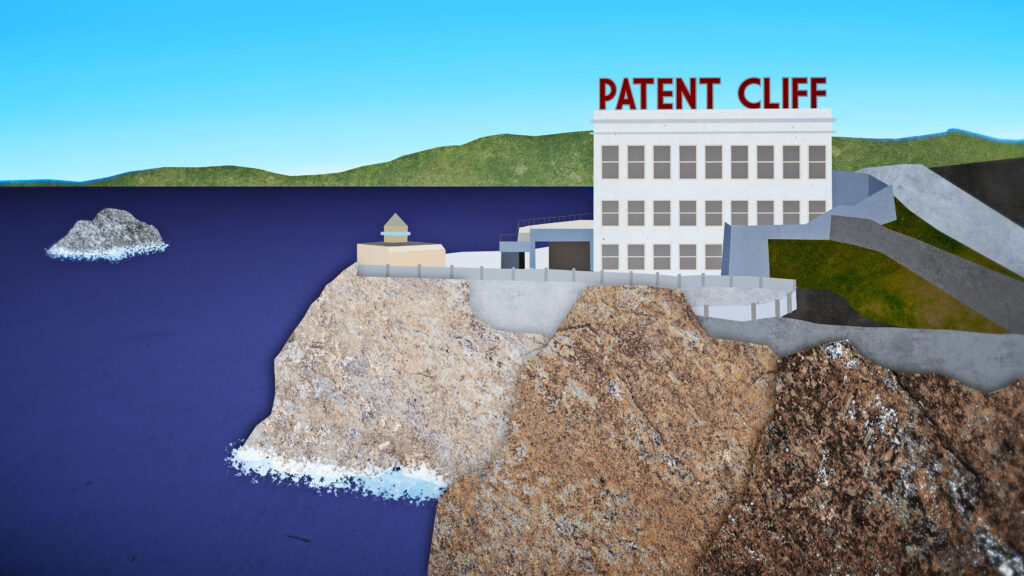

SAN FRANCISCO — Next week brings the return of the J.P. Morgan Healthcare Conference, and with it another fabled opportunity for companies in the industry to court possible mergers, acquisitions, and licensing deals. This year, there will be even greater pressure to make a good match, as the pharmaceutical industry, which drives more than $1 trillion in economic activity and thousands of jobs, faces one of the largest patent cliffs in recent history.

Between now and 2033, the patents on dozens of brand-name medications will expire, allowing generic drugmakers to begin selling cheaper versions. Drug companies stand to lose more than $400 billion in revenue as patents expire for Keytruda, Eliquis, Jardiance, Opdivo, and other blockbuster therapies. (By comparison, the last major patent cliff that hit the industry, in 2011, jeopardized around $250 billion in drug revenue.)

advertisement

One of the few tried-and-tested methods for navigating a patent cliff is to acquire startups and new drugs — and lots of them. As a result, many experts anticipate pharma ramping up M&A activity in 2025, starting at the J.P. Morgan conference.

STAT+ Exclusive Story

Already have an account? Log in

This article is exclusive to STAT+ subscribers

Unlock this article — plus daily coverage and analysis of the pharma industry — by subscribing to STAT+.

Already have an account? Log in

To read the rest of this story subscribe to STAT+.