Dive Brief:

- Owens & Minor on Tuesday agreed to buy home medical equipment company Rotech Healthcare Holdings for $1.36 billion.

- Orlando, Florida-based Rotech has more than 4,200 employees and provides products and services in 46 states. The takeover is expected to close by the end of 2024.

- Rotech is “fairly heavily deep into sleep and oxygen,” Jonathan Leon, Owens & Minor’s interim CFO, told investors Tuesday. The acquiring company expects a significant number of patients to continue to need such products despite the growing use of GLP-1 drugs.

Dive Insight:

Owens & Minor, a provider of healthcare products and services, set a goal of achieving $5 billion in patient direct sales by 2028 at an investor day in December. Needing to almost double its sales to hit the goal, the company identified acquisitions that accelerate growth in core categories and expand into adjacent conditions.

Buying Rotech will strengthen and expand Owens & Minor’s existing suite of products and services, including by adding durable medical equipment such as hospital beds, wheelchairs and mobility aids to the portfolio, Owens & Minor CEO Edward Pesicka said on a Tuesday call. Pesicka said payors and patients will benefit.

“Our combined customer base gives us the kind of platform payors want across one network,” Pesicka said. “This will facilitate improved efficiencies for claim approval and payments while also providing more flexibility for patients.” The CEO said patients across the country living with chronic conditions will also benefit from improvements to “the continuity of service.”

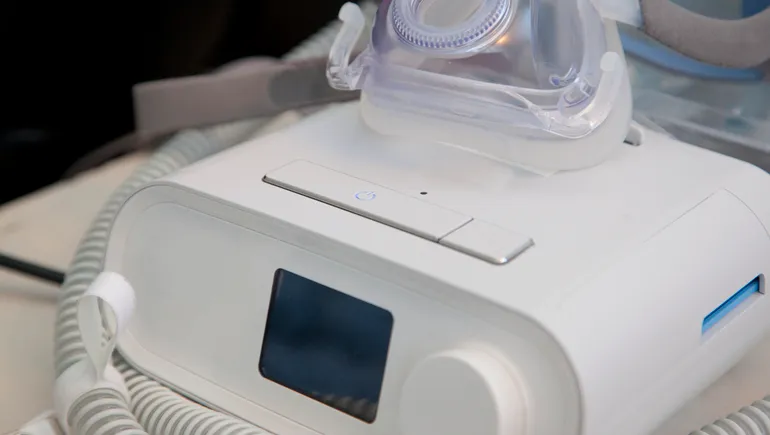

Rotech, which is privately owned, reported $750 million in net revenue in 2023. The acquired portfolio includes respiratory and sleep apnea products. Diabetes now makes up around 5% to 6% of Rotech, Leon told investors.

Barclays analyst Stephanie Davis said on the call she “was a little surprised” the company decided to go deeper into the sleep space “given some of the recent challenges in that.” However, Pesicka defended the choice.

“GLP-1s doesn’t necessarily cure the sleep issue,” the CEO said. “In addition to that, we also looked at it with the significant number of Americans with sleep apnea that haven’t been diagnosed yet. [There is a] tremendous opportunity there.”

Pesicka added that “a significant number of people” are going to need sleep apnea devices even if GLP-1 drugs reduce symptoms in some patients.

Owens & Minor is aiming to achieve synergies of around $50 million within three years of the deal. The target reflects a combination of “network and procurement efficiencies, heightened cash collection processes, and enhanced customer onboarding and technology,” Leon said.

Rotech has more than 300 account executives. Noting that Owens & Minor hired 80 sales reps “fairly recently,” Leerink Partners analyst Daniel Clark asked how the company is thinking about its footprint. Owens & Minor will initially try to minimize confusion among customers, Pesicka said, but at some point is “going to assess all aspects of the business.”