Novo Nordisk’s announcement this week of plans to buy the top contract development and manufacturing organization (CDMO) Catalent Inc (Somerset, NJ, US) has raised objections related to the risk of drug shortages, manufacturing standards, and antitrust violations.

Novo Holdings A/S (Hellerup, Denmark), the owner of pharma company Novo Nordisk (Bagsvaerd, Denmark), which markets the obesity drug Ozempic/Wegovy (semaglutide), will pay $16.5bn if the deal is approved by regulators.

Catalent quality problems

An unnamed pharma industry source told GlobalData PharmSource that the deal is bad news for patients and the pharma manufacturing industry:

“Catalent has been plagued with problems for about a decade now, and they just keep getting worse and worse…How is Catalent being rewarded for its overarching failures? How do the fat cats [wealthy and privileged people] get to cash out for failing?”

Catalent’s facilities have been plagued with problems. The FDA found quality control problems at Catalent’s Bloomington, Indiana, US site in October and November 2023, Reuters reported this week. Inspectors spotted a “pest” on the production line, the report says. The regulator observed five violations, including Catalent’s failure to review unexplained discrepancies in certain batches of product.

The FDA recorded almost 200 deviations at the Bloomington site between October 2021 and October 2023. Catalent failed to identify the root cause of 171 of those incidents, it said. In April 2023, Catalent admitted in a company press release that it had “experienced productivity challenges and higher-than-expected costs at its drug product and drug substance manufacturing facilities located in Bloomington, Indiana; and Brussels, Belgium, where the company was unable to achieve anticipated productivity levels.”

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

GlobalData PharmSource previously reported that the Bloomington site also received an FDA Form 483 after inspections on 1 August-1 September 2022 and 4-12 May 2023. The regulator found that the site had failed to investigate an unexplained batch discrepancy. Other citations included poorly written records of investigation of a drug, a lack of control procedures, poor sampling and testing, and inappropriate equipment design. The FDA also noted problems with manufacturing that should have been sterile.

