For many of us, Thursday was Health-Policy-Wonk Festivus. The Centers for Medicare & Medicaid Services released the Maximum Fair Prices (MFPs) for the first 10 drugs subject to negotiation under the Inflation Reduction Act. This is an important moment in prescription drug pricing policy. For the first time, CMS had the opportunity to analyze current clinical evidence, unmet needs, and other related considerations as they negotiated the prices of these 10 drugs. And for the first time, we have transparency around the actual net prices to be paid by the single largest purchasers of drugs in the U.S. Most importantly, this is a milestone in CMS’ efforts to deliver savings to seniors and taxpayers for drugs that lack generic competition.

And what do the prices actually tell us? Well, there’s CMS’ estimate for how much would have been saved by the Medicare program had the MFPs been in effect in 2023 ($6 billion), and the estimate for how much seniors will save out-of-pocket just from the lower prices ($1.5 billion) in 2026.

advertisement

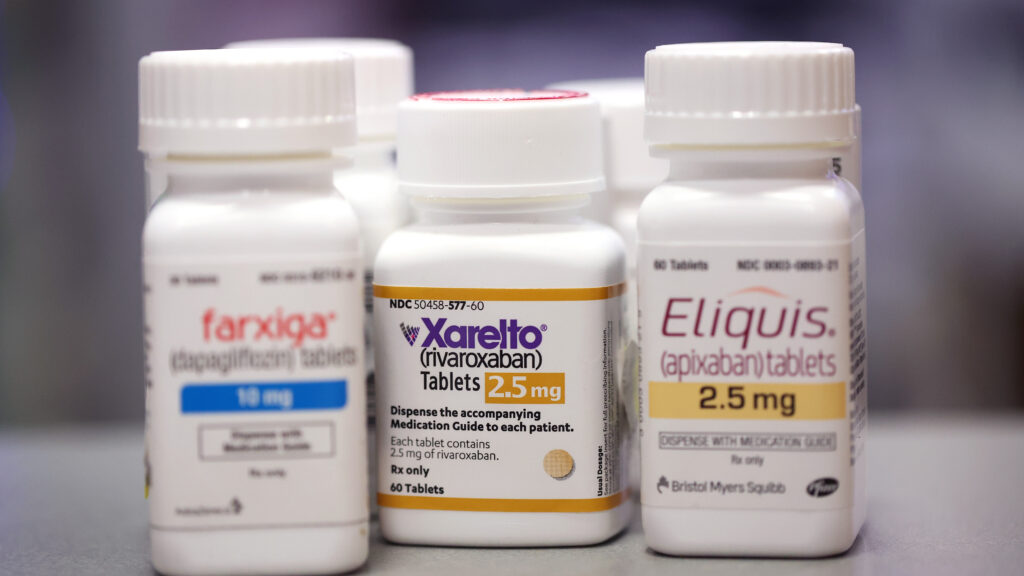

However, knowing what to make of discounts from list prices ranging from 38% for Imbruvica for blood cancers to 79% for Januvia for diabetes is trickier. Those of us who work in drug pricing daily are closely examining and evaluating the methods used to determine these prices. Which of the many factors outlined in the legislation most influenced CMS’ determination of initial price offers? How did manufacturers leverage the data they were entitled to provide to prove the case of the value of their medicines? The short answer: We don’t know. At least not yet.

STAT+ Exclusive Story

Already have an account? Log in

Get unlimited access to award-winning journalism and exclusive events.