By the numbers

Revenue: $5 billion

11% increase year-over-year

Net income: $738 million

13% increase year-over-year

Q2 trends

Stryker raised its revenue and earnings forecast for 2023, driven by rising procedure volumes, improved component supply and the company’s pricing initiatives.

The Kalamazoo, Michigan-based medtech firm now expects organic sales growth of 9.5% to 10.5%, compared to its previous forecast of 8% to 9%. It also expects adjusted earnings per share of $10.25 to $10.45, compared to its prior range of $10.05 to $10.25.

“Procedural volumes have largely recovered to pre-COVID levels in most countries. And while volumes are strong, patient backlog still remains, and we believe the elevated orthopedic procedural demand will continue well into 2024,” Stryker Vice President of Investor Relations Jason Beach said in a Thursday earnings call.

Pricing initiatives, particularly in the company’s medsurg and neurotechnology business, contributed to better margins, CFO Glenn Boehnlein said in the call, although some cost pressures remained in transportation, labor and electronics.

“Management reiterated the positive procedure volume commentary we’ve heard from other MedTech companies, calling out elevated procedure growth that’s expected to continue into next year,” J.P. Morgan analyst Robbie Marcus wrote in a research note on Thursday, adding that pricing and component availability should help drive Stryker’s recovery in margins.

‘A winning hand’

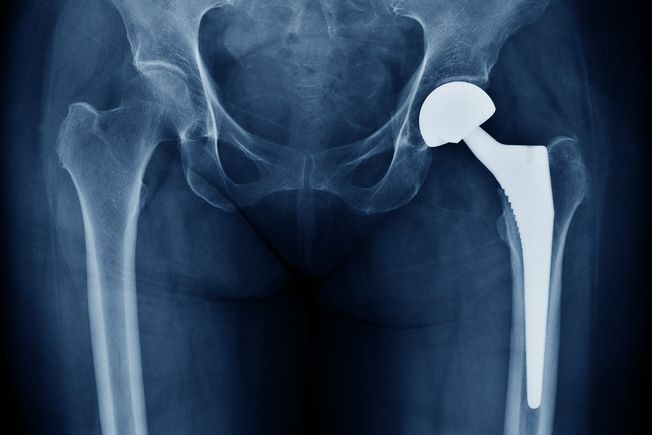

Stryker reported 12% revenue growth in its medsurg and neurotechnology segment, and 10% growth in its orthopedics and spine segment. New devices are expected to help the company continue its growth trajectory, CEO Kevin Lobo said.

In the second quarter, the company began a limited launch of its 1788 endoscopic camera, which is expected to contribute to the company’s finances next year, Lobo said. Other notable products include the company’s Insignia hip stem, which it debuted last year, cementless knee implants, where the company has “a huge head start,” and its Mako surgical robot, where Stryker plans to add additional features in the future, the CEO said.

“We think we have a winning hand, and we’re going to continue to play that hand,” Lobo added.

Shares of Stryker rose 4.2% to $287.13 in Friday morning trading.