EMA fears shortages

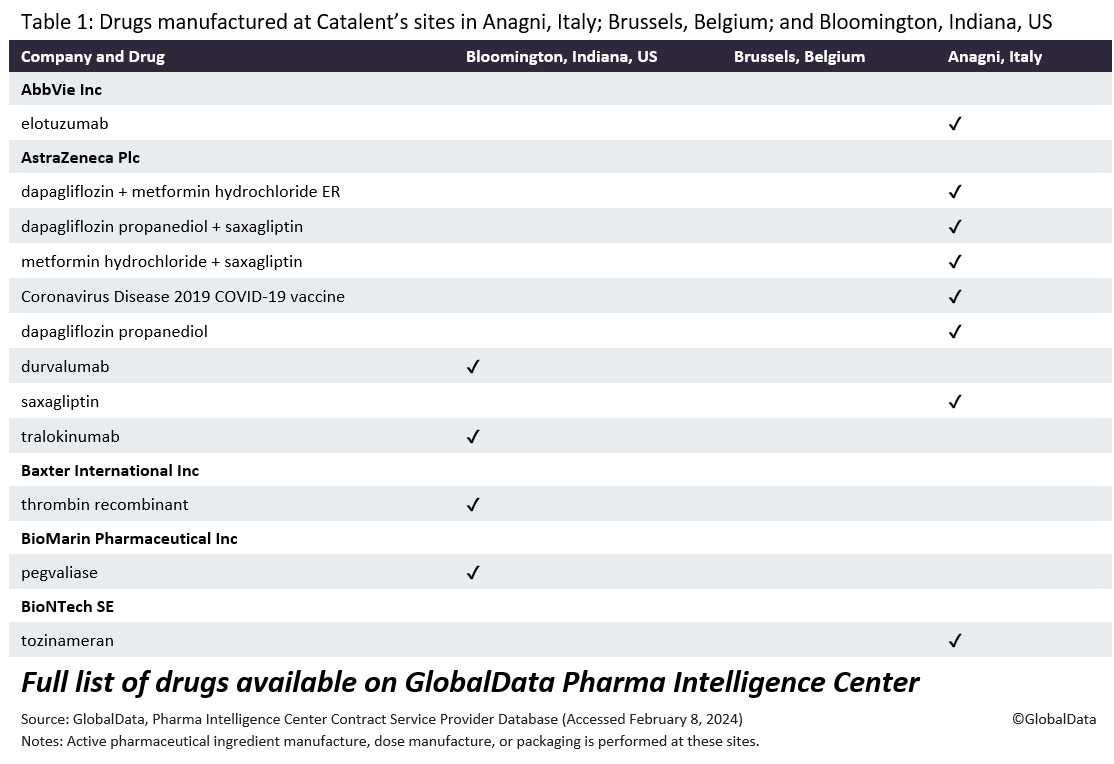

Under the terms of the deal, Novo Holdings will sell three of Catalent’s fill-finish sites (Anagni, Italy; Bloomington, Indiana, US; and Brussels, Belgium) to Novo Nordisk, in which Novo Holdings has a controlling interest.

Novo Nordisk said in a statement to GlobalData PharmSource that it “will honour all customer obligations at the three Catalent sites that Novo Nordisk is acquiring from Novo Holdings. However, the EMA is anticipating possible shortages. The EMA will investigate supply risks for medicines manufactured at the three Catalent sites that will be sold to Novo Nordisk, the agency told Reuters. The EMA’s Medicine Shortages Single Point of Contact (SPOC) Working Party will gather data on the products manufactured at the sites and “assess the possible impact on the availability of these medicines”, it said.

Eli Lilly claims antitrust concerns

Eli Lilly (Indianapolis, IN, US), which sells rival blockbuster obesity and diabetes drugs Mounjaro (tirzepatide) and Trulicity (dulaglutide), said some of its drugs are manufactured at Catalent’s sites.

In an earnings call on February 6, Anat Ashkenazi, chief financial officer at Eli Lilly, commented: “We certainly have questions about that transaction and need to learn more, and we don’t know. Catalent is an integral part or a manufacturer of both commercial and pipeline products for the industry especially in diabetes and obesity, and we have products with these sites as well.”

She added, “…we intend on holding Catalent accountable to their contract with us as we look and we gain more information on this proposed transaction.”

Eli Lilly chief executive officer David Ricks told Financial Times that the transfer of the three plants was “unusual” and raises antitrust concerns, given “a growing concern about control of critical nodes in the medical technology supply chain.” Ricks stated that antitrust authorities should examine the deal. “Given the nature of this transaction—a vertical integration where the client list of Catalent might number more than 100 entities, all of which plan to compete in some way with Novo Nordisk—it sets up for an interesting inquiry by everybody [including] politicians,” Ricks said.

Questions about more deals in the future

The acquisition announcement surprised the pharma industry. A much more common type of deal in recent years is the inverse, where a pharma company divests a manufacturing site to a contract manufacturing organization (CMO), with the facility continuing to make drugs for the seller, this time on an outsourcing basis.

Questions have been raised about whether this deal is a unique exception prompted by the extraordinary demand for obesity drugs, or if it signals the start of more CMO mega-mergers.

Experts were not convinced that this acquisition heralds a new trend. “Novo-Catalent is certainly a unique scenario, and I’m hard-pressed to imagine a similar take-out happening with the remaining CDMOs in the field,” Gil Roth, president, Pharma & Biopharma Outsourcing Association (PBOA), told GlobalData PharmSource.

“CDMO M&A [merger and acquisition] activity has been in an overall lull, largely due to macro factors in finance and the greater economy, but we’re likely to see more announcements than the last year-plus has offered, especially if interest rate cuts begin and PE firms start unlocking more funding.”

Roth continued: “However, we need to keep in mind that the current administration in the US has promised to look closely at proposed mergers for potential anticompetitive effects, and that may put a chill on some larger M&A deals.”

The unnamed industry source suggested that Novo could be on the hunt for its next massive acquisition, adding, “Novo seems to be mainly purchasing them [Catalent] to gain the fill/finish for Ozempic…The rest of their portfolio they continuously shift for market demand…And I can’t imagine they aren’t also looking to just buy their way into cell and gene therapies now, but can they do that? Do they really understand how pharma and cell and gene therapies vary?”

Novo Nordisk and Catalent were approached for comment.