Healthcare Pulse

The healthcare sector edged higher in the first half of the year. It made a new high in March before pulling back and consolidating. This contrasts with the Nasdaq (QQQ) and S&P 500 (SPY) indexes, which increased by 18% and 15%, respectively, reaching new highs in June. The S&P Healthcare Index (XLV) rose 6% in the first half, while the Prudent Healthcare model portfolio gained 25%.

Despite underperforming the broader market, healthcare did well, given the lack of big-tech exposure. Over half of S&P 500 companies have declined since the start of 2022, according to a WSJ analysis.

Healthcare has been consolidating since 2023, moving in a tight range, only to break out in February this year. It did not perform as strongly in the first half as anticipated, given the uncertain environment due to diminishing expectations for the Fed’s rate cuts. However, the uncertainty in the second half can work potentially in healthcare’s favor.

This report is a follow-up to our January report on the 2024 healthcare outlook.

Healthcare’s Path In The Second Half

The second-half outlook for healthcare depends on market uncertainty. Some systemic factors can create a more favorable environment for the sector.

Economic Concerns: If the Fed does not cut rates in September, economic concerns may rise. Healthcare’s defensive nature will attract investors in a slowing economy. Typically, rate cuts aimed at reducing real interest rates are good for the stock market, but those triggered by economic uncertainty and downturn may not lead to durable rallies.

Election Uncertainty: Election uncertainty in October or earlier may make healthcare a preferred choice for investors seeking defensive sectors.

Policy Changes: A change in administration can bring policy uncertainty, prompting investors to shift towards defensive sectors.

Interest Rate Cuts: Some healthcare industry groups could thrive in a lower-yield environment. These include biotechnology, medical devices, and medical systems.

Healthcare performance in the second half will depend on economic conditions and the sector’s defensive nature. Not all healthcare groups are defensive; some are highly sensitive to the economy, similar to the broader market.

Few Key Healthcare Industry Groups

Pharmaceuticals

This is the largest healthcare industry group by market capitalization and is sensitive to policy changes, but quite defensive and resilient to economic conditions. The Inflation Reduction Act [IRA] has empowered the Centers for Medicare & Medicaid Services [CMS] to negotiate prices for Medicare, starting with ten drugs in 2024. Legal challenges to this authority have so far been unsuccessful. Johnson & Johnson reiterated its projections last week and emphasized that IRA-related price reductions are already discounted in its forecast. Most of the ten companies in the first round appear to have accepted the new prices, which cap drug price inflation, and will go into effect in 2026.

Pharmaceuticals are a safe haven during market stress and may perform well if economic concerns or election uncertainty arise. Any suggestions of a potential revision to drug price regulation in case of an administration change may also help the group’s valuations.

A few large companies in this group include Eli Lilly (LLY), Merck (MRK), AstraZeneca (AZN), Novo Nordisk (NVO), Pfizer (PFE), and Novartis (NVS).

Biotechnology

This group is highly correlated with interest rate changes. A declining or low-yield environment typically benefits biotechnology, as lower rates spur speculative risk-taking and improve pipeline valuations for unprofitable but promising companies. Leading companies include Amgen (AMGN), Vertex Pharmaceuticals (VRTX), Gilead (GILD), and Alnylam (ALNY). Biotechnology should be a strongly performing healthcare group in the second half provided the yields can trend lower and stay below 4%. We discussed the industry group in greater detail in the Biotechs Second Half Outlook.

Others

Managed care, hospitals, and drug distributors also possess defensive attributes. These groups include companies like UnitedHealth Group (UNH), Cigna Group (CI), CVS Health (CVS), and McKesson (MCK).

Medical products, systems, services, and supplies are more growth-oriented and sensitive to the economy. Rate cuts and continued economic growth would benefit these groups. However, if economic concerns mount, then some companies in these groups will be more exposed. Companies from these groups include Intuitive Surgical (ISRG), Tandem (TNDM), Glaukos (GKOS), Insulet (PODD), Becton, Dickinson (BDX), Pulse Biosciences (PLSE), and GE HealthCare (GEHC).

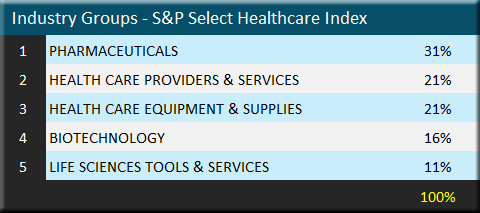

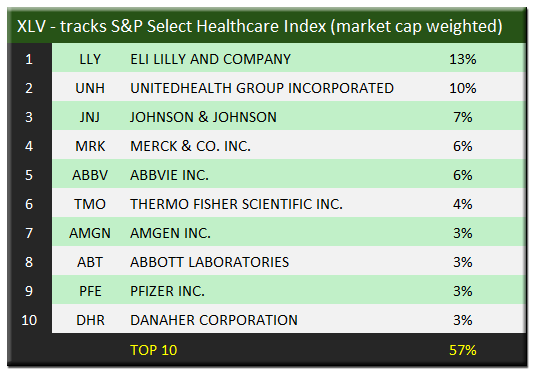

Investing in the Healthcare Index – XLV

The S&P Healthcare Select Sector Index comprises healthcare companies from the S&P 500. It is market cap-weighted, meaning its performance is closely tied to the largest companies. The ETF that represents this index has a ticker symbol XLV and provides a quick way to adjust healthcare exposure.

Conclusion

The Fed is likely to start cutting interest rates from September. If that happens, groups like biotechnology, medical devices and systems, and medical services will perform exceptionally well in the second half. On the other hand, if rate cuts are accompanied by mounting evidence of an economic slowdown then defensive groups like pharmaceuticals, hospital services, and managed care will become more attractive.

Healthcare is well-positioned for the second half as the economic and political situation evolves. In our annual outlook, we projected the S&P Healthcare Index to gain 5% to 10% this year, with biotechnology as one of the best-performing groups. We maintain this forecast and believe there can be an upside.

Besides gaining healthcare exposure through the ETF XLV, there are many promising companies as well for investors to consider, including Eli Lilly (LLY), Natera (NTRA), Intuitive Surgical (ISRG), Twist Bioscience (TWST), TransMedics Group (TMDX), Glaukos (GKOS), RadNet (RDNT), Procept BioRobotics (PRCT), Halozyme Therapeutics (HALO), and GeneDx Holdings (WGS). Some companies may already be part of the Prudent Healthcare model portfolio.

Investors should conduct due diligence and understand the risks, especially in volatile groups like biotechnology and medical products.

This article was first published on Seeking Alpha