Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Hello, everyone. Damian here with some unrest at well-funded startups, a curious biotech run-up, and long-awaited news at BIO.

advertisement

The need-to-know this morning

• Swiss drugmaker Pharvaris said its twice-daily pill for the prophylactic treatment of hereditary angioedema (HAE) achieved the goals of a mid-stage clinical trial. The drug reduced the frequency of HAE “attacks” by 84% compared to a placebo — efficacy that approaches the level of currently approved injectable treatments. Along with the data, Pharvaris raised $300 million via a stock offering.

• Novartis won U.S. approval for the first oral drug to treat paroxysmal nocturnal hemoglobinuria (PNH), a rare immune-related blood disorder. The new medicine will be sold under the brand name Fabhalta.

$300 million doesn’t go as far as it used to

ReNAgade Therapeutics, a biotech startup just months removed from raising the year’s largest Series A round, is laying off 10% of its staff and shifting its focus.

As STAT’s Allison DeAngelis reports, ReNAgade launched in May with an announced $300 million investment led by MPM Capital’s BioImpact Capital and F2 Ventures, billing itself as a one-stop shop for medicines targeting RNA. With the cuts, which will affect about 10 employees, the company has “reorganized and reduced its workforce to focus efforts” on programs that are closer to clinical trials, ReNAgade said in a statement.

advertisement

More than 100 biotech companies laid off staff in the first half of 2023, according to the industry trade group BIO, which is double the pace of the prior year. And ReNAgade isn’t the first to downsize shortly after raising money. Orna Therapeutics, another RNA startup, cut its payroll about a year after raising nearly $300 million, and Orbital Therapeutics laid off more than a dozen people about six months after launching with $270 million.

What’s going on here?

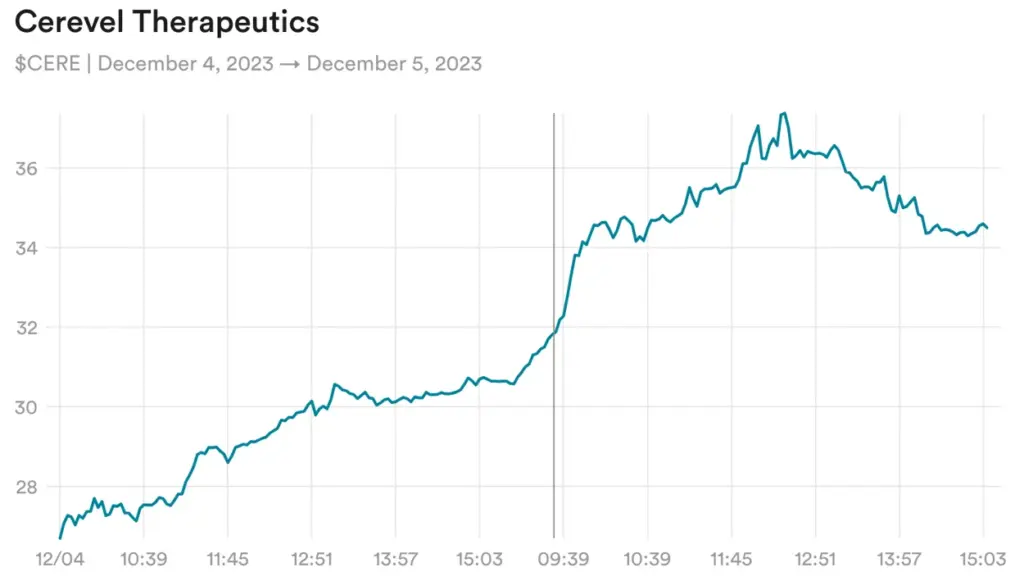

Cerevel Therapeutics, a neuroscience company that has had more clinical delays than clinical data in the past year, is up about 50% since Monday despite no news and no discernible changes to its chances of success.

The only thing on the calendar is a conference call, slated for next week, in which the company will explain in detail its investigational treatment for Parkinson’s disease, which is now in Phase 3 development. Results aren’t expected until 2024, which is to say there won’t be any new data disclosed next week.

Generally, the likeliest explanation for a news-free biotech run-up is that a bunch of investors believe a given company is soon to be acquired. For Cerevel, the case for a buyout relies on two facts: Cervel has an investigational treatment for schizophrenia that is similar to one from Karuna Therapeutics, which is awaiting FDA approval, and, in May, the company hired Ron Renaud to be its CEO, recruiting a long-time biotech executive with a track record of selling small drugmakers to larger ones. Whether all that adds up to an impending deal remains to be seen, but investors seem convinced.

Evaluating Ozempic-style weight loss drugs

Read any article, research note, or Twitter screed about GLP-1 drugs and you’ll probably run into the figure $100 billion, a commonly echoed estimate of just how much medicines like Wegovy will generate each year starting in around 2030. But how did everyone come up with that number?

“I think you can get there using Microsoft Excel pretty easily, right?” Jared Holz, a health care strategist at Mizuho, said at a STAT event this week. A nuance-averse analyst can simply plug in a drug price, multiply it by the more than 100 million Americans who are eligible for treatment, and come up with a world-historic revenue projection, Holz said. “But I think there’s a few things in the way.”

Among them is the fact that relatively few eligible patients are actually getting GLP-1 medicines, Holz said, and insurers are working hard to keep it that way. Then there’s the reality of human behavior, said Liisa Bayko, managing director at Evercore ISI. Patients are likely to cycle on and off GLP-1 treatments, just as people do with diet and exercise, which could significantly cut into long-term sales potential.

BIO finds a familiar face to be its CEO

BIO, a year removed from the messy departure of its CEO, has chosen biotech executive and rare disease advocate John Crowley to lead the organization.

As STAT’s Rachel Cohrs reports, Crowley has been a member of BIO’s board for more than a decade and serves as its vice chair. Crowley, 56, co-founded Novazyme Pharmaceuticals, a rare disease-focused biotech later sold to Genzyme, and then Amicus Therapeutics, where he serves as executive chairman.

His appointment marks a fresh start for BIO, which has suffered from the bruising departure of its prior CEO, Michelle McMurry-Heath, the organization’s first Black woman leader, in 2022. Crowley will take over the role from interim CEO Rachel King.

More reads

• Infertility worries will temper sickle cell patients’ embrace of new gene therapies, STAT

• Drug companies explore making some of their most lucrative drugs in space, Bloomberg

• Altimmune open to partnerships, deals with drugmakers, says CEO, Reuters

• Resonance Medicine, a protease biotech from David Liu’s lab, shuts down, Endpoints