Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Hello! Today, we discuss why a cell therapy stalwart is pivoting, and why a Feng Zhang startup is laying off a quarter of its staff. Also, Novartis is using some of its GLP-1 windfall to invest in Flagship Pioneering startups in the cardiometabolic space.

advertisement

The need-to-know this morning

We’ve got a news lull ahead of next week’s all-encompassing J.P. Morgan Healthcare Conference in San Francisco. Inhale. Relax. Exhale.

As a reminder, starting on Sunday, this newsletter will become your one-stop source for all of STAT’s reporting from the conference, delivered to your inbox each afternoon.

Allogene changing gears, prioritizing early-stage disease

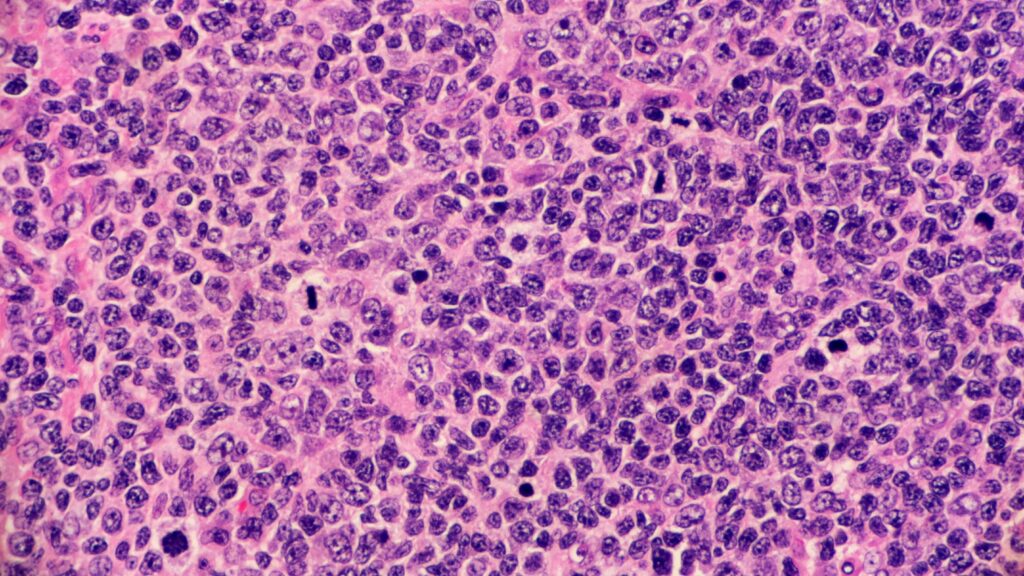

Allogene is pivoting: The biotech, which is developing off-the-shelf cell therapies for blood cancers, is moving from patients with later-stage lymphoma to patients with earlier, but high-risk, form of the disease. The company has shut down two clinical trials testing the experimental therapy ALLO-501A in advanced lymphoma, and will launch a new study with the treatment in patients who have been recently diagnosed.

advertisement

This is part of a “frontline consolidation” strategy, CEO David Chang told STAT’s Adam Feuerstein, based on emerging evidence that cell therapies used earlier in the course of treatment increase the likelihood a patient is cured. It was a “hard decision” to shut down the trials and pivot, Chang said, along with forthcoming layoffs and other reductions in operating expenses. At around $3, Allogene’s share price is trading close to an all-time low. The company’s market value has dropped from $6 billion in 2020 to just over $500 million now.

“The CAR-T space has become very crowded,” Chang said. “We’re trying to focus on how we can differentiate what we’re doing from others.”

Illumina exec leaves to become Delfi CEO

Liquid biopsy startup Delfi Diagnostics has snagged Susan Tousi, Illumina’s chief commercial officer, as its new chief executive. She’s the fourth senior executive to leave Illumina since June, STAT’s Jonathon Wosen writes. Illumina, of course, had tried to join the liquid biopsy space itself, but now is being forced to divest itself of Grail.

Tousi will begin next week, right before this year’s J.P. Morgan Healthcare Conference; founding CEO Victor Velculescu will remain on the company’s board. Delfi has ambitions to expand its commercial reach, following the launch last year of its lung cancer screening test.

Tousi led Illumina’s global product development efforts starting in 2012, and has been chief commercial officer since 2021. Under her watch, the company introduced a fleet of new sequencers to the market, with the latest instruments sequencing a genome for as little as $200 apiece.

Feng Zhang startup laying off a quarter of staff

Aera Therapeutics, launched last year by CRISPR pioneer Feng Zhang, has laid off a quarter of its staff, STAT’s Jason Mast reports. The persistent downturn in the biotech market is to blame: The company says it’s still in a “strong cash position,” but it’ll focus more on its novel delivery platforms, and trim the excess.

Aera is developing new ways to deliver CRISPR enzymes and other gene-editing tools to specific cells and organs in the body. The company has disbanded the portion of the company focused on developing new gene-editing enzymes.

Advocates disagree with FDA opioid surveillance plan

Advocacy groups are livid that the FDA has proposed to team up with a surveillance system to monitor the misuse of prescription opioids. That’s because the system, called RADARS, was initially created by one of the primary perpetrators in the opioid epidemic — Purdue Pharma. It was later sold to the Denver Health and Hospital Authority, but the FDA is interested in the system’s data, which spans many years.

But RADARS works with the pharma industry in ways that advocates find problematic — such as offering consulting services to drugmakers ahead of their FDA advisory panels. Advocates say there are more independent sources of opioid use data, such as SAMHSA, a federal program that focuses on substance abuse.

“RADARS and its staff have provided opioid manufacturers… with a unique suite of services to help them avoid regulations and sell more opioids. These services include lobbying international, federal, and state regulatory agencies and publishing deceptive articles in medical journals,” the Physicians for Responsible Opioid Prescribing wrote in a letter last month to the FDA.

More reads

- Scorpion’s CEO Axel Hoos, CMO bite the dust as oncology biotech brings in new leadership, FierceBiotech

- Lilly launches website, home delivery option for weight-loss drug, Reuters

- Bluebird snags more outcomes-based coverage for its $3M+ sickle cell gene therapy, Endpoints