) announced an agreement with Swiss-based Corden Pharma International for the manufacturing of Mounjaro (tirzepatide), a competitor to Novo Nordisk’s obesity drugs. Under this agreement, Corden Pharma International provides active pharmaceutical ingredient (API) manufacturing services from its Boulder, Colorado, US site. It was reported on 16 July 2024 that Corden Pharma is earmarking $982 million up to 2027 to expand its peptide platform capacity in the US and Europe to meet rising GLP-1 manufacturing demand.

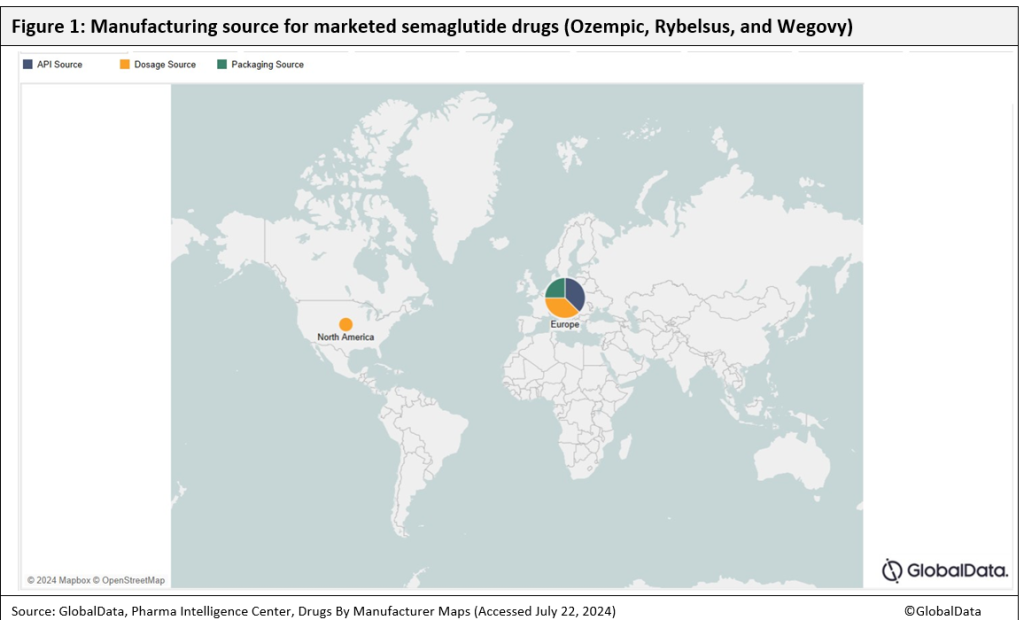

Novo also uses CMOs to produce its semaglutide products Ozempic, Rybelsus and Wegovy. New Jersey-based Catalent and Massachusetts-based Patheon package Wegovy, and the Portuguese company Hovione FarmaCiencia SA produces API for Rybelsus. Most of Hovione’s sites are in Europe, split across Denmark, Belgium and Portugal.