Dive Brief:

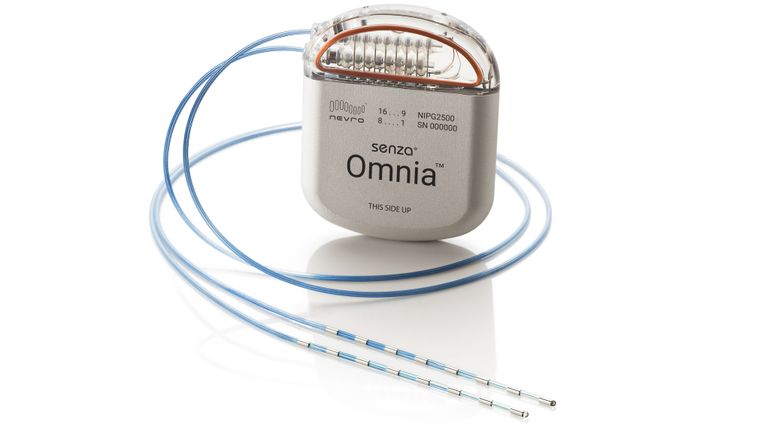

- Spinal cord stimulation (SCS) specialist Nevro is laying off 63 people across corporate, sales and marketing, and operations to free up cash to invest in long-term growth and profitability.

- The restructuring, which will affect 5% of the workforce, is largely focused on internal roles, not customer-facing personnel in the field. Nevro expects to complete most of the layoffs by the end of the first quarter of 2023.

- Management disclosed the changes alongside preliminary results for the fourth quarter of 2022. Nevro is set to beat the analyst sales consensus estimate, driven by growth in painful diabetic neuropathy (PDN) and the stabilization of the core business.

Dive Insight:

Nevro competes with Abbott, Boston Scientific and Medtronic in the SCS market. Talking to investors on a quarterly results conference call in November, Nevro CEO Kevin Thornal said the market was “on the road to recovery” but was “definitely not to the levels where we were prior to COVID.”

Nevro “held share in new implants” in the quarter, Thornal said. The company had originally forecast revenue of $445 million to $455 million for 2023, but lowered the range over the summer.

Investors responded by sending Nevro’s stock down more than 40% in 2023, and by the end of the year, activist investor Engaged Capital was building a stake in the company and reportedly pushing for change.

In the third quarter, Nevro forecast 2023 sales of $417 million to $419 million. The company brought in $425 million in revenue according to preliminary results shared on Tuesday.

Nevro’s plan to drive long-term growth and profitability includes layoffs. The SCS specialist was missing from the long list of medtech companies with mass layoffs last year. Nevro ended 2022 with 1,087 employees.

The layoffs are forecast to have a $14 million to $15 million positive impact on adjusted earnings this year, although Nevro warned the benefits “will be largely offset by normal operating expense increases, including inflation, merit increases and other acquisition-related expenses.”

Nevro is making the cuts after a fourth quarter in which sales grew 2% to $116 million, per preliminary results, to beat analyst expectations. J.P. Morgan analysts forecast $109 million. The outperformance was driven by the core SCS business, rather than the newer, faster-growing PDN opportunity.

William Blair analysts had questions about the core business but see signs that the unit may be stabilizing.

“While core sales were still down year-over-year, their rate of decline improved from last quarter’s 5% decline, suggesting either core markets are stabilizing or the company is seeing early benefits of recent commercial changes. It is likely too early to definitively point to durably accelerated core growth in 2024, but a stabilized core business is encouraging as management layers on new commercial efforts and recently acquired products,” the analysts wrote.