What You Should Know:

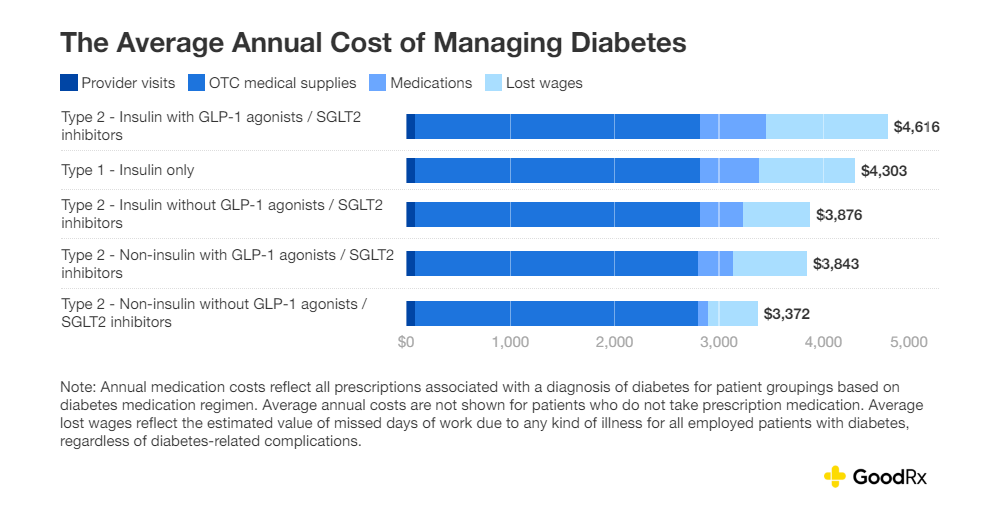

– The average person with diabetes could spend between $3,300 and $4,600 a year on out-of-pocket costs, including prescription medications, provider visits, over-the-counter supplies, and lost wages, according to a recent GoodRx report.

– The report, The True Cost of Diabetes takes into account medications, visits with healthcare providers, and blood sugar level monitoring, as well as costs for emergency room visits, hospital stays, and chronic complications for those with uncontrolled diabetes.

Beyond the Basics: Insulin, CGMs, and the Pricey Pantry

For those reliant on insulin, GLP-1 agonists, or SGLT2 inhibitors, costs skyrocket. Out-of-pocket medication expenses can jump from $90 for basic oral meds to $560 with these advanced therapies. Uninsured patients face a quadruple whammy, with costs exceeding $4,200 annually.

Continuous glucose monitors (CGMs), those invaluable blood sugar monitoring devices, add another layer of expense. Even with insurance, they can cost around $80 per year, not to mention insulin cooling cases and other essential supplies.

And let’s not forget the invisible cost of managing diabetes: the time. Self-testing, foot care, exercise, and meal planning – it all eats away at precious hours, adding another layer of burden to an already demanding condition.

Lost Wages and the Domino Effect: The Indirect Costs of Diabetes

Diabetes doesn’t just drain wallets; it can drain bank accounts. Absenteeism due to illness is high among diabetic patients, translating to lost wages and potential job loss. This domino effect can lead to lost insurance, further exacerbating the financial strain.

The Tip of the Iceberg: Complications as Cost Catalysts

The true financial storm hits when diabetes complications arise. Hyperglycemia, hypoglycemia, ulcers, and even heart attacks can send patients to the ER, rack up hospital bills, and necessitate home health services. The average out-of-pocket cost for these services? Nearly $590 per year.

And that’s just the tip of the iceberg. Chronic complications like heart disease and kidney disease add another layer of expense, with medication and preventive care adding to the financial burden. Each additional chronic condition bumps up out-of-pocket costs by an average of $470 annually.

A Call to Action: Breaking the Financial Chains of Diabetes

The staggering costs of diabetes paint a grim picture, but it’s not a hopeless one. Early diagnosis, proactive management, and access to affordable medications and healthcare can help mitigate the financial strain. Policy changes, insurance reforms, and increased access to preventive care can also play a critical role in alleviating the financial burden for millions of Americans living with diabetes.