Dive Brief:

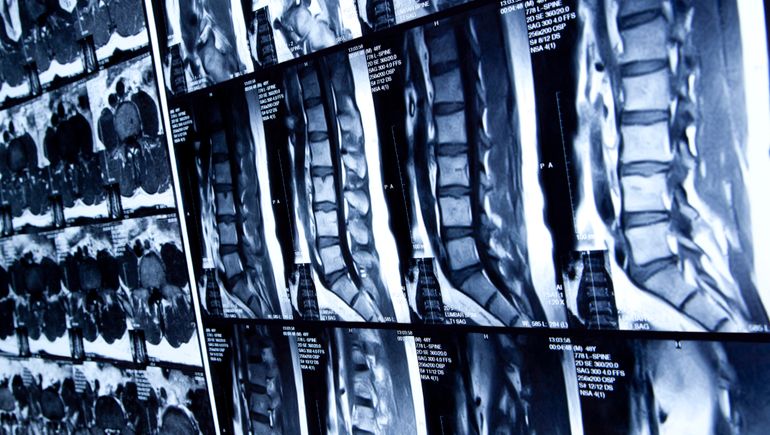

- Zimvie announced plans on Monday to sell its spine business to Miami-based investment firm H.I.G. Capital, narrowing the company’s focus to its dental business.

- H.I.G. will pay $315 million in cash and a $60 million promissory note that will accrue interest at a rate of 10% per year, for a total consideration of $375 million.

- The sale is “a step in the right direction for ZimVie as it allows it to double down on what we view as the more attractive of its two end markets while also significantly improving its financial position,” J.P. Morgan analyst Robbie Marcus wrote in a research note.

Dive Insight:

Less than two years after Zimmer Biomet spun out its dental and spine segments into Zimvie, the business is splitting again. H.I.G. Capital will acquire Zimvie’s spine, motion preservation, and EBI bone healing technologies.

The sale is “intended to create a leaner, more focused ZimVie with a leading position in attractive and growing global dental markets,” Zimvie CEO Vafa Jamali said in a statement.

The company plans to use the after-tax proceeds to reduce its debt and expects the sale to be accretive to its revenue growth, EBITDA margin, and cash flow conversion rate.

Shares of Zimvie increased by nearly 44% to $16.11 in Monday morning trading.

J.P. Morgan’s Marcus supported the planned transaction, noting that there had been “limited synergies” between Zimvie’s dental and spine businesses. The additional $315 million in cash should help the company reduce its net debt, he said.

Zimvie had $515.5 million in total debt as of Sept. 30, according to the company’s most recent quarterly statement.

For the nine months ended Sept. 30, Zimvie’s dental sales were roughly flat year-over-year at $344.1 million, and its spine sales declined by 8.5% to $308.7 million.

Zimvie’s board has approved the sale, and it is expected to close in the first half of 2024, subject to closing conditions, including required regulatory approvals.