Cystic fibrosis (CF) is an autosomal recessive disease characterised by its effects on pancreatic function and persistent airway infections. Mutations in the CF transmembrane conductance regulator (CFTR) gene cause the condition, with the most prevalent mutation being the deletion of phenylalanine at codon 508 (F508del). Advances in disease comprehension, expanded screening at birth and the development of drugs that modify the disease have transformed treatment strategies, leading to enhanced quality of life and longer lifespans for individuals with CF (Sreenivasulub et al, 2023).

Since 2015 there have been significant changes in the CF market due to the development of CFTR modulator therapies that target the underlying cause of the condition. Currently, Vertex Pharmaceuticals dominates the entire CFTR modulator market with its four marketed CFTR modulators: Kalydeco (ivacaftor), Orkambi (lumacaftor + ivacaftor), Symdeko/Symkevi (tezacaftor + ivacaftor and ivacaftor), and Trikafta/Kaftrio (elexacaftor + tezacaftor + ivacaftor and ivacaftor). Notably, Trikafta/Kaftrio is currently regarded as the most effective therapy for the treatment of patients with CF as it addresses a larger proportion of F508del mutation profiles compared to previous-generation CF therapies (Guo, Garratt, and Hill, 2022).

During Vertex’s Q1 2024 earnings call, the company disclosed that it has submitted regulatory marketing applications for its once-daily vanzacaftor triple combination, also known as the vanza triple therapy (vanzacaftor/tezacaftor/deutivacaftor) with the European Medicines Agency and the US Food and Drug Administration. The submission follows Vertex’s February 2024 announcement of positive results from its pivotal Phase III trials (SKYLINE 102, SKYLINE 103, and RIDGELINE 105). Data from the programme demonstrated that vanza triple therapy achieved its primary endpoints across the Phase III trials, indicating noninferiority against Trikafta for improving lung function. It also achieved superiority to Trikafta in the trials’ secondary endpoint of lowering levels of sweat chloride (SwCl).

Vanza triple therapy may emerge as a preferred treatment

However, it is unclear whether vanza triple therapy’s superiority in lowering levels of SwCl will translate to higher market penetration as SwCl levels may not directly relate to enhanced lung function (Fidler et al, 2017). Still, vanza triple therapy could emerge as a preferable alternative for some patients experiencing side effects with Trikafta, such as rash, liver enzyme dysregulation and central nervous system issues, as well those who prefer its once-daily dosing regimen compared to Trikafta’s twice-daily dosing. Additionally, with Trikafta’s patent set to expire in 2037, affirming the company’s expected leadership position in CF, the approval of vanza triple therapy has the potential to further extend this timeframe, given the standard 20-year patent duration from the filing date of the Patent Cooperation Treaty (PCT) application. For context, the patent (US20220047564) for vanza triple therapy was filed in February 2022.

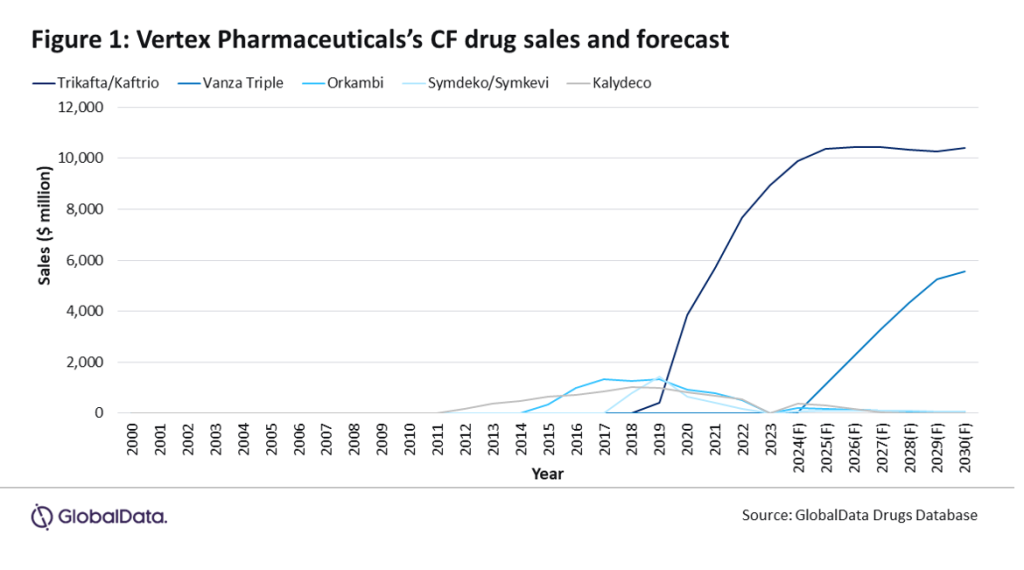

If vanza triple therapy receives approval, it is anticipated to become one of Vertex’s leading assets within its CFTR modulator portfolio along with Trikafta/Kaftrio. GlobalData predicts that sales of Trikafta will reach $10.4 billion in 2030, compared to vanza triple therapy, which is projected to reach sales of $5.5 billion in 2030, surpassing Orkambi, Symdeko/Smykevi, and Kalydeco (Figure 1). According to GlobalData’s POLI Database, a key contributing factor to the billion-dollar projection is the high cost of treatment, with Trikafta/Kaftrio averaging about $948/treatment day, translating to approximately $346,000 for one year’s supply. However, Trikafta’s high price tag faces pricing pressure despite being a groundbreaking CF treatment, particularly with several advocacy efforts by patients, doctors and activists emphasising concerns over affordability and access.

Vertex’s dominance in the market could be solidified

In April 2024, Vertex announced that Trikafta would be available for individual patients under a private health plan in South Africa (Navlin Daily, 2024). The decision followed the increasing pressure over Vertex’s alleged “patent abuse” as the company registered patents for Trikafta in South Africa in 2019 even though the drug is not yet approved in the country (Lay, 2024). More recently, the company appointed Dr Jennifer Schneider to its board of directors. She is also the co-founder and current CEO of Homeward Health, a company focused on rearchitecting the delivery of health and care in partnership with communities everywhere, particularly rural America (Vertex Pharmaceuticals, press release, 15 May 2024). Vertex may be looking to leverage Schneider’s expertise in health systems, policy and reimbursement to navigate these challenges.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

CF treatment has undergone remarkable transformations in recent years, driven by advances in disease understanding and the development of targeted therapies. Vertex, with its suite of CFTR modulators, has played a central role in revolutionising CF treatment, culminating in the success of Trikafta/Kaftrio, which has been hailed as the most effective CF therapy to date. The company’s latest submission of regulatory applications for its once-daily vanza triple therapy emphasises its commitment to drive innovation in this field. While vanza triple therapy shows promising efficacy in clinical trials, its potential market penetration and impact on Vertex’s market-leading position in CF treatment remains to be seen. Pricing pressures, highlighted by efforts of patient advocacy groups, continue to challenge Vertex, prompting the company to act. The company’s strategic moves, including board appointments such as that of Schneider, reflect a proactive approach to addressing these challenges and sustaining its leading position in the evolving CF market. With the potential approval and market success of the vanza triple therapy, Vertex’s dominance could be further solidified, shaping the future trajectory of CF treatment.