Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Good morning. I have learned that a local brewery has been fined by the Illinois Liquor Control Commission for selling cicada-infused malört. A sobering sign that summer is coming to an end.

advertisement

Onto the biotech news of the day.

Acelyrin to start layoffs after anti-inflammatory drug disappoints

Acelyrin’s anti-inflammatory drug succeeded in a Phase 3 trial for a common skin disorder called hidradenitis suppurativa, but the results didn’t show a clear edge over competing products.

The biotech is now halting further investment in the drug, called izokibep, and will instead focus on an experimental antibody treatment for thyroid eye disease. As part of this pivot, the company will lay off about 40 employees, a third of its workforce.

advertisement

“I hope that this will be read as sort of a reflection of our commitment to making data-driven and capital-conscious decisions,” CEO Mina Kim said in an interview.

Read more from STAT’s Jonathan Wosen.

Illumina plans to stick to its roots post-Grail

After Illumina spun out liquid biopsy company Grail earlier this year, executives yesterday laid out their vision for the company going forward. CEO Jacob Thaysen made clear that the company, which controls about 80% of the current DNA-sequencer market, is essentially returning to its traditional role of creating instruments for academic researchers and the biopharma and health care industry.

On an investor call, Thaysen stressed that Illumina will shift more of its attention to helping sequencing users understand the biological significance of genetic variants. The company has plans to debut products in the next 12 to 18 months that would allow users to more easily collect data on chemical modifications to DNA and to sequence the genome with minimal sample preparation.

Read more from Jonathan.

Meanwhile, Grail is undergoing a big restructuring as it aims to save cash and concentrate resources on developing its blood-based cancer-detection test. It said yesterday that it will cut around 350 existing positions and 150 open roles, representing a roughly 30% workforce reduction. Read more, also from Jonathan, who was working nonstop yesterday.

