What You Should Know:

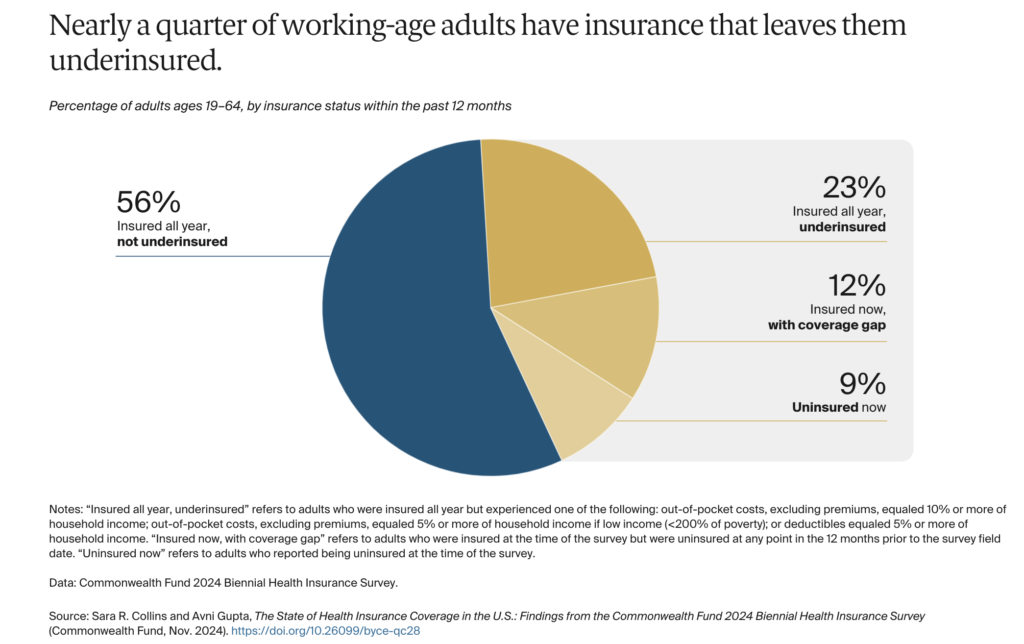

– A new report from the Commonwealth Fund reveals that despite significant progress in expanding health insurance coverage under the Affordable Care Act (ACA), millions of Americans still lack adequate and affordable healthcare.

– The report highlights the prevalence of coverage gaps, high out-of-pocket costs, and the burden of medical debt, underscoring the need for further policy action to achieve truly universal coverage.

Uninsured and Underinsured

While the uninsured rate has declined significantly since the ACA’s implementation, many Americans still experience gaps in coverage or are underinsured, meaning their health plans don’t provide affordable access to care. Other key findings of the report include:

- Employer-Based Coverage: A majority of underinsured adults (66%) have coverage through their employers, highlighting the limitations of employer-sponsored health insurance in providing adequate financial protection.

- Cost-Related Barriers to Care: More than half of uninsured and underinsured adults reported skipping necessary healthcare, including doctor visits, tests, and medications, due to cost.

- Medical Debt: Over one-third of working-age adults who were uninsured or underinsured are burdened by medical debt, often leading to further delays in care and financial hardship.

- Health Consequences: Delaying or skipping care due to cost has serious health consequences, with many individuals reporting that their health worsened as a result.

Policy Recommendations to Address Healthcare Affordability

The report emphasizes the need for policy action to address these challenges and improve healthcare affordability and accessibility. Key recommendations include:

- Extend Enhanced Tax Credits: Make permanent the enhanced marketplace premium tax credits, which are set to expire in 2025, to prevent premium increases and coverage losses.

- Address Medical Debt: Remove medical debt from credit reports and strengthen protections against aggressive debt collection practices.

- Improve Insurance Affordability: Lower deductibles and out-of-pocket costs in marketplace plans and adjust premiums and cost-sharing in employer plans based on income.

- Expand Medicaid: Establish a federal fallback option to cover the millions of uninsured individuals in states that have not expanded Medicaid.

- Promote Continuous Coverage: Allow states to maintain continuous Medicaid eligibility for adults for 12 months to prevent gaps in coverage.

“The Affordable Care Act has covered 23 million people and cut the uninsured rate in half. But high costs are a serious problem for many Americans, regardless of the kind of insurance they have. Congress, employers, insurers, and health care providers all play a role in lowering costs and making care more affordable, so families can avoid debt and get the care they need to stay healthy,” said Sara R. Collins, lead study author and Commonwealth Fund Senior Scholar and Vice President for Health Care Coverage and Access & Tracking Health System Performance.

Report Background/Methodology

The Commonwealth Fund 2024 Biennial Health Insurance Survey was conducted between March and June 2024, involving a nationally representative sample of adults aged 18 to 64. The survey provides valuable insights into the state of health insurance coverage in the U.S. and informs policy recommendations to improve healthcare access and affordability.