Competition in the fast-growing pulsed field ablation (PFA) market has intensified with the arrival of Johnson & Johnson’s Varipulse system and new heart mapping capabilities from Boston Scientific and Medtronic.

J&J’s U.S. approval this month created a three-way race among the medtech heavyweights for PFA devices to treat atrial fibrillation (AFib), an abnormal heart rhythm. Each now also has integrated mapping for doctors to track the heart’s electrical activity during the procedure.

A person with AFib may feel their heart quivering, pounding or skipping beats. The condition increases the risk of blood clots and stroke.

Doctors are embracing PFA to treat AFib amid evidence the approach can restore normal heart rhythm with fewer complications than traditional methods of cryoablation and radiofrequency ablation. PFA, which delivers electrical pulses to destroy the cardiac cells causing AFib, also enables faster procedure times.

Less than a year after its U.S. debut, PFA “is quickly becoming the standard of care,” J.P. Morgan analysts wrote last month.

PFA is already the preferred form of treatment in about a quarter of AFib ablation procedures, at the expense of cryoablation and radiofrequency energy, according to Stifel analysts.

J&J, Boston Scientific and Abbott executives described a changing AFib treatment landscape on their third-quarter earnings calls.

On Tuesday, Medtronic is expected to weigh in on early progress launching its second-generation PFA device, Affera, when it reports quarterly results.

Here is where medtech companies stand in the rapidly evolving PFA market:

1. Boston Scientific adds mapping

In October, Boston Scientific unveiled Farawave Nav, a follow-up to its Farapulse system and the first mapping-integrated PFA catheter to hit the U.S. market.

Farapulse launched in January, a month after Medtronic’s Pulseselect. Both companies have seen strong adoption for their initial offerings.

Truist Securities in October predicted that by 2026, PFA would comprise about 60% of a global AFib market worth $8.2 billion, with Boston Scientific claiming at least half the share.

Farapulse is driving a “transformative conversion” from radiofrequency and cryoablation thanks to excellent outcomes for patients and efficiencies for providers, Boston Scientific CEO Mike Mahoney said on an October earnings call. Strong procedure volumes helped the company’s electrophysiology sales nearly triple in the third quarter.

Farapulse is approved for people who have episodes of AFib that come and go, called paroxysmal AFib, and don’t respond well to medications. Boston Scientific has its sights on additional patient groups as well.

One clinical trial underway is studying Farapulse in drug-refractory patients with persistent AFib lasting more than a week. Mahoney expects a label expansion for the indication in the second half of 2025. Boston Scientific is also evaluating the system as a first-line treatment for persistent AFib.

2. Medtronic introduces Affera

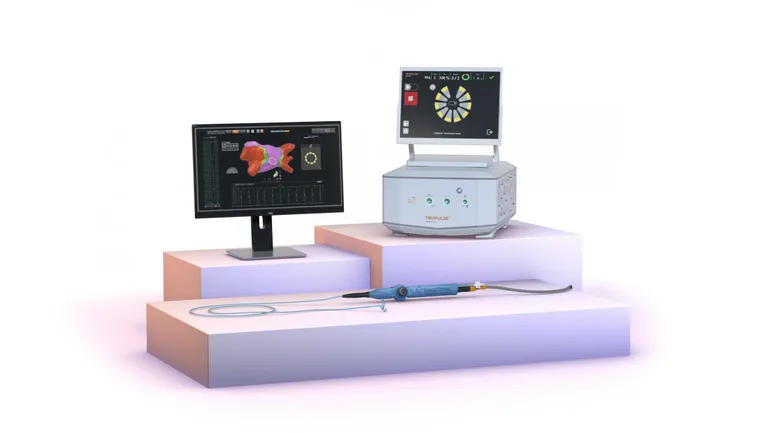

Days after Boston Scientific won the nod for Farapulse Nav, Medtronic announced Food and Drug Administration authorization for its second PFA device, the Affera mapping and ablation system.

Affera is indicated for persistent AFib and is the first catheter to combine mapping and a dual-energy option that allows physicians to switch between PFA and radiofrequency.

Needham analysts called Affera a “considerably more formidable threat to Farapulse” and predicted the device would capture more market share than Medtronic’s Pulseselect system, which is approved to treat both paroxysmal and persistent AFib in drug-refractory patients.

Medtronic has also begun to study Affera in patients with ventricular tachycardia, a form of arrhythmia that causes the heart to beat abnormally fast.

3. J&J joins the PFA race

J&J is now set to challenge Medtronic and Boston Scientific in the U.S. after getting the FDA’s go-ahead for Varipulse in drug-refractory, paroxysmal patients.

The platform integrates with J&J’s Carto mapping system in a single device. Mapping integration could give J&J an edge, according to J.P. Morgan’s analysts, because many hospitals already have a Carto system.

“J&J’s large existing presence in PFA could help drive share when it comes to market, especially in cases where mapping is needed,” the analysts said.

More than half of competitors’ cases use J&J mapping, said J&J Medtech Chairman Tim Schmid, adding that the company’s $5 billion electrophysiology business is the sector leader.

“That combination of the 5,500 installed base of Carto system’s best-in-class mapping and highly trained mappers, we believe, is a significant advantage and positions us extremely well when PFA comes to market,” Schmid said on an October call.

Beyond Varipulse, J&J expects to develop a range of PFA catheters and has already applied for the CE mark in Europe for a dual-energy device, said Schmid.

4. Abbott trails rivals

Abbott, which does not yet have a PFA system on the market, expects to file for FDA approval next year for its Volt device, CEO Robert Ford said on an October call.

“We’re very committed to being able to bring PFA to the market,” Ford said.

Abbott also said last month it completed enrollment in its Volt clinical trial ahead of schedule. Enrollment in the Volt CE mark study was completed earlier this year.

Like J&J, Abbott already has a large installed base of mapping systems that the company expects will bolster the appeal of its PFA option.

With open cardiac mapping, Abbott’s electrophysiology business has benefited from the rollout of other PFA systems as procedure volumes rise, Ford said. Still, Abbott’s electrophysiology growth has been shy of the market overall, the CEO noted.

Abbott has maintained that existing PFA technologies have limitations and is betting on a new device design, called “balloon in basket,” to improve the procedure.

In addition to Volt, Abbott is developing a device that can deliver both PFA and radiofrequency energy.