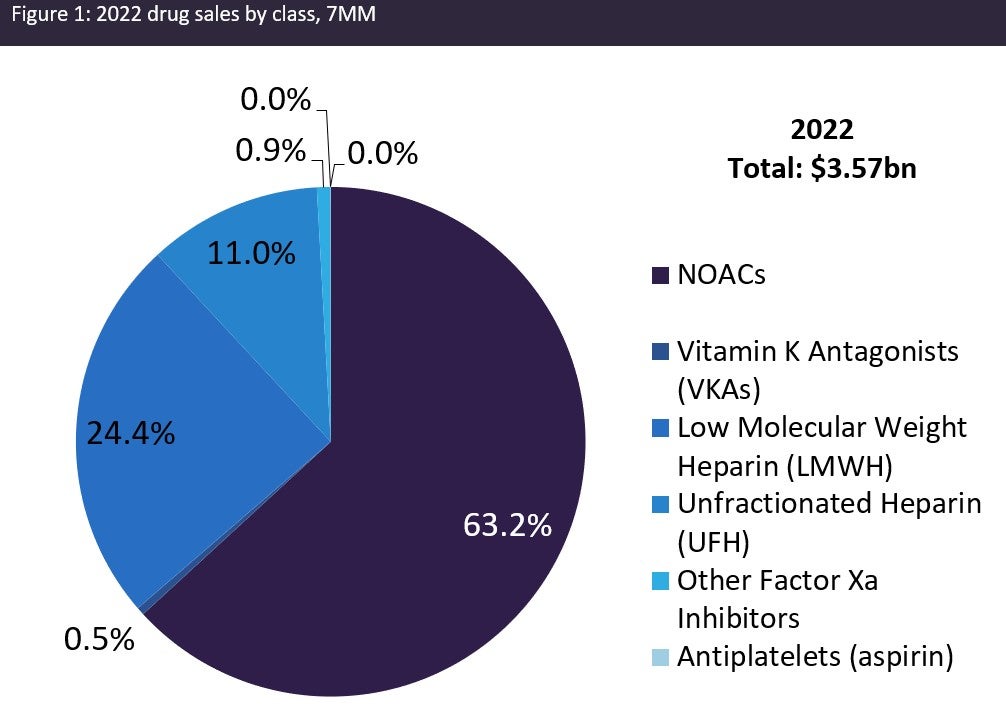

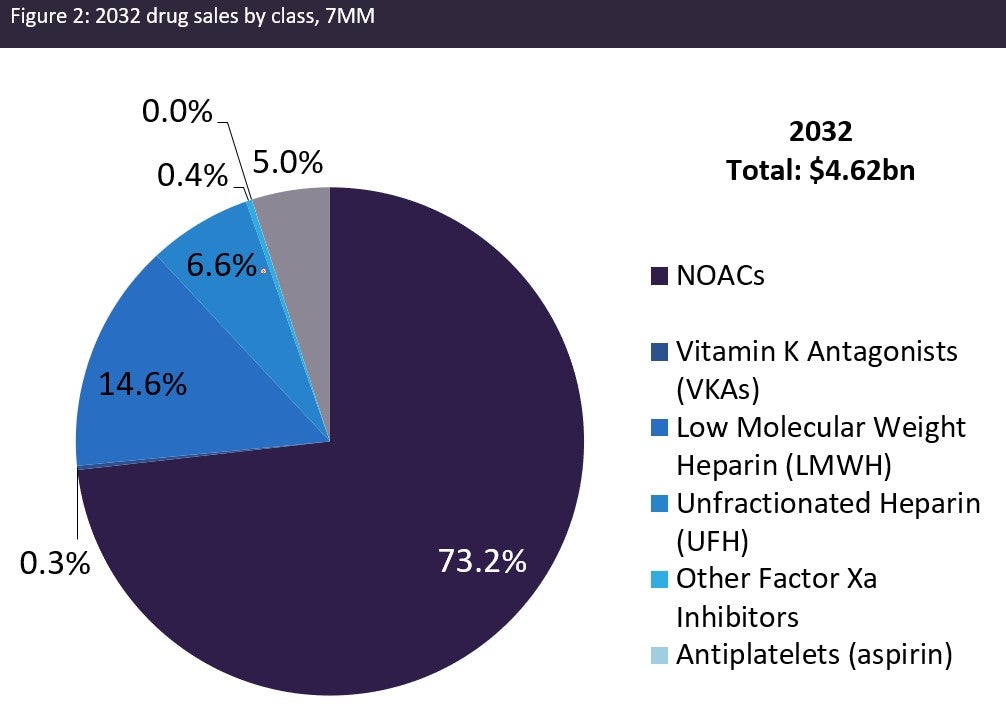

The venous thromboembolism (VTE) market is expected to grow from $3.6bn to $4.6bn globally, according to GlobalData’s upcoming report ‘Venous Thromboembolism: Seven Market Drug Forecast and Market Analysis’, which covers the seven major markets (7MM): the US, 5EU (France, Germany, Italy, Spain, and the UK), and Japan. This growth is primarily due to the increase in the incidence of VTE and the launch of the first factor XI inhibitor, abelacimab. Factor XI inhibitors are a key area for clinical trial development in VTE due to the associated decreased bleeding risk. However, growth in the VTE market is significantly tempered by the expiration of the patents on novel oral anticoagulants (NOACs). All four NOACs’ patents are set to expire during the forecast period: Eliquis (apixaban), Xarelto (rivaroxaban), Pradaxa (dabigatran), and Savaysa/Lixiana (edoxaban). NOACs are the current standard of care for VTE treatment, and therefore generic erosion is expected to have a significant impact on the trajectory of the VTE market from 2022 to 2032.

The US is the most significant contributor to the VTE market, accounting for 80.8% of sales in 2022 and 83.7% of future predicted sales in 2032. The USA’s dominant role is primarily due to the higher price tag of US therapeutics as compared with the other 6MM and the increased size of the VTE population. Spain is expected to contribute the least to VTE drug sales: only 1% and 0.9% in 2022 and 2032, respectively. However, Japan will experience the least amount of growth from the beginning to the end of the forecast period, with a CAGR of 0.1% for the VTE treatment population and -0.02% for the VTE primary prophylaxis population. Japan’s minimal or negative growth is due to the country’s declining VTE patient population, as well as the fact that abelacimab, the only late-stage pipeline therapy projected to launch during the forecast period, is not expected to launch in Japan.

The figures below summarise the projected growth in the VTE market across the 7MM from 2022 to 2032.

Major drivers of the VTE market during the forecast period include:

- The increasing incidence of VTE due to the obesity epidemic, ageing population, and increasing awareness of VTE among physicians and patients.

- The continued uptake of the NOACs for the treatment and prophylaxis of VTE.

- Recent clinical trial guidelines endorsing the use of NOACs for patients with cancer and renal impairment, further boosting market growth.

Major barriers to the growth of the VTE market include:

- The NOACs will face generic erosion as their patents expire at the beginning of the forecast period.

- Large, costly, and comprehensive clinical trials are required to support regulatory approval of cardiovascular drugs, acting as a barrier to drug developers wanting to enter the VTE market.

- There is a sparse VTE pipeline, limiting the number of drugs that would come to market.