What You Should Know:

– Healthcare organizations worldwide continue to prioritize implementing Electronic Health Record (EHR) systems, according to a new report by KLAS. While the total number of finalized EHR purchases in 2023 dipped slightly below the average for recent years, the number of hospitals impacted by these decisions reached a five-year high due to several large regional contracts.

– Government initiatives in Asia and Latin America are expected to fuel future EHR purchases. Several large decisions in Eastern Canada are also anticipated to be finalized in the coming years.

Key findings of the Global (Non-US) EHR Market Share 2024 report include:

- Global EHR Market Share:

- Epic: Most new hospital wins in 2023, including a large contract in Australia (NSW), making them the vendor with the largest total EHR market share (by number of hospitals).

- Dedalus: Added the most beds with a strong showing in Europe, particularly Italy.

- Oracle Health: Gained the third-highest number of hospitals with a continued presence in Canada and the UK.

- MEDITECH: Active in the private sector with wins in multiple countries.

- Regional Highlights:

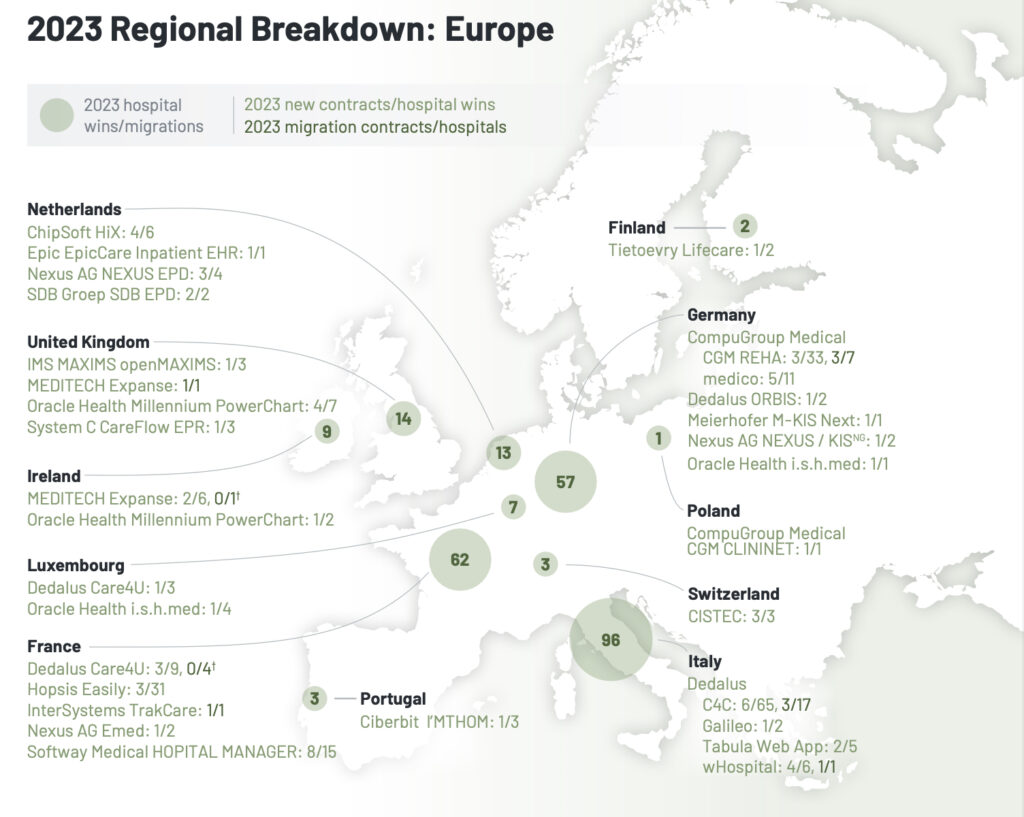

- Europe: Most active market with Dedalus, CompuGroup Medical, Hopsis, and Softway Medical seeing strong growth, particularly in France and Italy.

- Oceania: Epic became the most widely contracted EHR vendor after a large NSW selection in Australia.

- Asia: EHR activity slowed down but Kranium saw success in India.

- Latin America: MV and Philips remained the top choices in Brazil, while Dedalus made inroads in Panama and Peru.

- Canada: High number of hospitals impacted by large decisions for Oracle Health, Epic, and MEDITECH.

- Middle East & Africa: Lower activity compared to previous years, with some wins for Oracle Health, MEDITECH, Dedalus, and SIB.

- Vendor Selection Trends:

- Large regional decisions significantly impacted the number of hospitals affected.

- Increased investment in Europe, particularly Southern Europe, due to government initiatives.

- Continued consolidation in France with GHTs driving activity.

- Growth in the private sector across several regions.