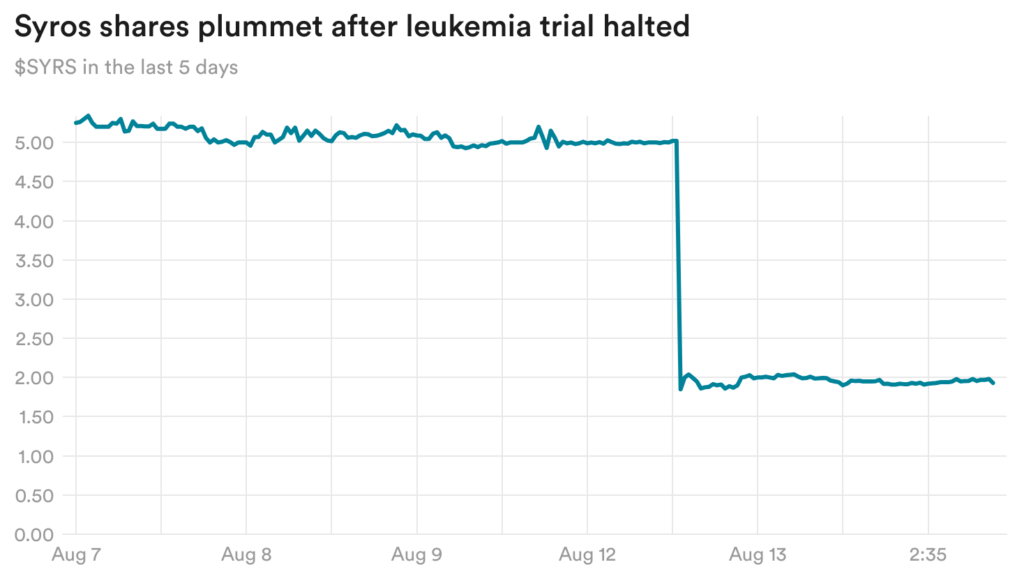

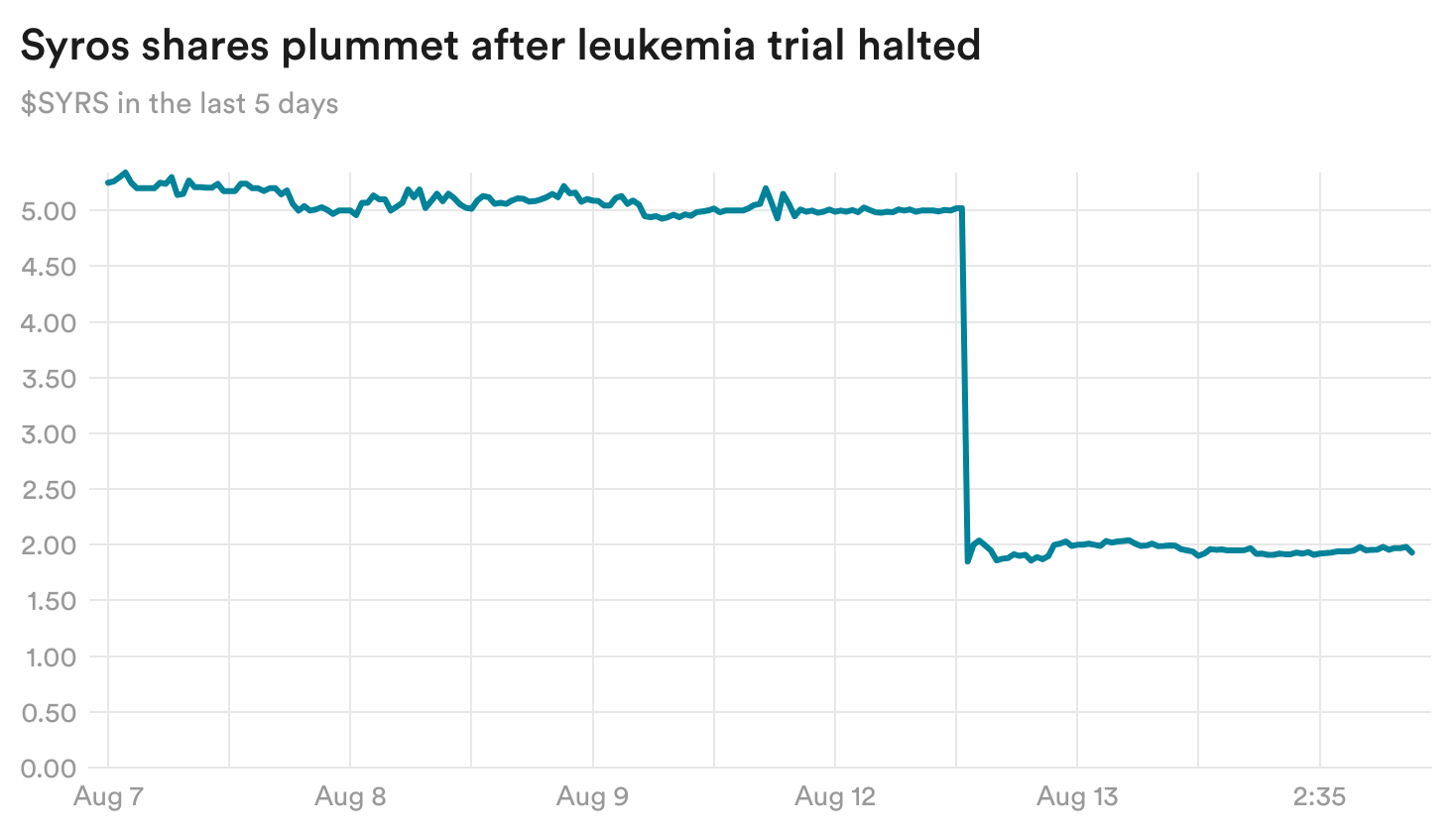

Syros shares battered after it stops leukemia trial

The worst-performing biotech stock yesterday was Syros Pharmaceuticals. Its shares plummeted over 60% after the company said late Monday that it will stop a Phase 2 trial studying its treatment tamibarotene in acute myeloid leukemia (AML), following an interim analysis of the study.

The trial tested tamibarotene on top of the dual treatment venetoclax and azacitidine, compared with patients taking just the dual treatment. The interim analysis found similar response rates between the two arms, suggesting that tamibarotene is unlikely to show a significant benefit in the final analysis, Syros said.

The company is continuing to study the treatment in a different condition, myelodysplastic syndrome (MDS), in a Phase 3 trial. TD Cowen analyst Phil Nadeau wrote that while some investors may fear that this new development bodes poorly for the ongoing MDS trial, he thinks there are limited implications and is still optimistic the study will show positive results.

Rivus sees promise for its obesity drug in heart failure

Following Novo and Lilly, Rivus yesterday reported a positive update on its obesity drug in heart failure with preserved ejection fraction (HFpEF). It said that its treatment HU6, which is not a GLP-1 drug, led to statistically significant weight loss compared with placebo, meeting the primary endpoint. But the company did not disclose the weight loss data.

Rivus also said the study met several secondary endpoints, without specifying which ones or reporting figures. The trial looked at improvements in exercise capacity and quality of life measures, among other changes as secondary endpoints.

HU6 is a “controlled metabolic accelerator,” an oral small molecule drug that raises the resting metabolic rate, which Rivus argues will increase energy expenditure and lead to weight loss that’s more preferential toward cutting fat mass than lean mass.

Rivus said it’s on track to discuss a Phase 3 HFpEF study with regulators, but it has a high bar to meet after recent developments with Lilly’s and Novo’s drugs. Lilly just reported that Zepbound cut the risk of HFpEF-related complications like hospitalizations and death. Novo, meanwhile, pulled its HFpEF application to regulators, saying that it will also have more data soon on the effects of Wegovy on major complications.

Otsuka’s plan for its app-based treatment: losing money

Otsuka Pharmaceuticals has started selling its prescription app for major depressive disorder, called Rejoyn, at a low price that it hopes will attract users.

Sanket Shah, president of the division that’s handling the launch of Rejoyn, said Otsuka has spent hundreds of millions of dollars bringing the treatment to market. With the pricing strategy, “to be honest, we’re probably going to lose a lot of money on this, but that’s the approach that you need to take to be able to understand the market learnings,” he said.

Otsuka’s strategy highlights the business challenges faced by digital therapeutics developers that must spend huge sums to develop their products and run clinical trials, only to find that there’s limited interest from patients, physicians, and payers.

Read more from STAT’s Mario Aguilar.

More reads

- Eli Lilly opens $700 million research center in Fort Point, Boston Globe

- Novartis loses bid to thwart launch of MSN’s Entresto generic—for now, Fierce Pharma

- Opinion: Better safety studies could restore America’s confidence in vaccines, STAT