Dive Brief:

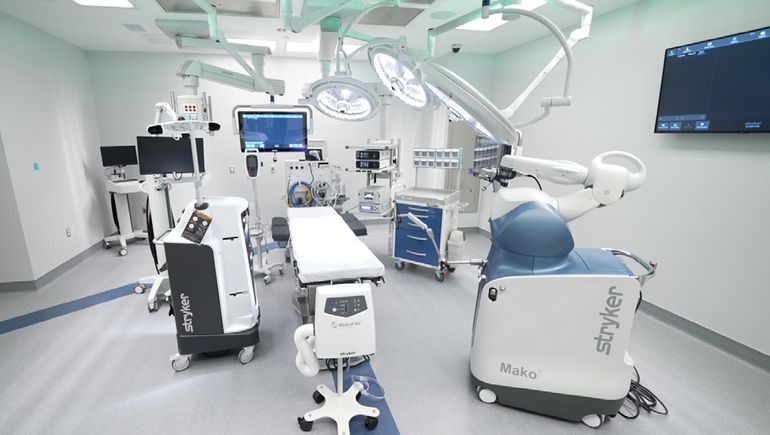

- Stryker is rolling out a direct-to-patient marketing campaign aimed at promoting the advantages of its Mako surgical robot to people with joint pain who might consider a knee or hip replacement, the company announced Friday.

- The strategy is the latest example of DTC advertising by medtech companies looking to reach groups of patients beyond those who have been traditional recipients of their devices, analysts said.

- In its messaging, Stryker cites clinical research showing that its Mako robotic system has demonstrated better outcomes, such as less pain and faster recovery times, than joint replacement surgery performed manually.

Dive Insight:

Orthopedic device makers have dabbled in direct-to-consumer marketing over the years, but medtech companies have not invested as heavily as the pharmaceutical industry. Stryker’s DTC efforts date back two decades, when the company tapped Jack Nicklaus to be its spokesperson after the golf legend received a Stryker ceramic-on-ceramic hip.

Now, Stryker is looking to boost public awareness of its robotic offering for partial knee, total knee and total hip replacement surgeries for patients with arthritis in those joints.

The push follows similar moves by medtech companies looking to expand into a broader population, beyond the patients in most immediate need of an implant or other device-based treatment, RBC Capital Markets analyst Shagun Singh said in an interview.

For example, said Singh, Edwards Lifesciences turned to DTC marketing when it received an expanded indication to market its transcatheter aortic valve replacement devices to a healthier patient group.

Abbott is another company marketing directly to consumers. Beyond its advertising for the FreeStyle Libre continuous glucose monitor, the company said it was the first in the healthcare field to headline the Consumer Electronics Show last year in support of its Lingo wearable device designed to track health signals such as glucose, ketones and lactate.

Boston Scientific has advertised its Watchman device for left atrial appendage closure, Inspire Medical has promoted its implant to treat sleep apnea and Teleflex launched a national campaign for its Urolift treatment for enlarged prostate.

DTC marketing will be an “increasing focus going forward” among device makers, Singh predicted.

Stryker’s DTC campaign for Mako comes as more hospitals advertise their orthopedic robots as a way to attract joint replacement patients, Morningstar medtech analyst Debbie Wang wrote in an email. “We’re not surprised to see Stryker support Mako with DTC,” Wang said.

Stryker, whose competitors include Zimmer Biomet and Johnson & Johnson, has the largest installed base of systems among orthopedic device makers with surgical robots.

As hospitals promote robotic surgery, Wang said, “even if the patients don’t know exactly which robot to ask for, they may only know that robotic knee replacement is better than non-robotic. And once they start looking into doctors and hospitals, there’s still a greater chance that they’ll find their way to a Mako surgeon.”

Stryker’s direct-to-patient strategy for its robot includes streaming and traditional broadcast TV, social media, YouTube and paid search advertising.

The company is highlighting attributes of its system such as CT scanning to develop a model of the patient’s joint and a personalized surgery plan, and the ability to generate clinical, operational and financial insights through digital capabilities. The DTC marketing campaign is called “Scan. Plan. Mako Can.”