Healthcare Pulse

The healthcare sector meaningfully outperformed the broader market last year. The sector’s performance was dominated by pharmaceuticals, managed care, and medical equipment companies, as investors were attracted to the defensive nature of these groups in times of market stress.

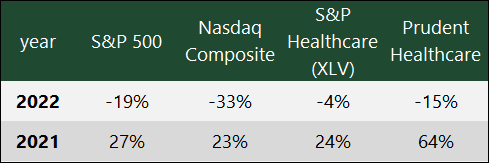

After two consecutive years of trailing the S&P 500, the S&P Healthcare index finally outperformed and was down 4% in 2022, compared to the broader S&P 500’s nearly 20% decline. The Nasdaq Composite index lost 33%.

In the 2022 outlook, we noted that, “healthcare is relatively well-positioned as a defensive sector in what is to be a volatile market environment… For the year, we anticipate the S&P Healthcare Index to rise 5% to 15%… the Fed’s inflation targeting strategy will play a vital role in market returns, and our assumption is for 4 quarter-point rate increases this year.”

Last year the Fed raised rates by 4.5%, well above the 1% expectation.

Healthcare’s Path in 2023

Healthcare was eminently positioned during 2022 as a defensive sector to withstand the turmoil from an aggressive monetary policy of the Federal Reserve to counter soaring inflation. But not all industry groups within healthcare performed well as growth-oriented and high-risk industry groups, like biotechnology and medical devices, lagged sector performance.

We are entering a period of an economic slowdown engineered by a restrictive monetary policy to combat inflation. Earlier this month, leading banks J.P. Morgan and the Bank of America on earnings calls characterized the upcoming slowdown as a shallow recession. Keeping this economic outlook in mind, the top-performing defensive groups from last year should continue to outperform the broader market earlier in the first half. However, defensive groups will soon face rotation risk to growth stocks later in the second quarter and into the second half. That’s when the market will begin to discount the possibility of the economy emerging from a slowdown by end of the year. High-risk groups, like biotechs, can perform well as the year matures and risk becomes actively sought to boost returns. Of course, if inflation persists and the recession is deeper than presently anticipated, we can witness defensive groups outperforming through most of the year.

Healthcare continues to benefit from the megatrend of an aging demographic. Medicare-related service providers will gain from the growth in the over-65 population. COVID-19 will remain endemic going forward and will have more seasonal than year-round disruptions to medical routines. Consulting firm McKinsey estimates that COVID-19 in the US could result in healthcare costs of $200 billion annually going forward. That is still a significant recurring market opportunity for biopharma and service providers.

While COVID-19 will remain a major healthcare expense and opportunity on an ongoing basis, the pandemic also has positively transformed healthcare – how it is envisioned and delivered. It is accelerating the adoption of new technologies, solutions, and more accessible delivery models.

The country spends over $4 trillion annually on healthcare. Of this amount, McKinsey estimates nearly one-quarter of the spending, or one trillion dollars, is related to administrative spending and the remaining three-quarters to care delivery. The healthcare system has thousands of players and there are multiple opportunities in this diverse and highly influential sector.

Large Pharmaceuticals

The pharma group, which has an outsized impact on the healthcare index performance, should do well in the first half. During the second half, the group will more likely be driven by individual stock performances than by a rising tide for the whole group.

Pharmaceuticals and biotech companies continue to deliver some ground-breaking treatments, as they push the frontiers of medical science. Oncology and Neurology continue to garner a major share of R&D spending.

Last year, Eisai and Biogen reported positive results in a Phase 3 trial of the anti-amyloid beta treatment, Lecanemab, for mild cognitive impairment due to Alzheimer’s disease. The drug was approved by the FDA in an accelerated approval earlier this month. Another major pharma, Eli Lilly, is seeking approval for its drug, Donanemab, which works on the same amyloid beta reduction hypothesis. Its accelerated approval filing was denied by the FDA last Friday, and the company must submit a larger dataset, which it intends to do around midyear. The FDA’s approach to granting approvals in high-need areas when positive outcomes have not yet been established is shining a light on a path that has been very hard to travel. As a result, significant research dollars are being drawn into Alzheimer’s disease research and other areas that have not yet witnessed treatment progress over decades.

Obesity is another area that is experiencing new ground-breaking treatments. Since 2021, when pharma diabetes giant Novo Nordisk’s drug Wegovy was approved and became a blockbuster treatment, large biopharma has been moving similar treatments through the pipelines. The next major obesity drug up for accelerated approval is Eli Lilly’s Tirzepatide as a weight loss treatment. Amgen is working on an early-stage drug which last month showed a 15% reduction in body weight for people without diabetes in a Phase 1 trial. Pharma giant Pfizer is working on an obesity treatment as well.

