Dive Brief:

- HistoSonics has received de novo authorization for a device that uses sound waves to destroy liver tumors, clearing it to sell the product in the U.S.

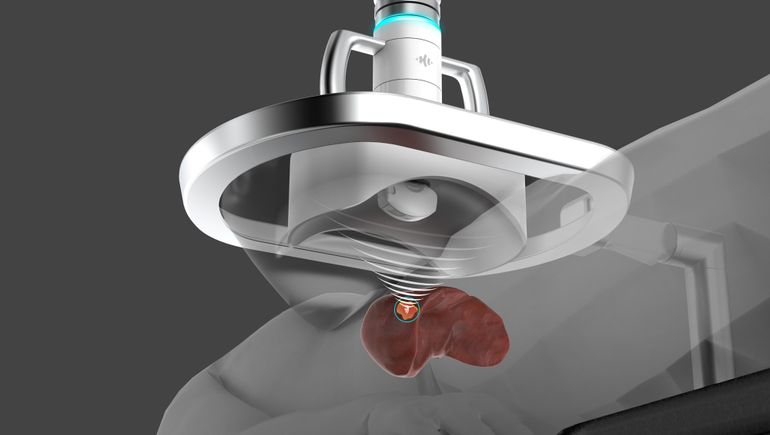

- The company, which received investment from Johnson & Johnson last year, has developed the Edison system to offer a minimally invasive alternative to surgical resection and thermal ablation in patients with primary and metastatic liver cancers.

- HistoSonics received the Food and Drug Administration authorization after linking the device to a technical success rate of 95.5% in a trial of patients with primary and secondary liver tumors.

Dive Insight:

HistoSonics’ system is based on histotripsy, a technology that uses focused ultrasound to liquefy tissue. The pulsed sound waves cause bubbles to quickly form and collapse, creating mechanical forces that destroy tissue. By pairing the sound waves with imaging technology, HistoSonics enables physicians to aim waves at tumors and thereby destroy cancer cells without harming healthy tissues.

The technology offers an alternative to existing non-surgical approaches to the treatment of liver cancer. Physicians already use image-guided thermal ablation, with energy sources such as radiofrequency and microwave, to treat some cancers, but the methods are associated with local recurrence and side effects.

Histotripsy could overcome the shortcomings of thermal ablation and non-thermal techniques including irreversible electroporation. HistoSonics recently presented clinical data to support its case, linking its system to a 95.5% rate of technical success, defined by tumor volume after treatment. Three of the 44 subjects had grade 3 or higher adverse events in the 30 days after treatment.

De novo authorization of Edison in the non-invasive destruction of liver tumors, including unresectable liver tumors, positions HistoSonics to find out if the concept and data are attractive to physicians. The company raised $85 million to support commercialization late last year in a financing round led by J&J’s venture capital arm and added a further $15 million through the expansion of its debt facility.