Oncology remains one of the largest market opportunities for pharma with Merck’s drug Keytruda and Bristol-Myers Squibb’s drugs Revlimid and Opdivo being the highest revenue drugs for cancer. Bristol Myers, Novartis, and Johnson & Johnson are some of the companies pursuing the CAR-T cancer treatment approach.

Pharmaceuticals continue to face challenges from low R&D returns and patent cliffs. This will push the cash-rich pharma group to target acquisitions this year more aggressively as economic clarity improves.

On the regulatory front, the split control of Congress has further diminished regulation risk around price control and that is a favorable development for the industry group.

Some of the large pharmaceutical companies that can continue to outperform the broader market indexes include Merck, Elly Lilly, and Novo Nordisk. Pharma giant Pfizer is better positioned to outperform later in the second half as the COVID-19 vaccine business settles into a more steady state and year-over-year comparisons start to become easier.

Biotechnology

This is a group that has materially lagged the broader market for the last two years with negative or barely positive returns. However, we believe this year is likely to be a year of strong biotech returns. Being a high-risk group, biotechs are quite sensitive to interest rates. The 10-year yield has likely peaked, which bodes well for biotechs.

Last week, the Biotech Bonanza 2023 Outlook was published which covers this industry group’s outlook in greater detail.

Medical Devices, Systems, and Services

The advancements in technology and innovation continue to expand the opportunities for these industry groups. Solutions that address the growing demand for health care, address ongoing supply chain challenges and labor shortages, reduce costs of delivering health care, and improve efficiencies, continue to drive corporate health care spending. Companies that provide home-based care and solutions should also perform well due to the aging demographic.

Many of the mid-sized and smaller companies in these groups were hurt disproportionately due to being more growth-oriented and less profitable or unprofitable. The rotation into growth-oriented stocks as the year progresses should benefit these companies.

There are many promising companies in these groups and a few of them are Penumbra (PEN), Exact Sciences (EXAS), Veracyte (VCYT), Phreesia (PHR), Alphatec (ATEC), Zynex (ZYXI), 10x Genomics (TXG), and Pacific Biosciences (PACB), and Silk Road Medical (SILK).

Healthcare continues to hold significant promise for investors both as a defensive and a growth sector.

The market decline that started in 2022 is the first sustained pullback since the time of the Great Recession in 2008. The biggest uncertainty for the market and the Fed remains on how quickly inflation will trend down, thus allowing room for a less restrictive policy. Clarity on when the restrictive policy ends will determine when a new bull market is born.

If expectations for an end-of-the-year rate cut end up being true, then defensive healthcare industry groups can witness a quick rotation of investing dollars out of such safer groups to more growth-oriented ones. A near-term risk is that the Fed’s rate outlook does not align with a 25 basis point increase that the market is expecting at the end of the February 1 meeting. The Fed has to continue walking a fine line as any pauses or shift down can be perceived as approaching the end of its restrictive policy, which can have the undesired effect of boosting asset prices and impeding progress on inflation.

The first half could be chaotic for the market due to interest rates and policy risk. Thus, defensive healthcare groups can continue to remain attractive. However, growth stocks are going to be sought as the year matures. We anticipate the broader healthcare sector to perform better than the broader market in the first half, but likely not in the second-half. Growth-driven industry groups within healthcare are likely to be better positioned in the second half.

For the year, we expect the broader S&P Healthcare Index to rise 10% to 15%. The Prudent Healthcare model portfolio is 90% invested at this time. A few promising healthcare companies that can perform well in the 2023 market environment include Elly Lilly (LLY), Novo Nordisk (NVO), Merck (MRK), Gilead Sciences (GILD), Vertex Pharmaceuticals (VRTX), Moderna (MRNA), Collegium Pharmaceutical (COLL), TransMedics Group (TMDX), Exact Sciences (EXAS), Phreesia (PHR), Alphatec (ATEC), Xenon Pharmaceuticals (XENE), Akero Therapeutics (AKRO), Penumbra (PEN), Rhythm Pharmaceuticals (RYTM), Verona Pharma (VRNA), and Pacific Biosciences (PACB).

This outlook expectation is simply a general framework to guide investors and will need to be adjusted if market conditions deviate materially from current expectations.

The article was first published on Seeking Alpha.